Mexc Exchange Review

| Date: 29/08/2025 | 373 Views | Cryptocurrency Exchange Registration |

MEXC Exchange Review – The Cheapest Trading Fees of All

[Link to register for a free Mexc account]

MEXC is a fast-rising crypto exchange known for offering the lowest trading fees among its competitors. With over 10 million users across 170 countries, it has quickly become one of the top platforms in the industry.

At Tradevietstock, I’ll share my experience using the platform and explain why it’s a popular choice for scalpers, beginners, and traders seeking low-cost, high-leverage opportunities. Thanks to its wide selection of tokens and unbeatable fees, MEXC stands out—especially in emerging markets. Let’s dive in Mexc Exchange Review and see if it could be the right platform for you.

Founded in 2018, MEXC is a Singapore-based exchange known for its high-performance platform and cutting-edge blockchain technology. Led by a team of finance and crypto pioneers, including CEO John Chen, MEXC operates globally, with servers hosted independently across multiple countries to ensure top-notch data security and integrity.

i. Evaluation Criteria

To craft this MEXC Exchange Review, I’m using the same criteria as my Top 5 Crypto Exchanges list, ensuring a fair and practical evaluation for traders:

- User Base Size: How many users trust MEXC globally?

- App Downloads: Popularity in key regions like Asia and Africa.

- Asset Value Managed: The scale of MEXC’s financial reserves.

- Trading Volume: Liquidity for fast order execution.

- Technology and Products: Platform robustness and trading options.

- Transaction Fees: Cost-effectiveness for active traders.

This MEXC Exchange Review draws from my hands-on experience with the platform, focusing on what matters to traders like you.

ii. Pros You Should Know About MEXC

1. Easy To Use

One of MEXC’s biggest strengths is its user-friendly interface, which makes it especially easy for beginners to get started. The platform has a clean layout with straightforward navigation, allowing new users to quickly find trading pairs, manage assets, and place orders without feeling overwhelmed.

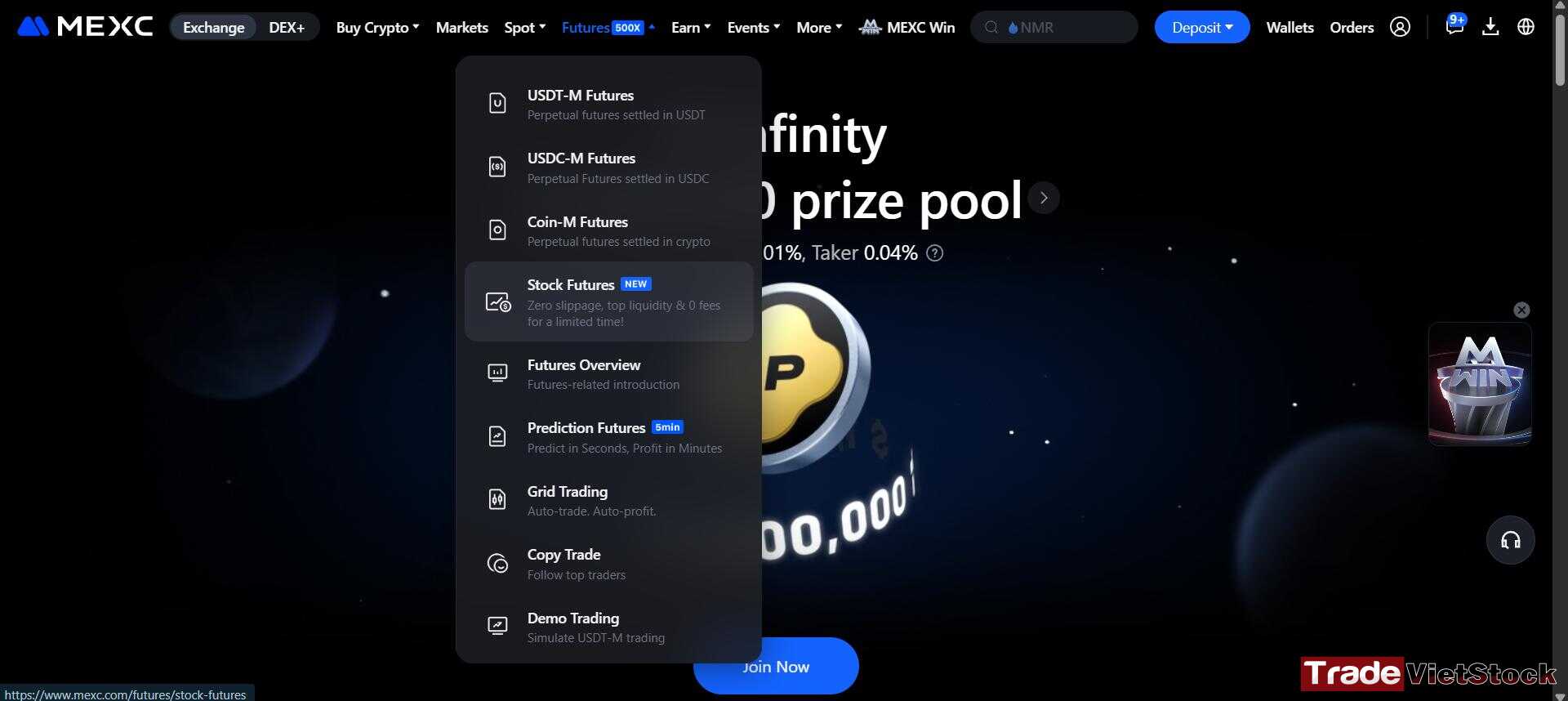

The dashboard is intuitive, and key functions like spot, futures, and copy trading are clearly organized, so you don’t have to dig through complex menus.

Even for first-time traders, the onboarding process feels smooth, with simple sign-up, clear charts, and helpful tooltips guiding the way.

