Top 1 newly listed crypto to invest

| Date: 19/03/2025 | 3731 Views | Investment and Trading Academy, Investment and Trading Signal |

Top 1 newly listed crypto to invest – Jupiter (JUP) – Is it worth your money?

Hello folks, it’s Tradevietstock again! As we move through 2025, the crypto market continues to be a rollercoaster of opportunities and risks. With so many projects out there, finding one with real value can feel like searching for a needle in a haystack. Today, I want to talk about Jupiter (JUP), a project that’s caught my attention as a potential investment this year, and I believe this is top 1 newly listed crypto to invest in this year.

i. General information about Jupiter

1. What Is Jupiter (JUP)?

Jupiter (JUP) is a decentralized exchange (DEX) and swap aggregation engine built on the Solana blockchain, one of the fastest and most cost-effective blockchains in the crypto space. At its core, Jupiter’s mission is to make token swapping as efficient as possible. It does this by aggregating liquidity from multiple sources—like other DEXs, liquidity pools, and market makers—ensuring you get the best price for your trade with minimal slippage (the difference between the expected price and the actual price you pay).

But Jupiter isn’t just a one-trick pony. It’s a full-fledged DeFi platform with a range of tools designed to enhance your trading experience:

- Limit Orders: Set specific buy or sell prices for your tokens, so you don’t have to babysit the market.

- DCA/TWAP (Dollar-Cost Averaging/Time-Weighted Average Price): Spread your trades over time to reduce the impact of price volatility—perfect for long-term investors.

- Bridge Comparator: Compare and choose the best route to transfer assets between blockchains (e.g., from Solana to Ethereum).

- Perpetuals Trading: Trade futures with leverage, allowing you to amplify your gains (or losses) without holding the underlying asset.

Jupiter is a cornerstone of the Solana ecosystem, providing the liquidity infrastructure that keeps the network’s DeFi activities running smoothly. As of March 2025, Jupiter has a circulating supply of 1,350,000,000 JUP tokens, giving it a significant presence in the market. The JUP token itself plays a role in governance, letting holders vote on key decisions like token usage or platform upgrades, which adds a layer of community involvement to the project.

2. Real-World Applications: How Does Jupiter Fit into Everyday Life?

After some careful analysis, I see that Jupiter isn’t just a project for crypto enthusiasts—it has practical applications that make DeFi more useful and accessible.

Here’s a closer look at how it’s being used and the problems it solves:

a) Efficient Decentralized Trading:

Jupiter lets you swap tokens without a centralized exchange, meaning you keep control of your funds. By aggregating liquidity from various sources, it ensures you get the best price with low slippage. For example, if you’re trading SOL for USDC, Jupiter will search across multiple pools to find the most cost-effective route, saving you money.

b) Cross-Chain Transfers:

The Bridge Comparator feature solves a big problem in crypto: moving assets between blockchains. Let’s say you want to move your SOL from Solana to Ethereum to use in a different DeFi protocol—Jupiter helps you find the cheapest and fastest way to do it, reducing fees and wait times.

c) Advanced Trading Tools for All Levels:

Whether you’re a newbie or a pro, Jupiter’s tools are a game-changer. Limit Orders let you set a price and walk away—say you want to buy a token at $1, but it’s currently $1.20; Jupiter will execute the trade when the price drops. DCA/TWAP is great for avoiding big price swings; you can buy a token gradually over a week instead of all at once. Perpetuals Trading lets you trade futures with leverage, which is ideal for experienced traders looking to capitalize on market movements.

- Limit Orders: This tool lets you set a specific price at which you want to buy or sell a token, and the trade only happens when the market hits that price. For example, let’s say you want to buy a token on Solana, like SRM (Serum’s token), but you think its current price of $1.20 is too high. You can set a Limit Order on Jupiter to buy 100 SRM at $1 each. You connect your wallet to Jupiter’s website (jup.ag), enter your order, and Jupiter’s smart contract (an automated program on Solana) watches the market for you. When SRM’s price drops to $1, the smart contract automatically swaps your funds—like SOL or USDC—for 100 SRM, and the tokens are sent to your wallet. This happens on the Solana blockchain, with a tiny fee (usually less than $0.01). It’s great because you don’t have to sit there watching prices all day—you set your price and walk away, knowing the trade will only happen when the conditions are right. For beginners, this takes the stress out of trading, and for pros, it’s a way to execute a strategy without constant monitoring.

- DCA/TWAP (Dollar-Cost Averaging/Time-Weighted Average Price): These are two related strategies that help you buy crypto in a safer way by spreading your purchases over time, reducing the risk of buying at a bad price.

