The art of trading

| Date: 28/04/2025 | 584 Views | Investment and Trading Academy |

The Art of Trading Is… Doing Nothing

Today, at Tradevietstock, I’m not gonna talk about data, indicators, or investment signals. Let’s put all of that aside for a moment and zoom out. Think about the entire trading journey. After years of trading—digging into data, building fancy strategies, chasing those perfect winning setups—I’ve come to a realization: the art of trading isn’t in the quant stuff, the data-driven tools, or even AI.

It’s in waiting.

Yup, just that. Waiting.

No matter how smart your strategy is, how advanced your indicators are, or how sophisticated your tools may be—if you don’t have the patience to wait for the right moment, the right opportunity… You’re screwed. That’s the truth. That’s why I say patience is the art of trading.

i. Why patience is the art of trading?

1. Selectivity: The Hallmark of Professional Trading

Every trade must be highly selective, not random. Professionals understand that not every market move is an opportunity. They wait for clear, high-probability setups where the odds are decisively in their favor — whether that means waiting for technical patterns to align, indicators to confirm, or fundamental news to create strong conviction.

Because they are so selective, trading opportunities are rare. Some days may offer no viable entries at all, and that’s perfectly acceptable. Forcing trades out of boredom or impatience is one of the quickest ways to lose both money and confidence.

2. Timing: Trade Only When the Market is Right

Beyond selectivity, timing plays an equally important role. Even the correct prediction of a market’s direction can lead to losses if the entry is poorly timed.