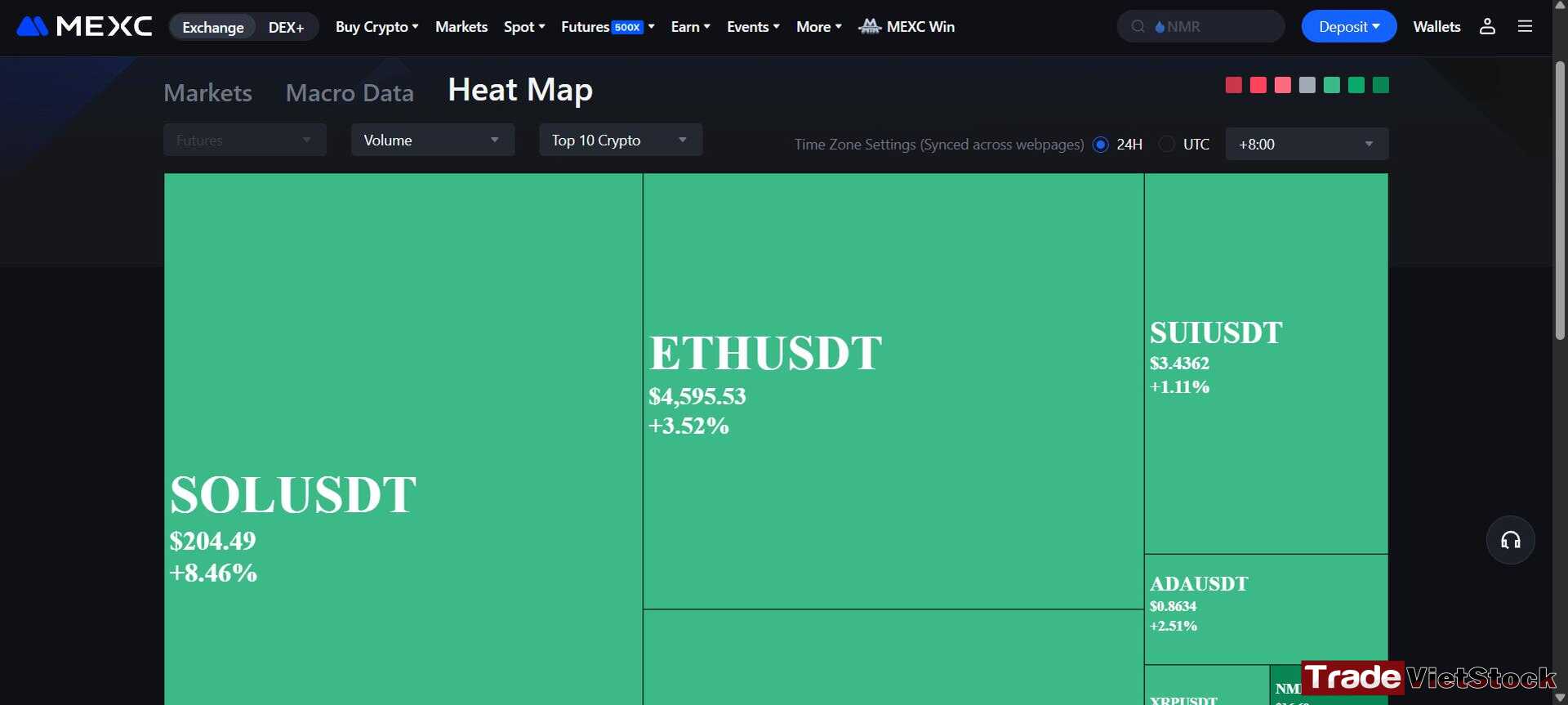

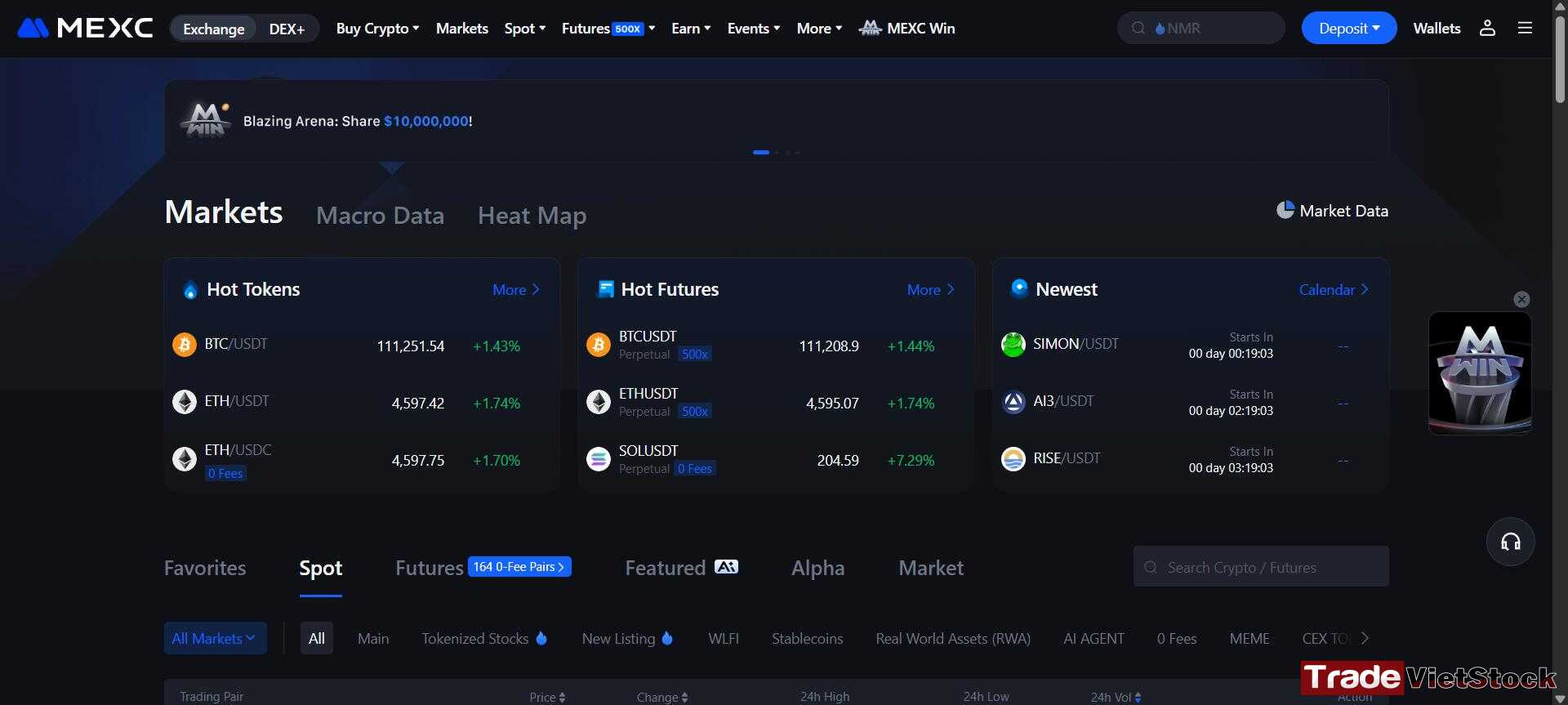

2. Relatively Large Market Share

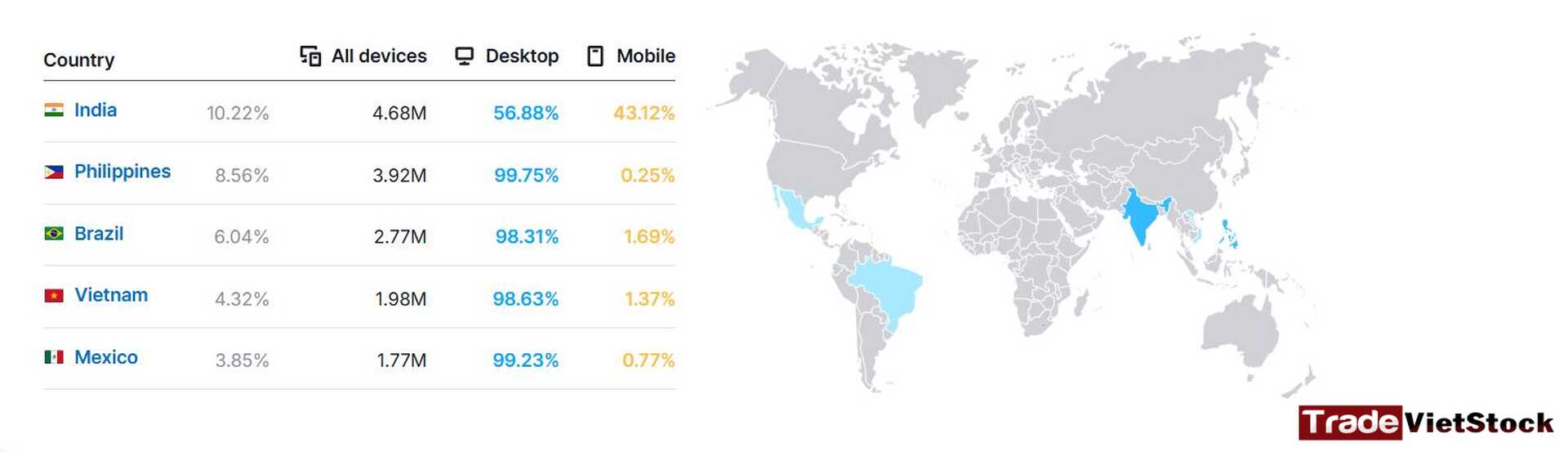

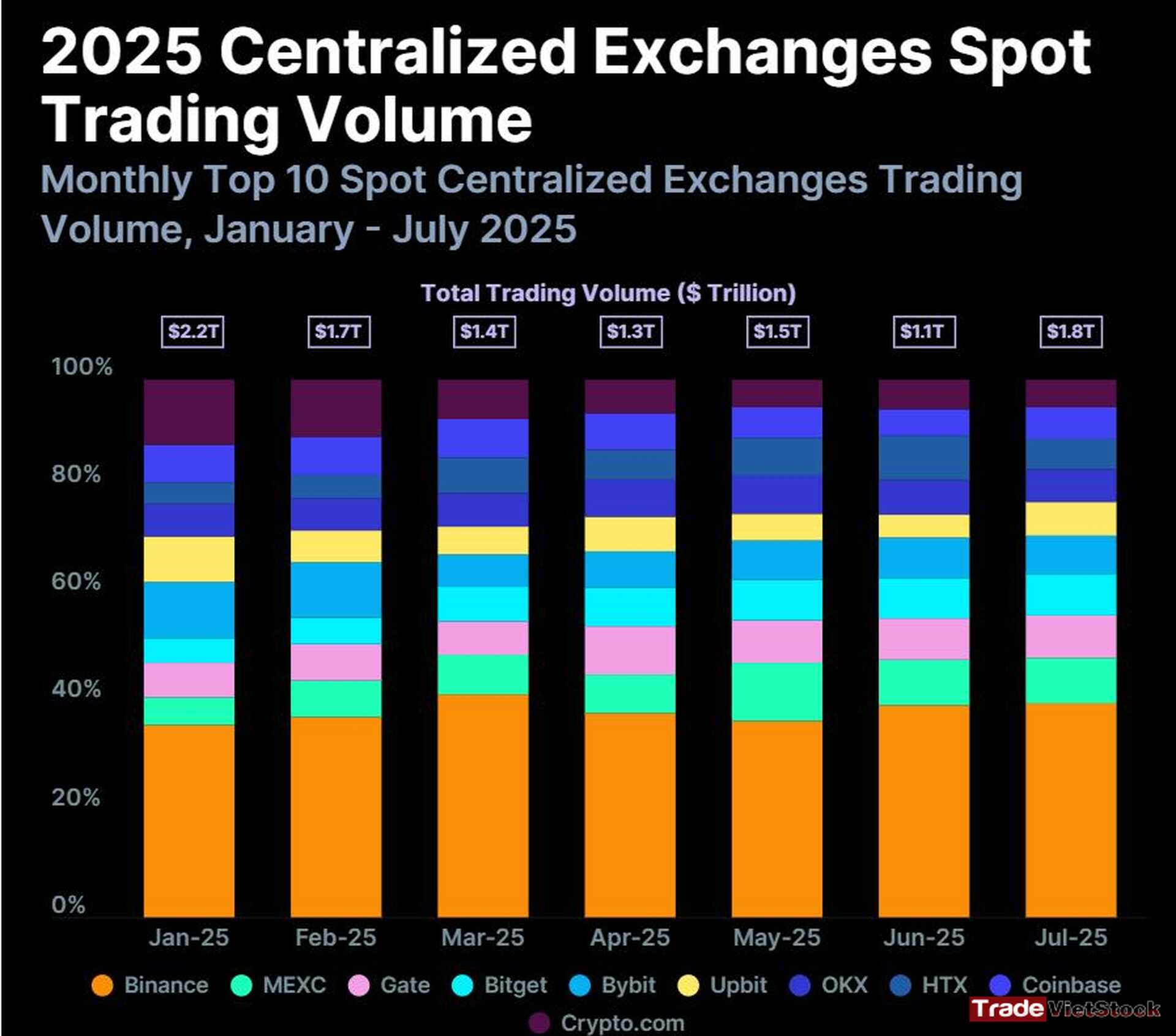

In this MEXC Exchange Review, we note MEXC’s solid but smaller market presence compared to giants like Binance. With 10 million users across 170 countries, MEXC holds a 1.5% global market share as of 2024.

This MEXC Exchange Review emphasizes its massive token offering, listing 2,744 trading pairs—the highest among major exchanges. MEXC is actively boosting its reach through marketing campaigns and new features, appealing to traders in regions like India, South America, and Southeast Asia.

