Exness Broker Review

| Date: 23/08/2025 | 91 Views | Trading Account Registration |

Exness Broker Review – A Top Choice For Asian and African Traders

Today, we’re breaking down Exness, a broker that’s become a favorite for over 800,000 users worldwide, securing its spot among the top five Forex brokers. At Tradevietstock, we’ll explore why it’s a go-to for Asian and African traders, offering a solid, no-frills platform that prioritizes affordability and ease of use. Let’s jump into this Exness Broker Review and see what makes it tick!

[Link to register for a free Exness account]

i. Background and Trustworthiness – A Reliable Player

Launched in 2008 in Russia, Exness has built a strong presence in the global trading scene, with a particular focus on Asia and Africa. A key highlight of Exness is its commitment to transparency, backed by licenses from top regulators like:

- Financial Conduct Authority (FCA, UK)

- Cyprus Securities and Exchange Commission (CySEC)

Exness ensures client funds are held in segregated accounts, adding a layer of security. It’s also part of the Investor Compensation Fund (ICF), offering up to €20,000 in coverage if things go south.

What sets Exness apart is its public financial reports, audited by Deloitte, one of the Big Four firms. This openness builds trust, unlike brokers like Mitrade or Axi, which often lack such transparency.

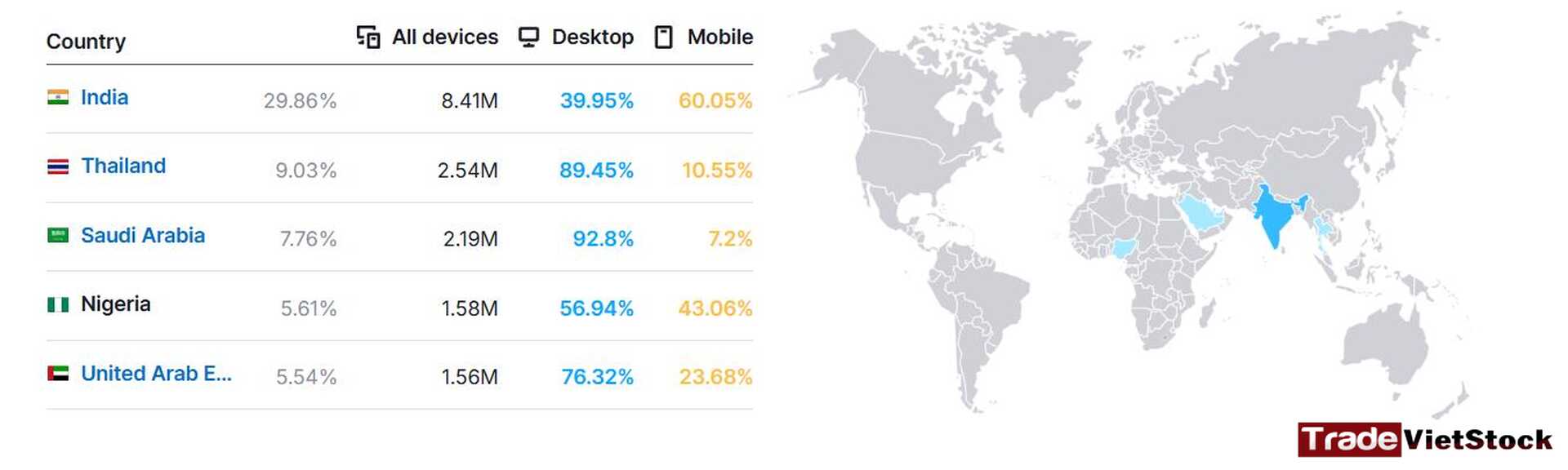

1. Web Traffic (by Country)

When preparing this Exness broker review, we analyzed online data to measure the broker’s regional popularity. The findings show that the keyword Exness is searched most frequently in Asia and predominantly Muslim regions. This indicates the broker’s strong presence in emerging markets, where trading interest is growing rapidly.

Southeast Asia—particularly Thailand and Vietnam—along with India in South Asia and countries across Africa such as Egypt and South Africa, account for a significant share of Exness’s online traffic and trading activity. These regions highlight Exness’s ability to connect with local traders and adapt to their needs.

Beyond its core base in Thailand, Exness has built influence in several other key markets:

- Nigeria: Forex trading is booming among young Nigerians, and Exness appeals to newcomers with Cent accounts and accessible learning resources.