- DCA (Dollar-Cost Averaging): This means buying a fixed amount of a token over a set period instead of all at once. For example, if you want to invest $400 in a token, you might buy $100 each week for 4 weeks. On Jupiter, you can set this up by connecting your wallet and entering your plan—like “Buy $400 of this token over 4 days, $100 each day.” Jupiter’s smart contract will automatically execute these buys for you on the Solana blockchain, swapping your SOL or USDC for the token each day. Why is this helpful? Crypto prices can jump around a lot—say the token is $1 today, $1.50 tomorrow, then $0.80 the next day. If you buy all $400 at $1.50, you’ll lose money when it drops. But with DCA, your average price might be $1.10, because you bought at different prices over time. This is perfect for beginners who don’t want to stress about timing the market.

- TWAP (Time-Weighted Average Price): This is a more advanced version of DCA, often used by bigger traders to avoid messing up the market with large orders. TWAP spreads your trade over time to get an average price that’s less affected by sudden price spikes or drops. For example, if you’re buying $400 of a token over a week, TWAP might break your order into tiny trades—like $10 every hour—and execute them at different times to get a fair average price. On Jupiter, you can set this up similarly to DCA, and the smart contract handles the timing and execution on Solana. For new investors, TWAP works like DCA but gives you an even smoother average price, which is great if the token you’re buying has a lot of price swings.

- Perpetuals Trading: This is a more advanced feature where you can bet on the future price of a token without actually owning it, using something called leverage. Let’s break it down: Perpetuals Trading (or perpetual futures) lets you open a position—like betting a token’s price will go up or down—and you can use leverage to amplify your gains (or losses). For example, if you think a token’s price will rise, you can “go long” with 10x leverage. This means you put in $100 of your own money, but you’re trading as if you had $1,000 (the extra $900 is borrowed). If the token’s price goes up 1%, you make a 10% profit ($100) instead of just 1% ($10)—but if it goes down 1%, you lose 10% ($100). On Jupiter, Perpetuals Trading happens on the Solana blockchain, often through partnerships with other Solana protocols (like Drift or Zeta Markets, which specialize in futures). You connect your wallet, deposit funds (like SOL or USDC), and open your position. The smart contract manages the trade, including profits, losses, and liquidation (if the market moves too far against you, your position is closed to avoid bigger losses). This is more for experienced traders because it’s riskier, but it’s part of Jupiter’s toolkit, showing the platform can grow with you as you learn more about crypto.

d) Bridging Crypto and Real Life:

One of Jupiter’s most exciting moves is its partnership with Sanctum to launch a SOL-based debit card. This card lets you spend your Solana-based assets (like SOL or JUP) in the real world—think buying groceries, paying for a meal, or even settling a bill. This is a huge step toward making crypto a practical part of daily life, addressing the common issue of “what can I actually do with my tokens?”

e) Liquidity for the Solana Ecosystem:

Jupiter’s role as a liquidity provider ensures that other DeFi projects on Solana can operate smoothly. For example, if a new Solana-based NFT marketplace needs liquidity for its token, Jupiter can help by connecting it to a broader pool of traders.

These applications show that Jupiter isn’t just about speculative trading—it’s building tools that make DeFi more efficient, connected, and usable in the real world. It’s solving problems like high trading costs, fragmented liquidity, and the lack of practical crypto use cases.

3. Scam or Legit? Does Jupiter Solve Real Problems?

With so many crypto scams out there, it’s natural to wonder if Jupiter is the real deal. I’ve looked into it, and I’m confident saying Jupiter is a legitimate project—not a scam. Here’s why I say it’s the top 1 newly listed crypto to invest with long-term growth:

a) Addressing Real DeFi Challenges:

Jupiter tackles some of the biggest pain points in DeFi. Liquidity fragmentation—where liquidity is spread across too many platforms, leading to high slippage—is a major issue. Jupiter solves this by aggregating liquidity, ensuring better prices for trades. It also reduces high transaction costs by running on Solana, which has much lower fees than Ethereum (often less than $0.01 per transaction compared to Ethereum’s $5-$50 during peak times).

b) Making DeFi Accessible:

The platform’s user-friendly design and low fees make DeFi more approachable for everyday users. If you’ve ever tried using a DEX on Ethereum and got hit with a $50 gas fee, you’ll appreciate how Jupiter makes trading affordable and simple. This solves the problem of high entry barriers in crypto.

c) Improving Blockchain Interoperability:

The Bridge Comparator addresses the issue of isolated blockchains. By helping users move assets between networks, Jupiter makes the crypto ecosystem more connected, which is crucial for the industry’s long-term growth.

d) Practical Utility in Real Life:

The SOL-based debit card is a big deal—it lets you use your crypto for everyday purchases, solving the problem of limited real-world applications for digital assets. This isn’t just a promise; it’s a tangible product that bridges DeFi and traditional finance.

e) Transparency and Community Involvement:

Jupiter involves its community in governance. For example, token holders voted on the ASR proposal, deciding whether to use additional JUP tokens or burn them. This kind of transparency and community engagement is a good sign—it’s not a project where the team makes all the decisions behind closed doors.