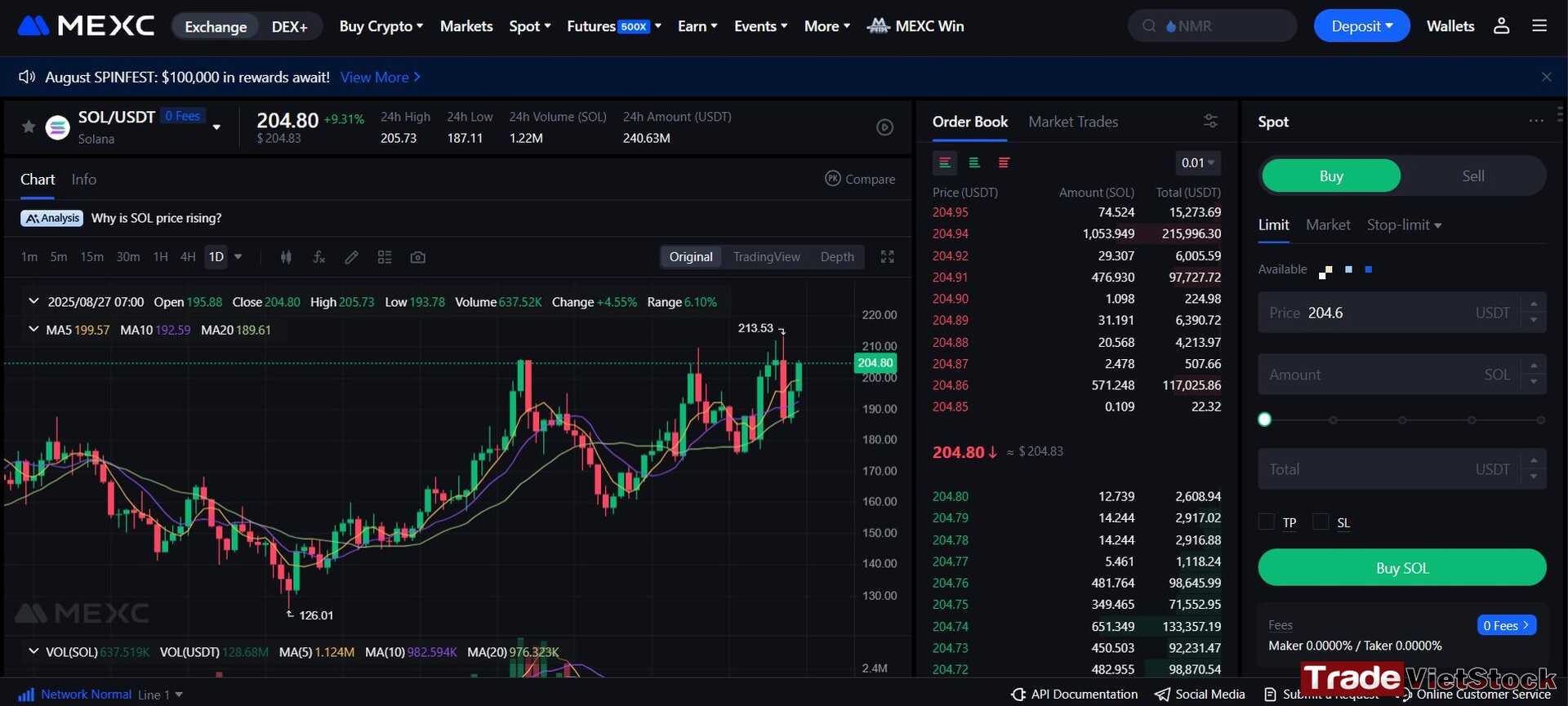

3. Immense Trading Volume

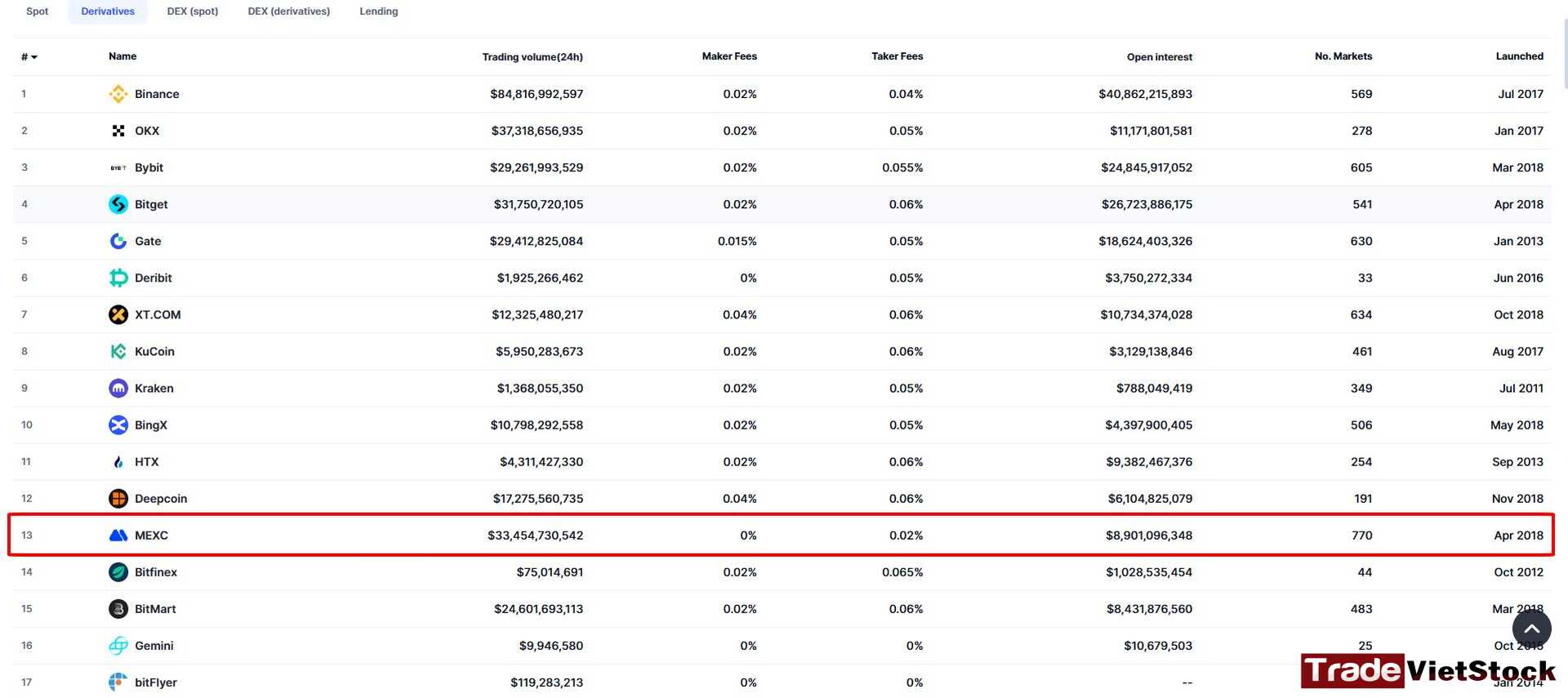

MEXC provides an impressive liquidity pool, a key factor for fast trades. Its 24-hour spot trading volume hits $2.8 billion, surpassing Bitget.