- India: With a growing middle class, India is a major growth hub. Exness’s $1 minimum deposit and demo accounts lower entry barriers for beginners.

- South Africa: Thanks to FSCA regulation and transparent pricing, Exness has established trust and credibility among South African traders.

- Kenya: A youthful, tech-driven population finds value in Exness’s localized support and swap-free Islamic accounts.

2. Why Exness Thrives in These Regions?

Exness’s success is no accident—it comes from aligning its services with the realities of emerging markets:

- Low Entry Barriers: Standard accounts require only $1 to start, while Pro and Zero accounts are accessible from $200. This makes trading realistic for individuals with limited starting capital.

- Education and Training: Through webinars, tutorials, and demo accounts, Exness equips traders in regions with developing financial literacy to trade more confidently.

- Islamic Account Options: Swap-free accounts, which comply with Sharia law by removing overnight interest, make Exness especially attractive in Muslim-majority markets.

- Local Presence with Global Reach: With offices in Cyprus, South Africa, Kenya, Curaçao, Seychelles, the UK, and Mauritius, Exness adapts to local regulations and provides region-specific support, offering a “local” experience to global traders.

In short, Exness’s focus on accessibility, user-friendly interface, and low fees has made it a leading broker across Southeast Asia, South Asia, and Africa—cementing its dominance in emerging markets.

| Country | Region | Monthly Searches | Key Appeal for Traders |

| India | South Asia | 246,000 | Low deposits, demo accounts, growing middle class |

| Vietnam | SE Asia | 135,000 | Strong forex community, affordability, local education support |

| Thailand | SE Asia | 90,500 | Major hub for Exness, localized services, simple account setup |

| Indonesia | SE Asia | 74,000 | Mobile trading adoption, low barriers to entry |

| Pakistan | South Asia | 49,500 | Cent accounts + Islamic options attract beginners |

| South Africa | Africa | 40,500 | FSCA regulation, transparency, trusted broker reputation |

| Nigeria | Africa | 33,100 | Growing youth trader base, strong forex interest |

| Uzbekistan | Central Asia | 33,100 | Rising demand for forex in emerging market |

| Bangladesh | South Asia | 27,100 | Low-cost entry + education resources |

| Japan | East Asia | 18,100 | Sophisticated retail traders seeking alternatives |

| Morocco | North Africa | 18,100 | Islamic accounts + mobile access |

| UAE | Middle East | 14,800 | Regional financial hub, strong Muslim trader base |