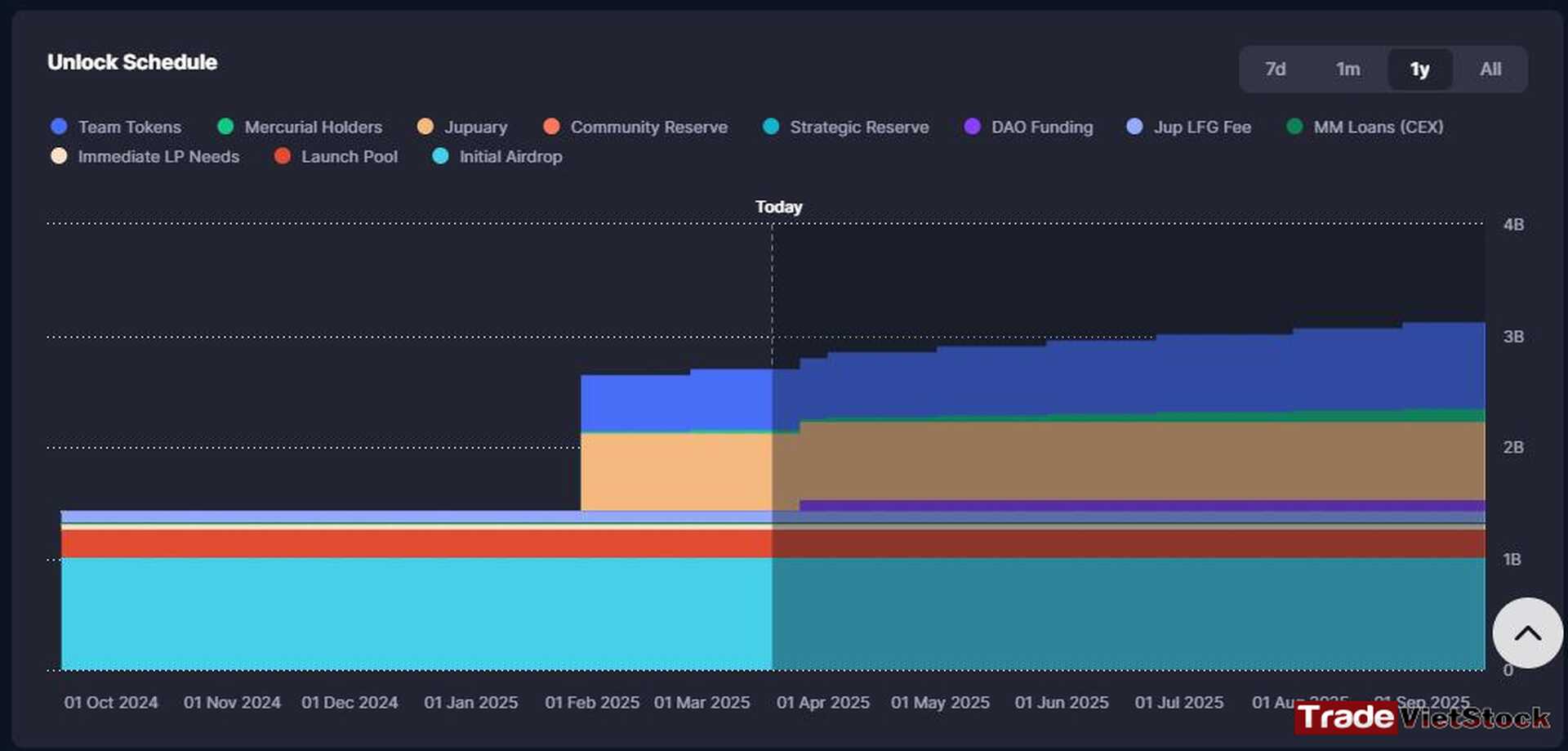

f. Jupuary events and burning mechanism

Jupuary is an event where JUP tokens are distributed to users through airdrops and staking rewards. These are not “new tokens” in the sense of being newly created (released)—they are unlocked from a pre-allocated reserve that was part of JUP’s total supply (10 billion tokens) set at launch in 2022. The 700 million JUP tokens airdropped in January 2025, for example, were already part of the total supply but were locked until Jupuary, when they were unlocked and sent to users’ wallets on the Solana blockchain. The token burn (30% in January 2025) helps balance this by reducing the circulating supply.