Additionally, futures trading reaches $39.5 billion, ranking 13th among all largest crypto exchanges, putting it in competition with Bybit and Bitget. This high liquidity ensures swift order matching, making MEXC a top choice for active traders, as noted in this MEXC Exchange Review.

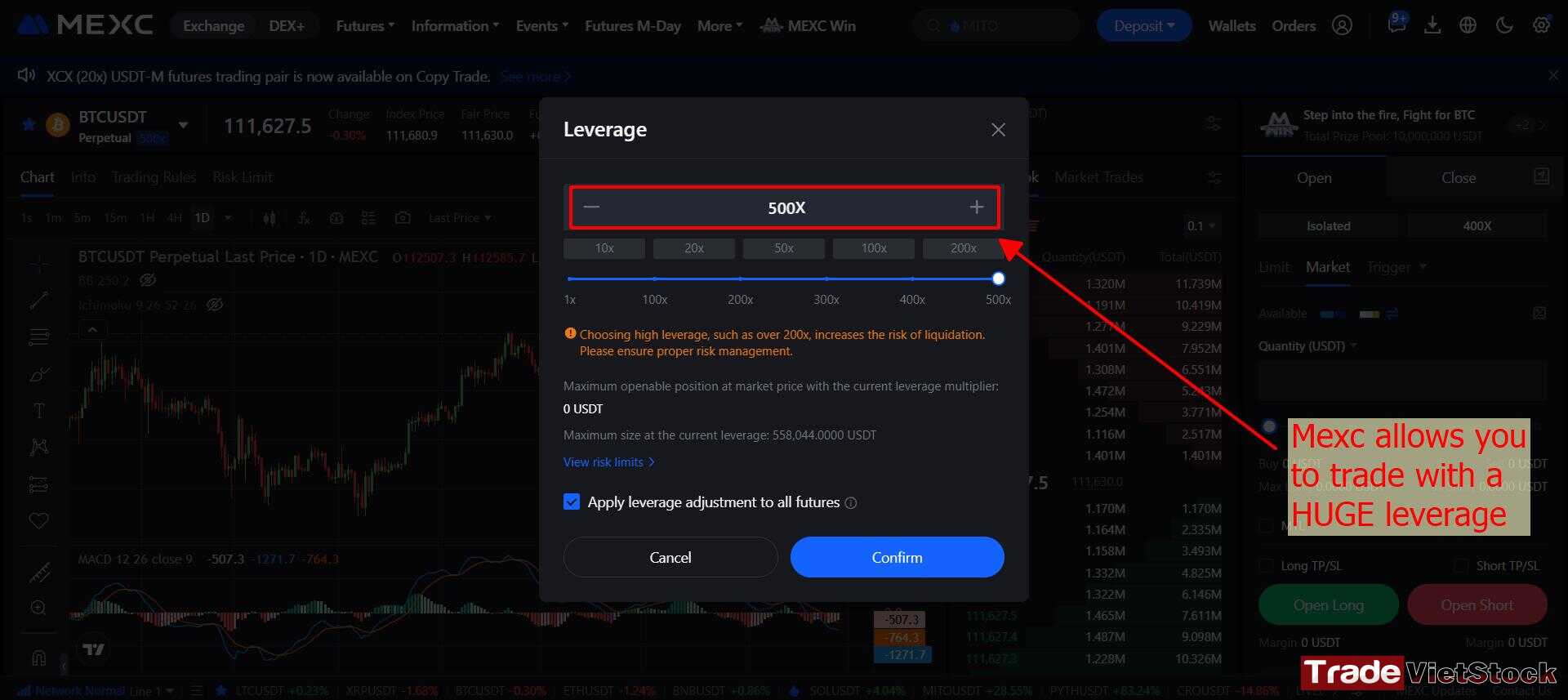

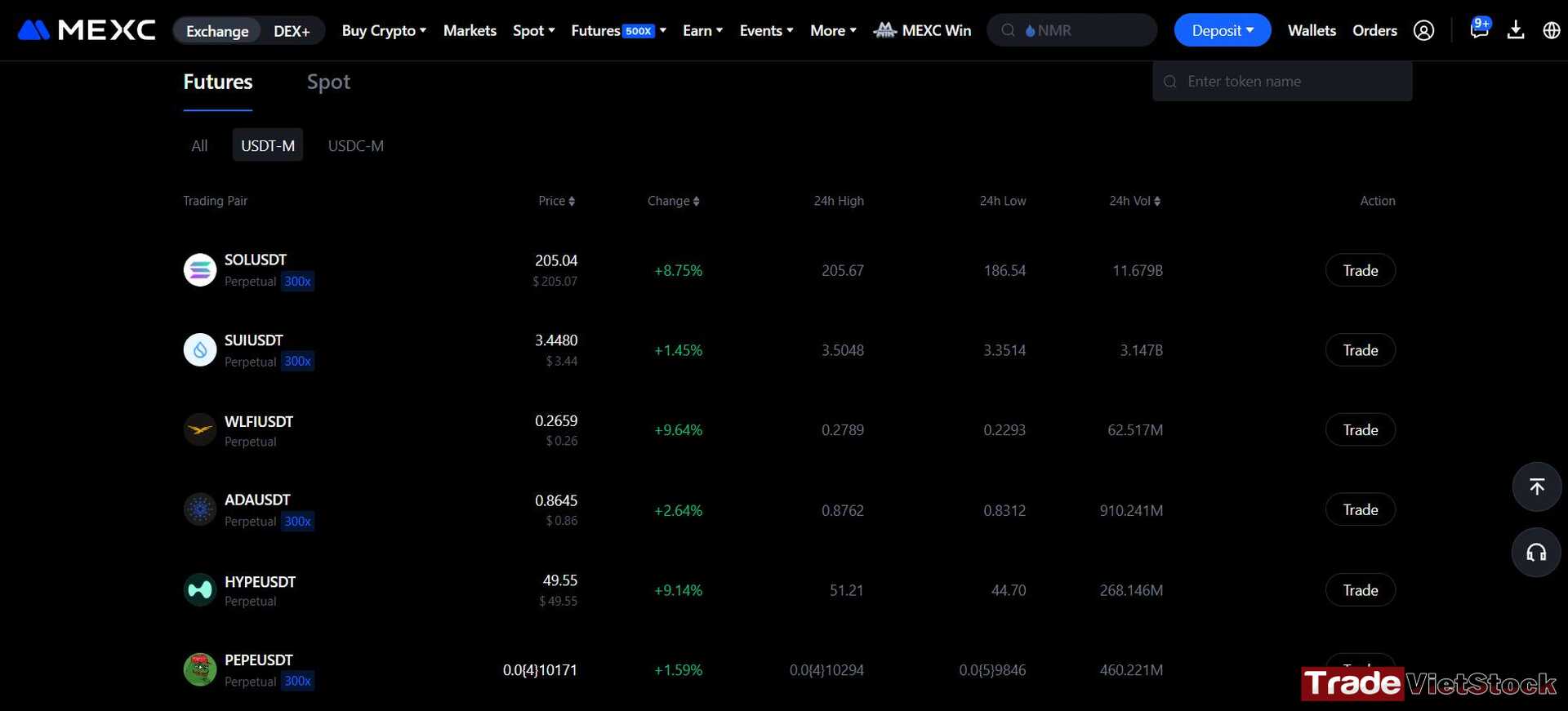

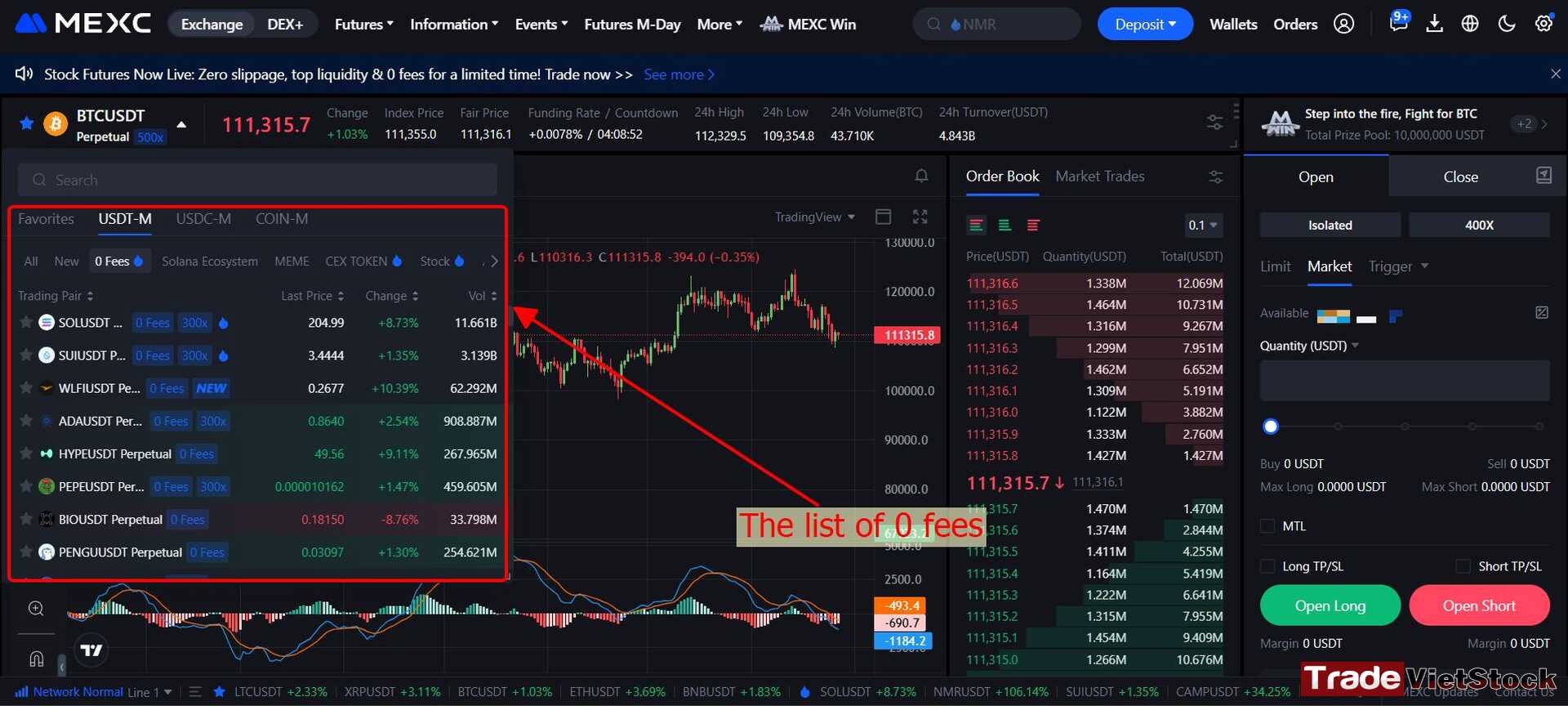

4. Highest Leverage in the World and Numerous Promotional Events

MEXC stands out for offering the highest leverage among major exchanges—up to 500x for Bitcoin, dwarfing Binance’s 125x or Bybit’s 100x. This makes it a haven for scalpers and high-risk traders.

MEXC also shines with frequent promotional events, including futures bonuses, airdrops, and cash giveaways ranging from 10 USDT to hundreds of USDT based on task completion. These rewards make MEXC a magnet for traders seeking extra value, especially in markets like Thailand and Kenya.