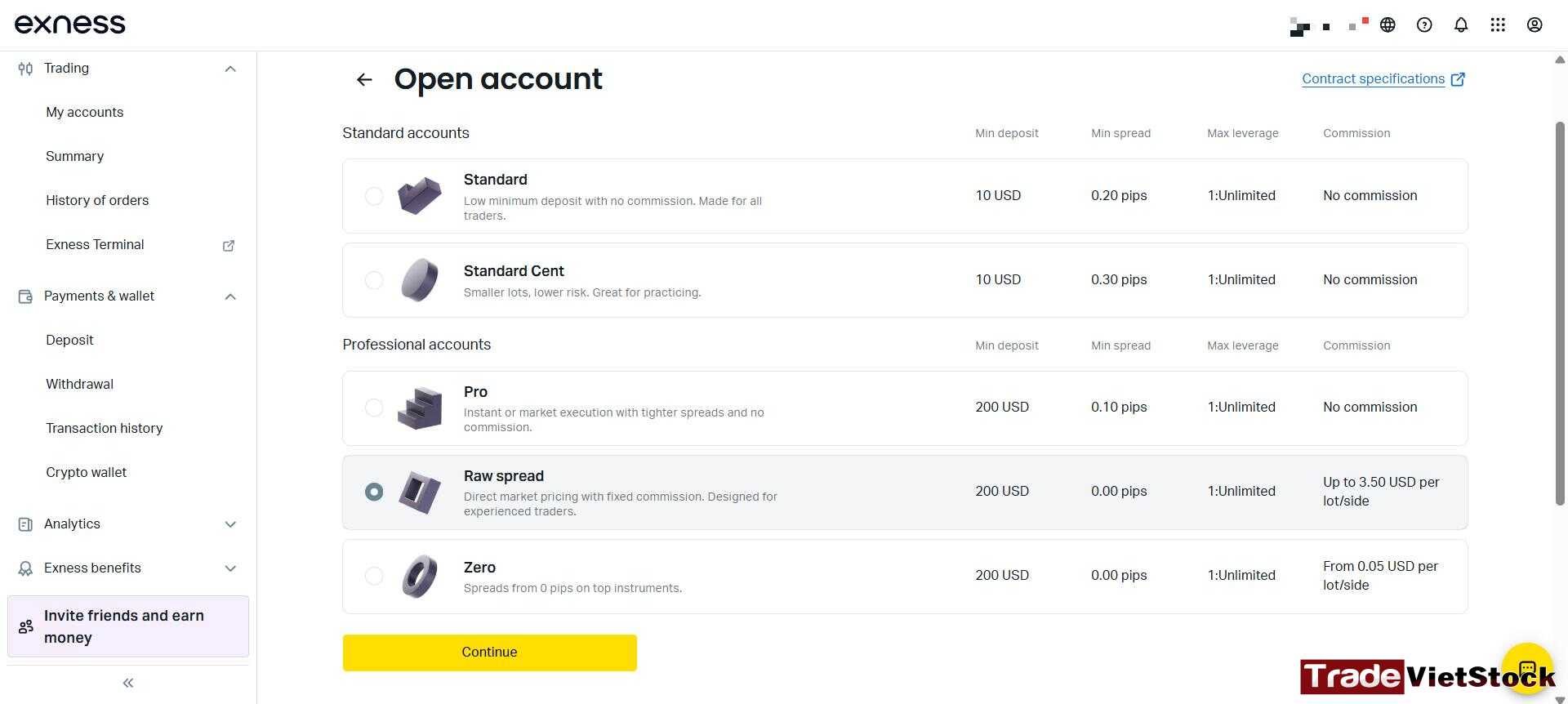

ii. Account Options – Flexible for All Levels

A key highlight of this Exness broker review is the broker’s versatile account types, designed to suit both beginners and experienced traders. Exness offers two main categories—Standard Accounts and Professional Accounts—providing flexibility for every trading style.

1. Standard Accounts:

- Standard: Minimum deposit of $1, with leverage up to 1:infinity (MT4).

- Standard Cent: Trade in cents instead of USD, minimizing risk for newbies.

Ideal for beginners, with low entry barriers and user-friendly features.

2. Professional Accounts:

- Pro: Spreads from 0.1 pips, no commissions, instant execution.

- Raw Spread: Spreads from 0 pips, $7 commission per lot.

- Zero: 0 pips on 30 instruments for 95% of the time, perfect for low-cost strategies.

One of the key highlights of this Exness broker review is the flexibility to open multiple accounts or switch between them as your skills develop and your needs evolve.