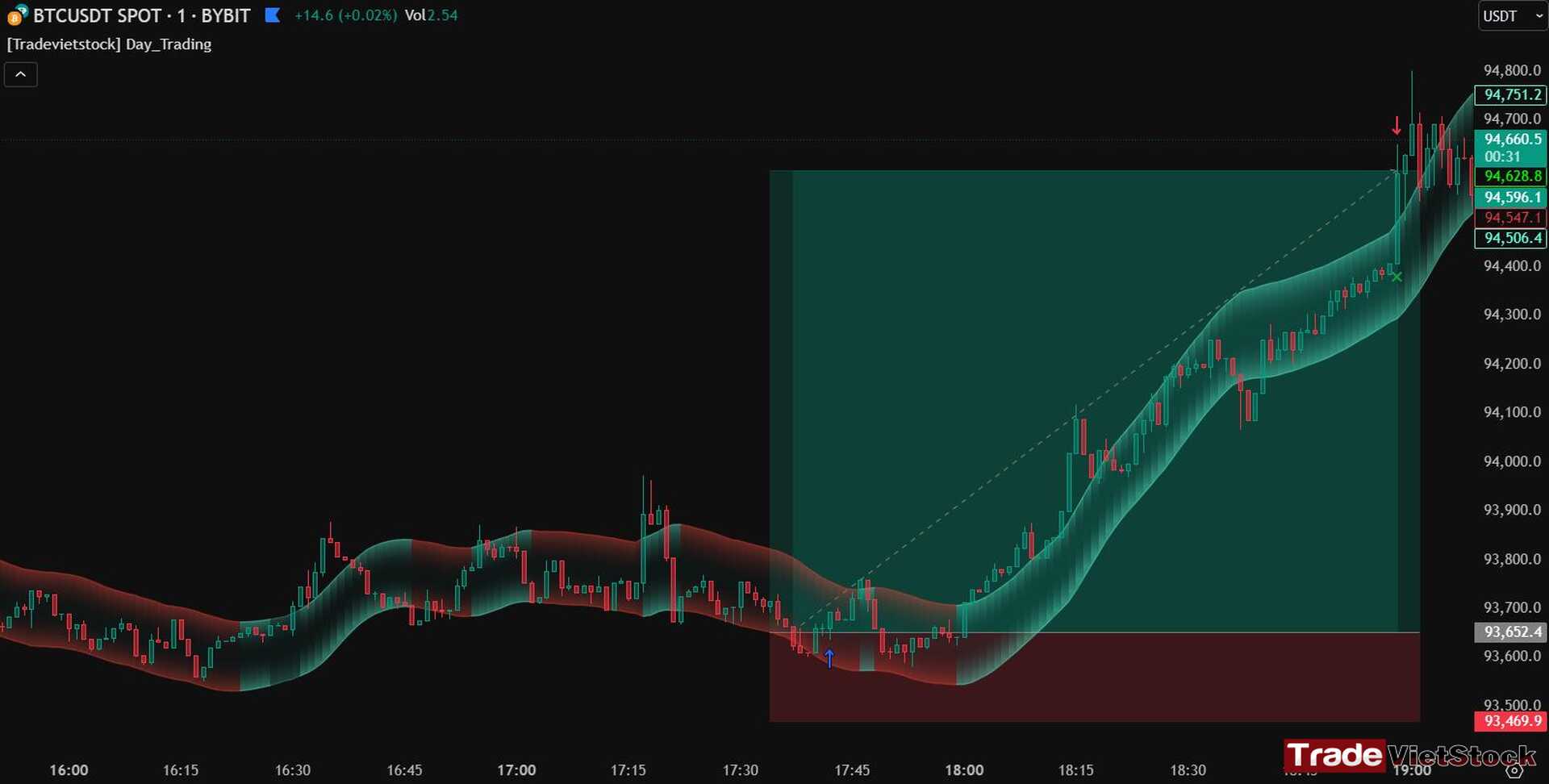

One key example lies in understanding different market sessions. During the Asian session, the market often moves sideways — price action tends to be flat, and liquidity is thin. This environment is a minefield for intraday traders, especially those using high leverage. In such conditions, traders are often stop-hunted, as the market lacks momentum and direction.

For intraday traders seeking clearer trends and meaningful volatility, the New York session is far superior. When volatility spikes, trends form more clearly, and opportunities are easier to spot with reduced risk of getting trapped in market noise. Choosing the right time to trade can make the difference between a stressful, loss-filled session and a highly profitable one.

3. Emotional Discipline: Why Patience is an Edge

Patience doesn’t just lead to better setups; it also fortifies emotional discipline. Trading is a psychological battlefield, constantly testing our fears, greed, and impatience. Impulsive trading often leads to overtrading, draining both your trading account and your emotional resilience. Sometimes, I say that AI and machines are better traders than humans because, unlike us, they do not experience emotions — they simply follow their programmed setups and logic without hesitation or fear.

By practicing patience and learning to wait, you detach yourself from greed and fear — the two most destructive emotions in trading. Without patience, these emotions will inevitably lead to blown accounts. True growth as a trader only begins once you master the art of patience.

ii. The importance of the right math in trading

Trading is like doing math. You need to do the math correctly to get the answer. It’s all about probability and calculating risk: if you win, how much you’re going to gain, and if you lose, how much you’re going to risk. If you cannot bear the risk, then do not trade! If you don’t calculate your risk and project your suitable returns, you can lose everything in just one single bet. This is the importance of risk management.

Now, let’s talk about trading strategy and the win rate of that strategy. This is crucial. Any trading strategy has its own win rate and setup. You need to follow it strictly because it’s all about math. If you follow the strategy strictly, the math works. If you screw up the strategy, you screw up the math — then the calculation of profit and risk is gone. At that point, it’s bad: you can lose all your capital in just one losing trade, or you’ll never reach the point of winning because you’ll experience losing streaks.

A losing streak is something you have to manage because it’s inevitable. If this nightmare happens, how will you survive and still have a chance to win — I mean, without blowing up your account? That’s where risk management comes in again.