=> That said, no crypto project is without risks. Jupiter operates in a volatile market, and Solana’s recent drop in Total Value Locked (TVL) could impact its ecosystem. There’s also competition from other DEXs, like those on Ethereum or emerging Layer 2 solutions. But unlike scam projects that promise unrealistic returns (like Ponzi schemes or fake “yield farming” platforms), Jupiter is focused on building real solutions with clear utility. It’s a project that’s here to make DeFi better, not just to pump a token price. Furthermore, Jupuary shows Jupiter’s strategy to reward users and grow its ecosystem, which can impact JUP’s price and make it an interesting investment.

4. Growth Potential – Long-term investment

Now, let’s talk about why Jupiter could be in the list of top 1 newly listed crypto to invest. Here are the key factors driving its growth potential:

- Solana’s Continued Rise: Solana is one of the most efficient blockchains out there, with high transaction speeds (up to 65,000 transactions per second) and low costs (often under $0.01 per transaction). It’s been gaining traction as a go-to platform for DeFi and NFT projects. In 2025, we’re seeing more developers and users flock to Solana, especially with potential regulatory clarity in the U.S. (like the Financial Innovation and Technology for the 21st Century Act, which could be signed this year). As Solana grows, Jupiter benefits directly as a core liquidity provider.

- DeFi Market Expansion: DeFi is on a growth trajectory. Analysts predict it could reach a $30 trillion market cap in the next decade as institutions start tokenizing real-world assets (like real estate or bonds) on blockchains. Jupiter’s advanced tools—like Perpetuals Trading, Limit Orders, and DCA/TWAP—make it well-positioned to capture a growing user base of DeFi traders, both retail and institutional.

- Innovative Features Driving Adoption: The SOL-based debit card is a big win—it makes crypto spendable in the real world, which could attract more users to the Solana ecosystem and, by extension, Jupiter. Perpetuals Trading also opens up Jupiter to a new market of futures traders, potentially increasing demand for JUP tokens.

- Community and Ecosystem Strength: Jupiter keeps its community engaged through airdrops (free token distributions to reward users) and governance votes. This builds loyalty and encourages long-term holding, which can support the token’s price over time. The introduction of Metropolis APIs also makes it easier for developers to build on Jupiter, expanding its ecosystem.

- Market Trends: The broader crypto market in 2025 is showing signs of recovery after a volatile 2024. Bitcoin and Ethereum are stabilizing, and altcoins like JUP often follow suit during bull runs. If the market sentiment turns bullish, Jupiter could see significant gains.

However, there are risks to consider:

- Competition: Jupiter faces competition from other DEXs, like Uniswap on Ethereum or emerging platforms on Layer 2 solutions (e.g., Solaxy). These competitors could challenge Jupiter’s market share.

- Market Volatility: Crypto prices are notoriously unpredictable. A bear market or negative news (like regulatory crackdowns) could drag down JUP’s price.

- Solana Ecosystem Risks: Solana’s recent TVL drop signals some challenges—like reduced activity or user confidence—which could indirectly affect Jupiter.

=> Despite these risks, Jupiter’s focus on real utility, its role in a growing ecosystem, and its innovative features give it a strong chance to grow in 2025. If you’re looking for a project with fundamentals and upside potential, this one’s worth watching and added to the top 1 newly listed crypto to invest list.

5. The Technology: What Makes Jupiter Tick?

Let’s take a closer look at the tech behind Jupiter. It’s built on the Solana blockchain, which is known for its high performance. Solana can handle thousands of transactions per second (up to 65,000 TPS) at a fraction of the cost of Ethereum—often less than $0.01 per transaction compared to Ethereum’s $5-$50 during peak times. This makes it an ideal foundation for a DeFi platform like Jupiter. Here’s a breakdown of the tech:

- Solana’s Consensus Mechanism: Solana uses a combination of Proof of History (PoH) and Proof of Stake (PoS). PoH creates a verifiable timeline of events, ensuring transactions are processed quickly and securely. PoS incentivizes validators to act honestly by requiring them to stake SOL tokens as collateral. This dual mechanism makes Solana fast, secure, and resistant to attacks.