iii. Product Range and Trading Costs

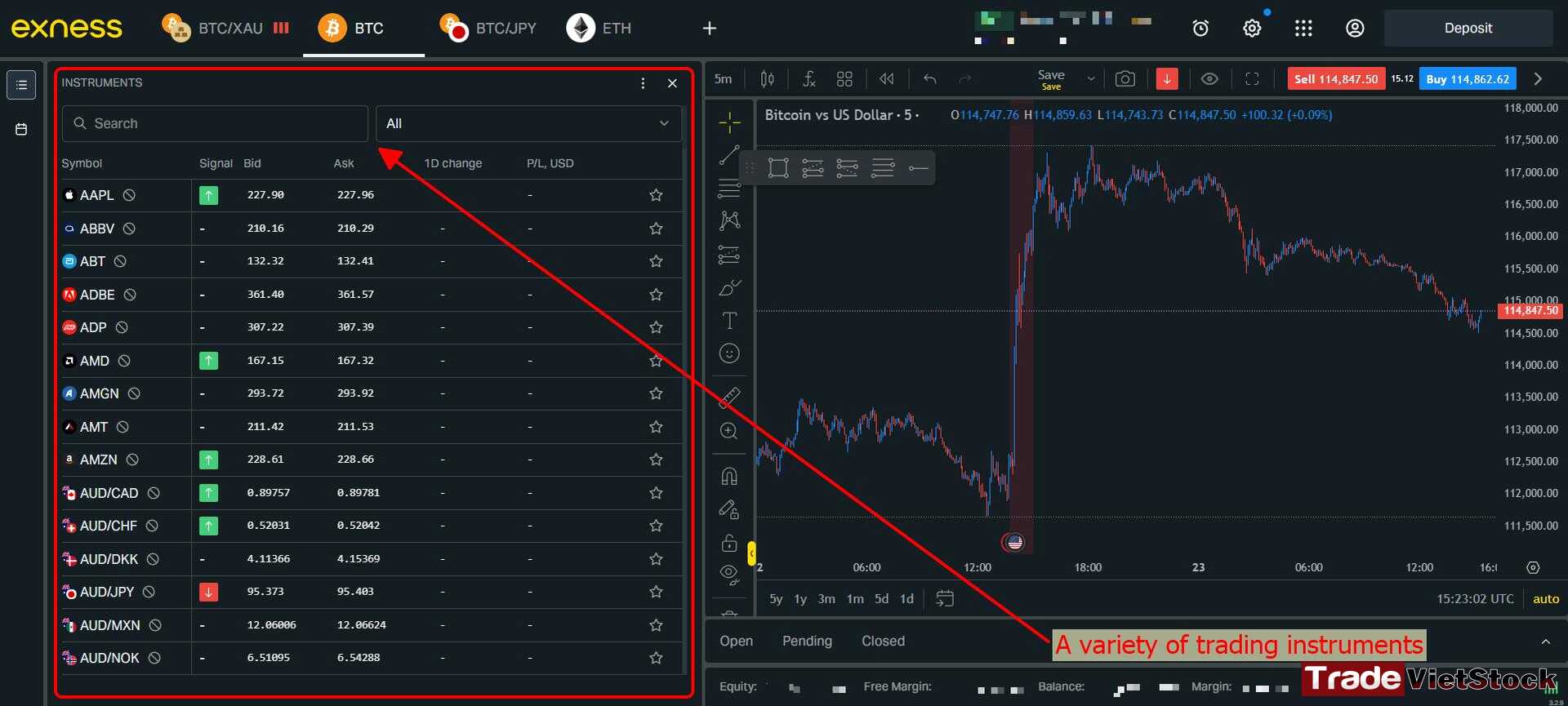

1. A Variety of Trading Pairs and Instruments:

In this Exness Broker Review, we note that Exness’s product portfolio isn’t the largest, but it covers the essentials traders love:

- Forex: 107 currency pairs, including majors, minors, and exotics.

- Stocks: 81 major stocks, like Apple, Google, and Amazon.

- Indices: 10 key indices, covering US, European, and Asian markets like Japan and Hong Kong.

- Cryptocurrencies: Limited to pairs like BTC/USD and ETH/USD, with 1:100 leverage and no swap fees.

- Metals & Energy: 11 assets, including gold, silver, and oil.

Please note that Exness’s 24/7 crypto trading and swap-free crypto positions as major perks, rivaling platforms like Binance. While not as diverse as XTB’s 6,100+ instruments, Exness’s focused range suits traders who prioritize major markets over niche assets like livestock or ETFs.