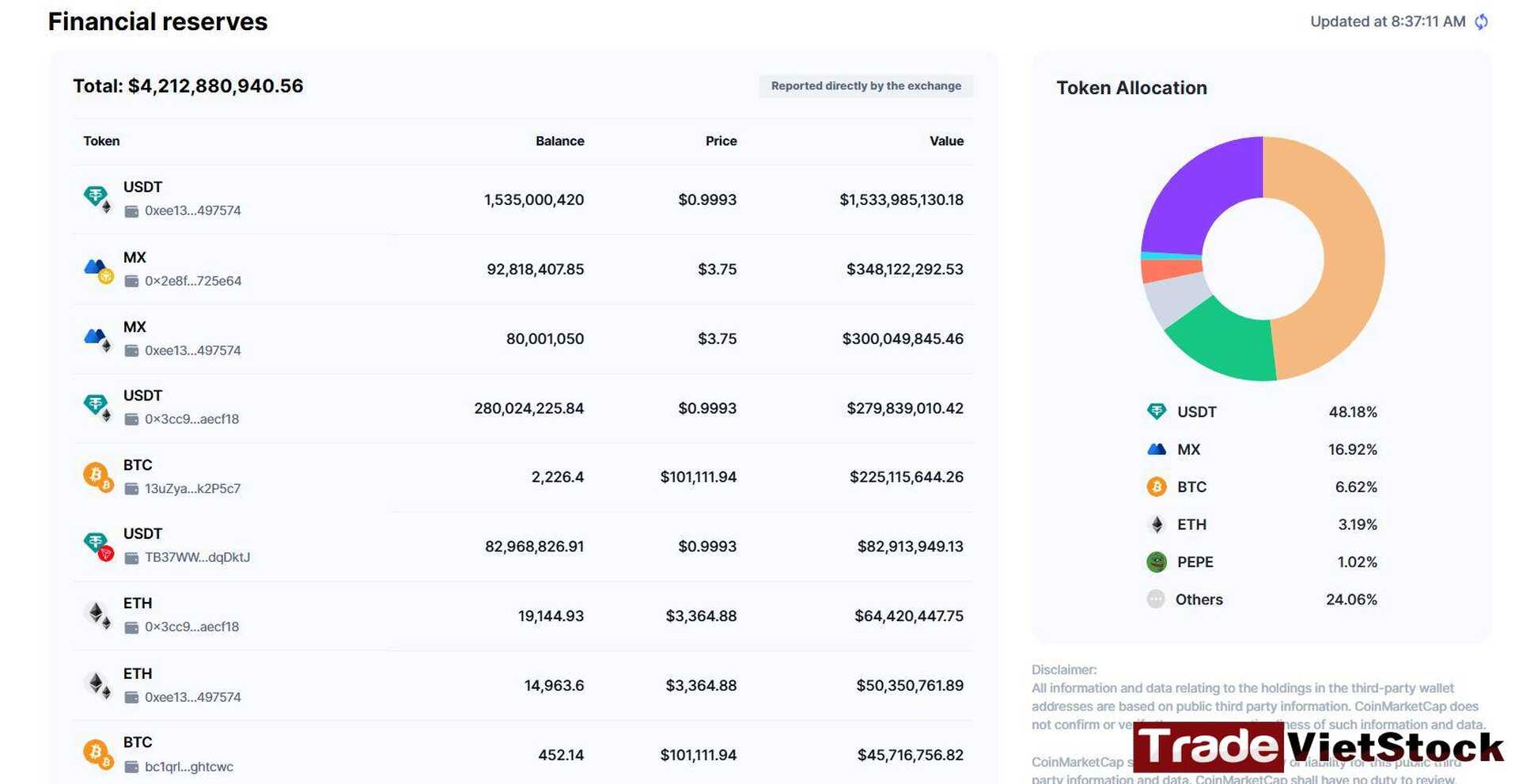

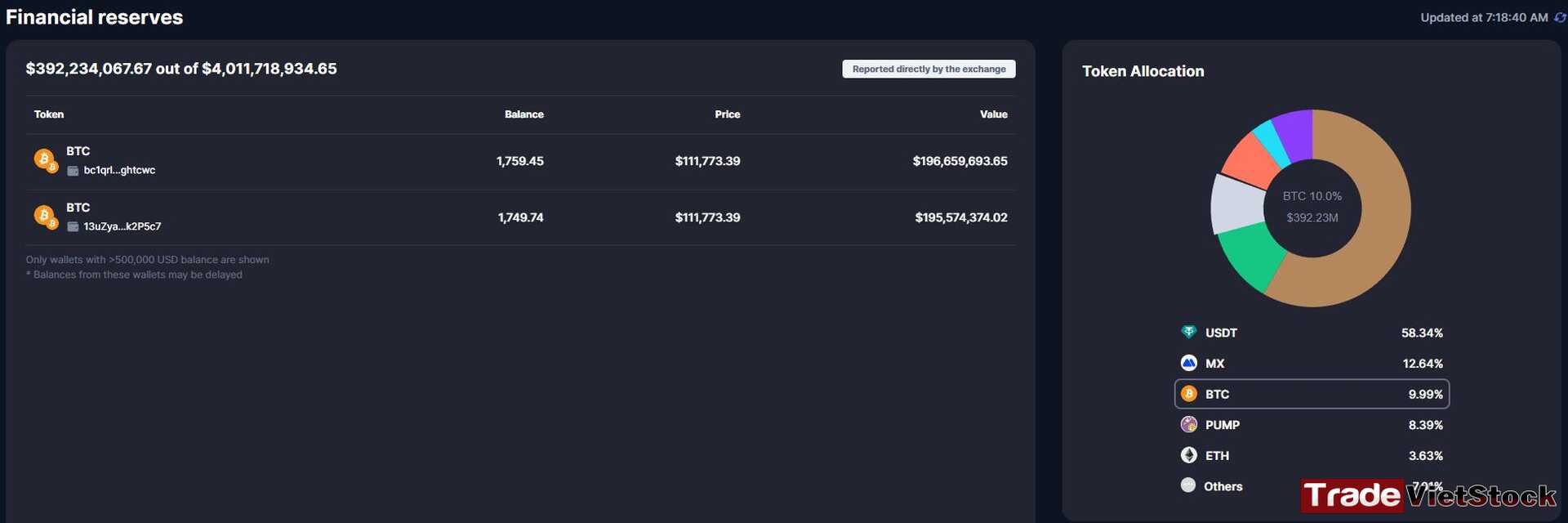

5. Large Financial Reserves

Please note that MEXC has robust financial reserves, valued at over $4.2 billion. USDT dominates at nearly 48%, facilitating easy P2P and stablecoin transactions, while Bitcoin accounts for 6.6% (over $225 million).

This asset structure suggests MEXC targets traders chasing price differentials rather than long-term Bitcoin holders.