- Swap Aggregation Engine: Jupiter’s core feature is its ability to aggregate liquidity from multiple sources—think of it like a search engine for the best trade prices. If you’re swapping SOL for USDC, Jupiter will check various liquidity pools and market makers to find the most cost-effective route, minimizing slippage and maximizing your value.

- DeFi Product Suite: Jupiter offers a range of tools to enhance trading:

- Limit Orders: Set a specific price for your trade (e.g., buy a token at $1 when it drops from $1.20).

- DCA/TWAP: Spread your trades over time to avoid big price swings—great for volatile markets.

- Perpetuals Trading: Trade futures with leverage, allowing you to bet on price movements without holding the asset.

- Bridge Comparator: Find the best route to move assets between blockchains, saving on fees and time.

- Security Features: Jupiter benefits from Solana’s robust security. PoH ensures a tamper-proof record of transactions, while PoS keeps validators in check. The decentralized nature of the platform means there’s no single point of failure, making it tough for hackers to target. Smart contracts also ensure trades are executed exactly as programmed, reducing the risk of errors or manipulation.

- Low Fees and Accessibility: Thanks to Solana’s low-cost structure, Jupiter keeps fees minimal, making DeFi accessible to more users. The platform’s design is also user-friendly, so you don’t need to be a tech wizard to use it.

=> Jupiter is the Top 1 newly listed crypto to invest in this year. Its tech is all about efficiency, affordability, and security. It’s built to handle the demands of DeFi while keeping things simple for users—a winning combo in my book.

6. Who’s Behind Jupiter? The Team Driving the Project

Jupiter was founded by a team with the right mix of skills to make it a success:

- Fabiano Solana: The tech expert, responsible for Jupiter’s blockchain infrastructure and ensuring the platform runs smoothly.

- Rolex Gold: A financial markets veteran, guiding Jupiter’s strategy and positioning it to meet the needs of traders.

- Mei: Focuses on community engagement and partnerships, helping Jupiter grow its user base and ecosystem.

- Meow: Played a key role in launching and managing the JUP token, though there have been some minor controversies around partnerships.