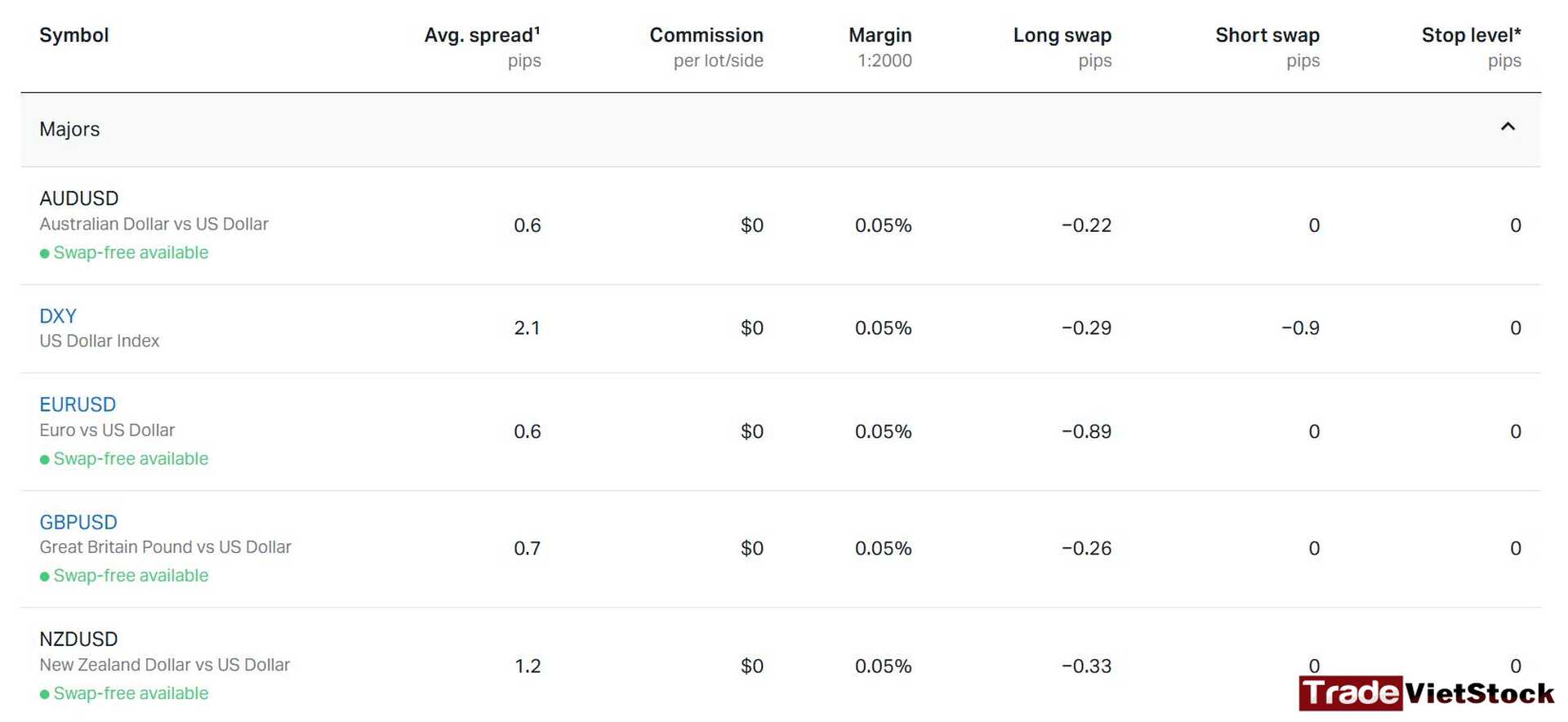

2. Trading Costs and Conditions – Wallet-Friendly

Let’s dive into Exness’s cost structure, a standout for budget-conscious traders:

- Spreads: Starting at 0 pips on Zero and Raw Spread accounts, with Pro accounts from 0.1 pips.

- Commissions: $7 per lot on Raw Spread, none on Pro.

- Leverage: Up to 1:infinity (MT4) or 1:2000 (MT5), scaling down to 1:1000 for accounts over $3,000.

- Swap-Free Trading: Available for crypto and select assets, ideal for long-term holds.

I love Exness’s low-cost model, making it perfect for small-capital traders in Asia and Africa. Compared to XTB or FxPro, Exness offers some of the market’s lowest fees, though it sacrifices product variety.

iv. Trading Platform – Simple and Effective

Exness supports many trading platforms, including Exness Terminal Web and MT4, MT5, a mobile app, and a web terminal, as noted in this Exness Broker Review. Key features include:

- MT4: Beginner-friendly, with low spreads and a simple interface.

- MT5: Advanced tools for stocks, indices, and technical analysis, suited for pros.

- Web Terminal: Clean and intuitive, though less modern than XTB’s xStation.

- Social Trading: Copy trades from successful traders, great for beginners.

1. Exness Terminal Web

The Exness Terminal Web is designed with a clean, user-friendly interface that makes online trading simple and accessible. Its intuitive layout allows beginners to navigate effortlessly, execute trades quickly, and access key tools without unnecessary complexity. Because it runs directly in a browser, there’s no need for downloads or complicated setups, making it an ideal choice for new traders who value convenience and ease of use.

The only limitation of using this platform comes from regional restrictions. For example, in Vietnam, traders may occasionally face difficulties accessing the trading web due to local network provider limitations. However, this can be easily bypassed by using a VPN, ensuring uninterrupted access to the Exness Terminal Web.