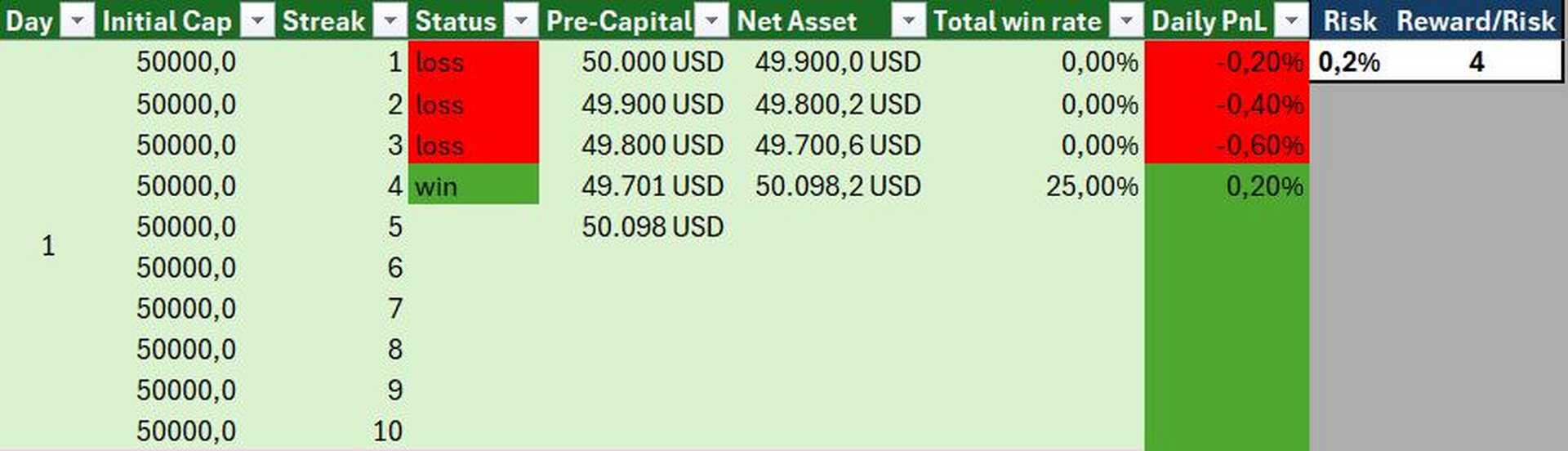

If you risk 2% of your asset on just one trade, it means you have about 50 trades before blowing up your account. If you risk only 0.2% of your asset on a single trade, you would need about 50 consecutive losses to lose just 10% of your account. Fifty losses is a lot — and if you get even 20–30 consecutive losses, it’s probably about you: you haven’t stuck to the trading strategy and screwed up at some point.

Every trading strategy has its win rate. An extremely high win rate, like 70%, is rare — forget about it; we’re not geniuses. But a 40–50% win rate is still decent, and you absolutely need to get there.

If your win rate is 40%, your risk-reward ratio needs to be around 4 to stay profitable. For example, if your account is $50,000, and you risk 0.2% per trade, that’s $100 risked per trade. If you win, you should make $400. So even if you lose 3 consecutive times, you would still make $100 profit on the fourth trade.

Look at the example below: with a strategy that has a 40% win rate, if you lose 3 times consecutively, it’s still within mathematical expectations. According to the math, the 4th trade should be a win. But if it isn’t, it suggests that the math isn’t working today and the market is acting unpredictably.

At this point, you have two options:

1. Quit trading for the day.

2. Keep trading until the 7th trade — because statistically, by the 7th trade, a win should occur.

This is why I always say you must follow a strategy strictly — and that strategy must be thoroughly backtested.

For example, if in one day you take 10 trades, risking 0.2% on each, you can achieve around 2% growth — if you stick to the math strictly. The win rate and reward-to-risk ratio are crucial. They are the soul of trading math.

The best scenario is having 4 winning trades in a row at the start. If that happens, you should stop right there — because the math is correct, and you shouldn’t mess it up at any cost. If you’re lucky, you might still win even when the math is off. But this misconduct will make you pay much more later, with just a single loss. This is called discipline. So waiting for the right opportunity and reject the trap is the art of trading.

=> That’s the math I’m talking about. I have a strategy that can give you a 40–50% win rate with a risk-reward ratio of around 4. If you’re interested, join our Telegram community HERE and contact the admin. The indicator set and strategy are available on TradingView.

iv. Conclusion

At the end of the day, the art of trading is not just about strategies, indicators, or even risk management alone — it’s about discipline, patience, and mastering the math behind the game.

You can have the best tools, the most optimized system, and all the knowledge in the world, but without patience to wait for the right setups, without discipline to stick to your strategy, and without understanding how math governs your trading outcome, you will eventually fail. Once again, waiting is the art of trading.

Master the art of doing nothing until the right moment comes. Respect the math. Stick to your plan. Control your emotions. This is the art of trading.

That’s how real traders survive — and win.

In trading, patience is profit, discipline is defense, and math is your only true edge.

📌 Interested in learning more about different account types or crypto trading knowledge? Check out our educational resources HERE

📌 Want to see detailed reviews of the top 5 best crypto exchanges? Read the full review HERE

I know trading isn’t an easy game, especially for those who take it seriously. That’s why I believe you should practice consistently before finding the trading strategies that suit you best. You can start risk-free by opening a demo FX account to get familiar with the market.

Below are registration links for two of the best brokers:

- XTB Online Trading — the top broker for traders in the EU

- Exness — the best choice for traders in Asia

You can also experience world-class services and trusted reputations from some of the top 5 crypto exchanges:

- Binance — The largest crypto exchange on Earth

- Bybit — A well-established name known for its long-standing reputation and diverse financial instruments

- Bitget — User-friendly interface combined with a strong reputation

- MEXC — The lowest trading fees with one of the most beginner-friendly interfaces

- OKX — A major name known for secure asset storage and powerful DEX tools

Tiếng Việt

Tiếng Việt