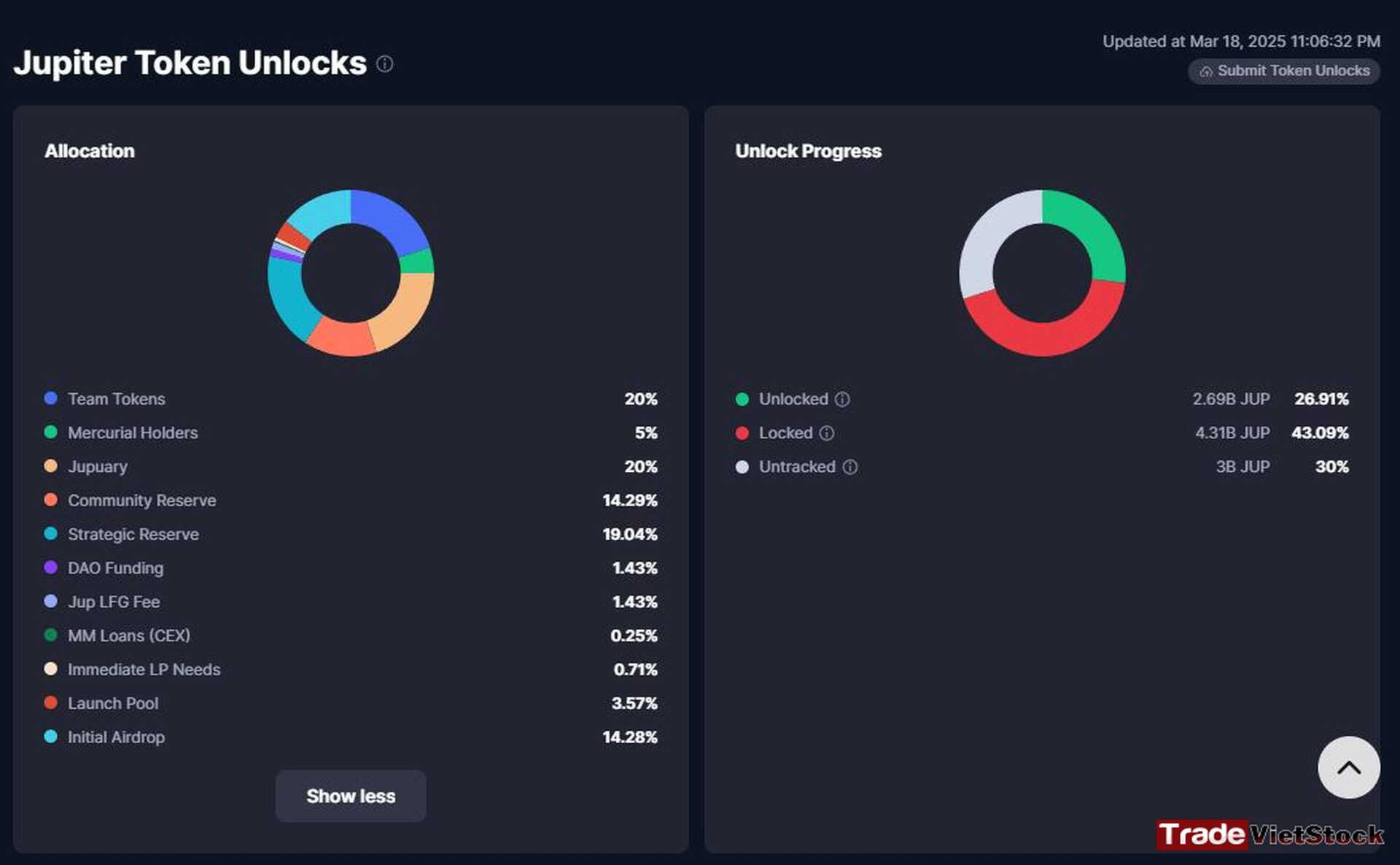

Before moving on, I will explain some key terms in the image above:

- Team Tokens: This refers to the portion of tokens allocated to the team behind the project. These tokens are usually subject to certain vesting schedules to ensure that team members are incentivized to remain involved in the project over time.

- Mercurial Holders: This refers to the percentage of tokens allocated to holders of the Mercurial token, which could be part of a partnership or incentive program.

- Jupary: This might be referring to a group or entity related to the Jupiter ecosystem. It’s likely a token allocation meant for contributors or important stakeholders associated with the Jupary initiative.

- Community Reserve: These tokens are set aside for the community, often used for future incentives or governance purposes, ensuring the community has a stake in the project’s success.

- Strategic Reserve: These tokens are held for strategic purposes, like partnerships, future fundraising rounds, or to stabilize the market if needed.

- DAO Funding: Tokens allocated to the Decentralized Autonomous Organization (DAO), which is responsible for decision-making within the project. These tokens could be used for funding the DAO’s activities or decisions.

- Jup LFG Fee: Likely refers to a fee associated with the Jupiter Liquidity Fund Generation (LFG) program, which may involve creating liquidity for the project or incentivizing liquidity providers.

- MM Loans (CEX): This represents tokens allocated for market-making (MM) loans in centralized exchanges (CEX), which are used to maintain liquidity and facilitate trading on exchange platforms.

- Immediate LP Needs: Tokens set aside to meet immediate liquidity pool (LP) requirements, helping to ensure that there is enough liquidity available for trading on decentralized exchanges (DEX).

- Launch Pool: These tokens are part of the pool used for launching the project, often to facilitate the early stages of a token’s distribution or public sales.

- Initial Airdrop: These tokens are distributed via an airdrop, which is a common way of giving free tokens to early adopters, participants, or holders to promote the project.