6. Lowest Trading Fees Among Current Exchanges

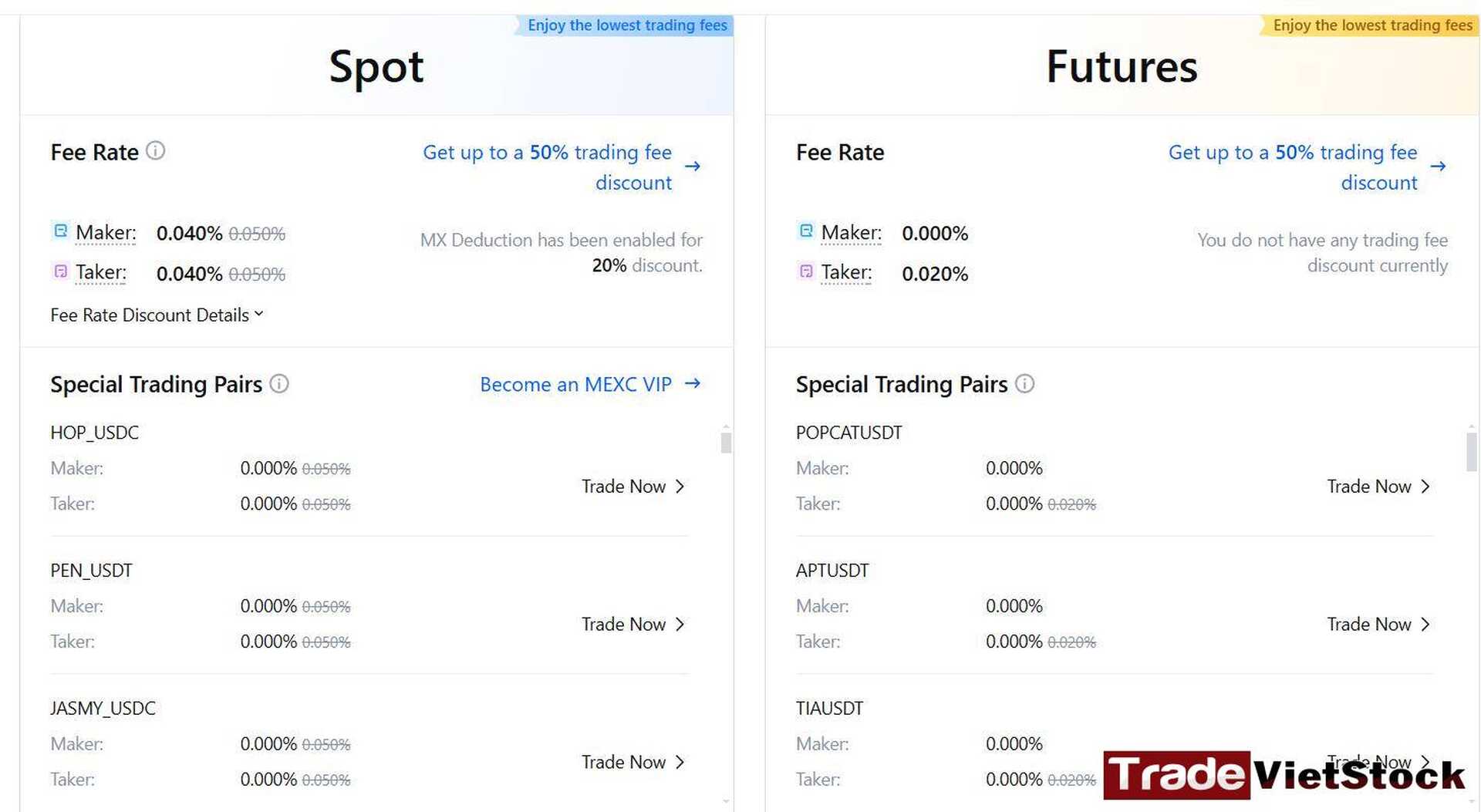

MEXC’s cost structure is a highlight of this MEXC Exchange Review. It offers the lowest fees among major exchanges:

- Spot Fees: 0.04%, reducible by 50% with MX token holdings.

- Futures Fees: 0% for makers, 0.02% for takers, also with MX discounts.

MEXC stands out by offering zero-fee trading on certain groups of cryptocurrencies, giving traders a cost-effective way to buy and sell without the usual charges. This feature is particularly attractive to frequent traders and scalpers, as it allows them to maximize returns by avoiding fees on high-volume trades.

Compared to Binance’s 0.1% spot fees or OKX’s 0.08%, MEXC’s fees are a steal, making it ideal for high-frequency traders and those with limited capital in markets like India.

iii. Things to Keep in Mind: MEXC’s Limitations

1. Prohibited Countries/Regions

MEXC is restricted in countries like the USA, UK, Singapore, China, and Canada due to regulatory constraints. However, it serves over 170 countries, focusing on emerging markets where crypto adoption is booming.

MEXC does not currently provide services, or allow account registration and trading, for users in the following countries/regions:

Canada, Cuba, Hong Kong, Iran, Mainland China, North Korea, Russia-controlled areas of Ukraine (including Crimea, Donetsk, Luhansk, and Sevastopol), Singapore, Sudan, and the United States (collectively referred to as the “Prohibited Countries/Regions”).

Please note that this list is not exhaustive. MEXC reserves the right to update or expand the list of prohibited countries/regions at any time, in line with legal or compliance requirements.

2. Relative Low Bitcoin and Ethereum Reserves Compared To Major Exchanges

A notable concern with MEXC is its relatively low Bitcoin and Ethereum reserves compared to major exchanges. While this may not affect short-term traders, it can be a red flag for long-term holders and serious Bitcoin investors who value strong reserve backing as a sign of stability and security.

Lower reserves may raise questions about liquidity during market stress and whether the platform can support large withdrawals if needed. For investors planning to store significant amounts of BTC or ETH, this makes MEXC less appealing compared to exchanges with stronger reserve levels.

iv. Summary Review of MEXC and Suitable Customer Groups

| Criteria | Details |

| Market Share & Users | 10 million users across 170 countries, holding 1.5% of the global market share. |

| Tokens & Trading Volume | 2744 tokens listed. 24h spot trading volume is $2.8 billion, futures at $39.5 billion, comparable to other major platforms. |

| Leverage & Promotions | Highest leverage among exchanges at x400 for Bitcoin. Diverse promotional programs including futures bonuses, airdrops, and substantial cash giveaways ranging from 10USDT to several hundred USDT. |

| Financial Reserves & Trading Fees | $4.2 billion in assets, with over 48% in USDT reserves.

Spot trading fee at 0.04%, futures at 0%/0.02% (Maker/Taker), with a 50% discount using MX tokens. These are the lowest fees across all exchanges. Trade with ZERO fees when you trade a certain group of cryptos, including Sol, Pepe, etc. |

Suitable Customer Groups:

- New traders learning the ropes

- Traders with small capital

- Traders focusing on scalping and high leverage

- Traders specializing in profit-making through price differentials

- Users seeking numerous promotional events for passive income generation

Less Suitable Customer Groups:

- Long-term BTC investors

- Traders needing a diverse range of financial products

This MEXC Exchange Review concludes that MEXC is a prime destination for new traders, scalpers, and those hunting low fees and high leverage. Its massive token selection and frequent promotions make it a standout in emerging markets.

v. Final Thoughts and How to Get Started

This MEXC Exchange Review wraps up by saying MEXC isn’t the biggest name like Binance, but its ultra-low fees, 500x leverage, and 2,744 tokens make it a top pick for cost-conscious traders in Asia and Africa. Its fast transactions, localized support, and generous promotions seal the deal.

While I’ve used Bybit for advanced products, MEXC is my go-to for scalping and altcoin trading. Long-term BTC holders might prefer OKX or Binance.

Ready to try MEXC? If you appreciate our honest review, you can sign up for Mexc via the link below to support us. Stay tuned for more exchange reviews! You can always return to Tradevietstock anytime for more trading tips and insights.

Tiếng Việt

Tiếng Việt