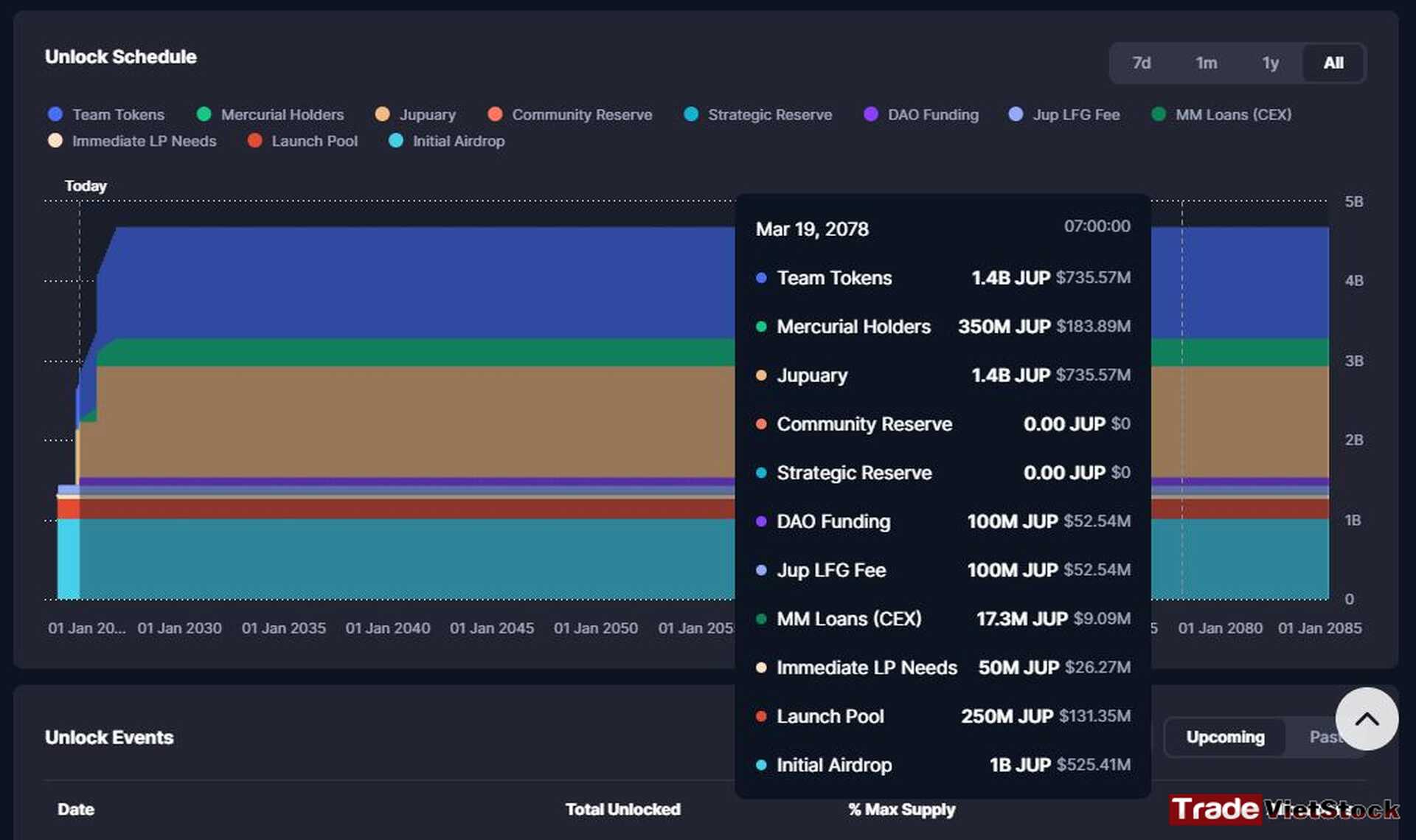

Currently, the proportion of team tokens is 20% of the total supply of JUP. After one month, the team will receive a fixed amount of JUP worth $20 million. The total the team will receive will be worth $735.57 million in 2027. Just to clarify, the total supply of JUP is 10 billion.

The team’s total share will be 14% of the total supply of JUP, which is not a significant concern for price manipulation. The total tokens allocated to Jupary will make up over 14% of the total supply, and these will then be distributed to staking holders.

However, one scenario to consider is that after the team receives the full amount of their tokens, they could potentially dump the project and liquidate. Yet, this will only happen in 2027, and the project is not designed to solve real-life problems. Despite this, I believe JUP is not likely to follow such a path.

ii. Investment analysis – Top 1 newly listed crypto to invest

1. Price chart

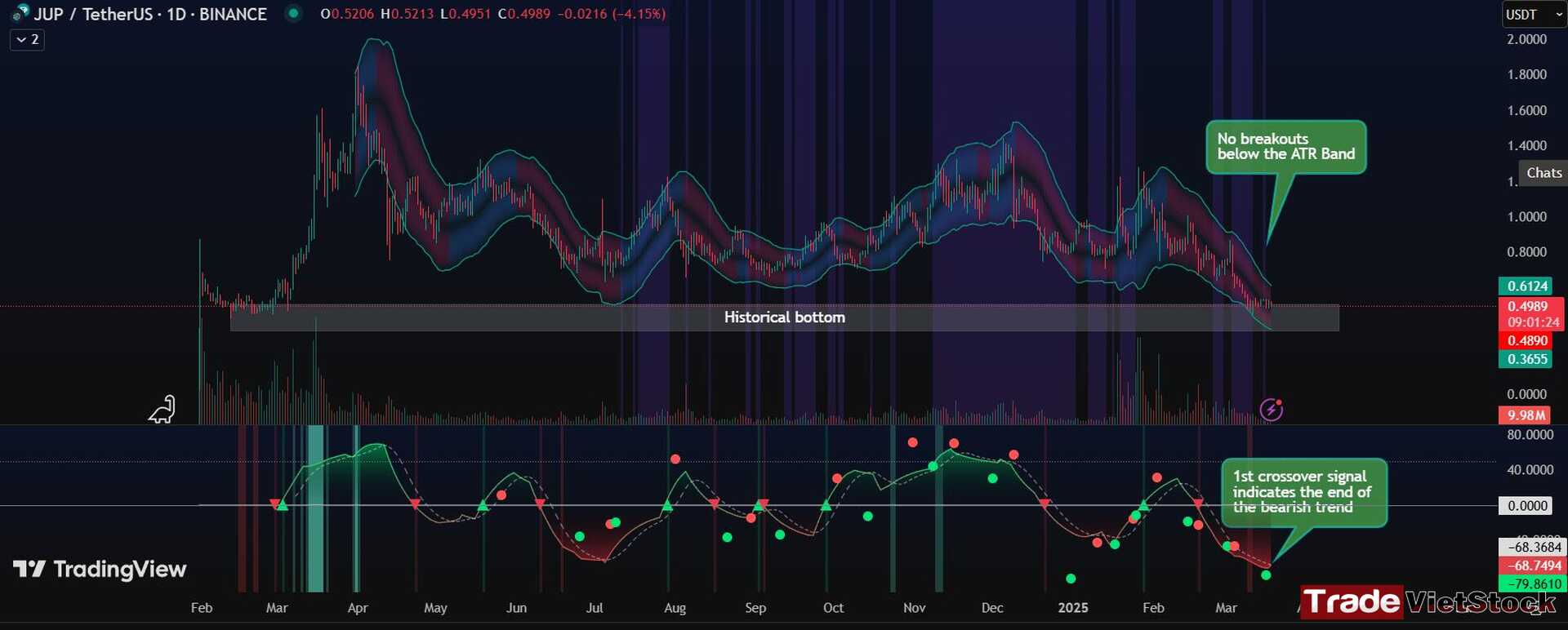

Jupiter is one of the recently listed tokens, and its price is still near the bottom, which I believe it should be included in the list of top 1 newly listed crypto to invest

Let’s move on to some technical analysis. The JUP price has reached its historical bottom at around 0.49 USDT. There has been no breakout below the ATR Bands, which indicates there are no bearish signals or a bearish trend expected in the near future. According to the Quantum indicator, there are some early crossover signals (green dots), suggesting that the bearish trend is coming to an end.

Still, we need to wait a little longer before buying JUP. So, what exact signals from the indicators should we look for before buying JUP? I’d say we need confirmation of the bottom from the Quantum indicator and a breakout above the ATR Band. This will give us a clear set of confirmation signals.

=> Although I say Jupiter is the top 1 newly listed crypto to invest, when investing in this token, we should treat it as a long-term investment, as tokens priced below $1 tend to experience significant fluctuations. Therefore, when buying JUP on Spot, we should consider staking it to receive a decent APR.

2. Conclusion: Is Jupiter a Good Investment?

After digging into Jupiter (JUP) in this Top 1 newly listed crypto to invest article, I can say it’s a strong contender for your crypto portfolio. It’s solving real problems in DeFi—like liquidity fragmentation, high fees, and blockchain isolation—while adding practical features like the SOL-based debit card that make crypto usable in everyday life. The technology is solid, leveraging Solana’s speed and low costs to deliver a seamless DeFi experience. The team behind it has the expertise and commitment to keep the project on track, and the growth potential is there, especially with Solana’s momentum and DeFi’s broader expansion.

Of course, there are risks to consider. The crypto market is volatile, and Jupiter faces competition from other DEXs. Solana’s recent TVL drop could also impact its ecosystem. But with its focus on utility, innovation, and community engagement, Jupiter stands out as a project with real substance—not just another hyped-up token. If you’re looking for a crypto with strong fundamentals and upside potential, Jupiter is worth adding to your Top 1 newly listed crypto to invest list.

Wishing everyone successful trades!

📌 Interested in learning more about different account types or crypto trading knowledge? Check out our educational resources HERE

📌 Want to see detailed reviews of the top 5 best crypto exchanges? Read the full review HERE

Register for the Top 5 Best Crypto Exchanges Now

[Link to register for a free Binance account]

The largest exchange currently

[Link to register for a free Bitget account]

Exchange with many financial products

Link to register for a free Mexc account]

Exchange with the lowest costs in the world

Link to register for a free Bybit account]

Exchange with professional financial technology

[Link to register for a free OKX account]

Exchange connected with DEX

Tiếng Việt

Tiếng Việt