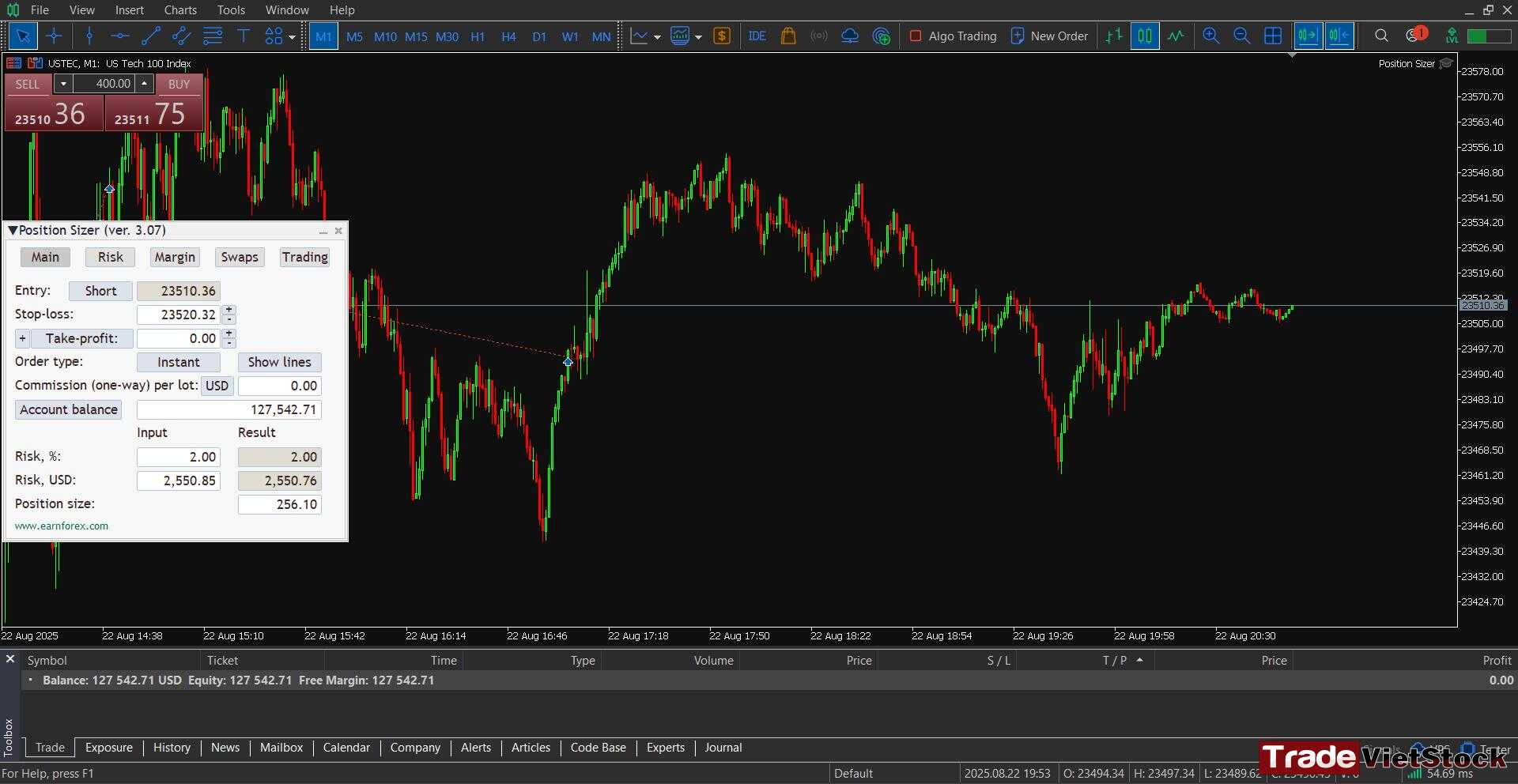

2. MT4/MT5 Platform

Using MT5 with the Exness server provides a professional-grade trading environment with seamless access, even in regions where web platforms may face restrictions. Beyond stable connectivity and advanced charting tools, MT5 allows traders to create their own custom indicators, automated strategies, and trading bots.

This flexibility makes it a powerful platform not only for beginners seeking reliability but also for experienced traders who want to tailor their trading experience to their own strategies.

This Exness Broker Review appreciates the MT4/MT5 support, which XTB lacks, but notes that the web terminal could use a design upgrade. Some Asian regions may face access issues due to local network restrictions, but MT4/MT5 or customer support can resolve this.

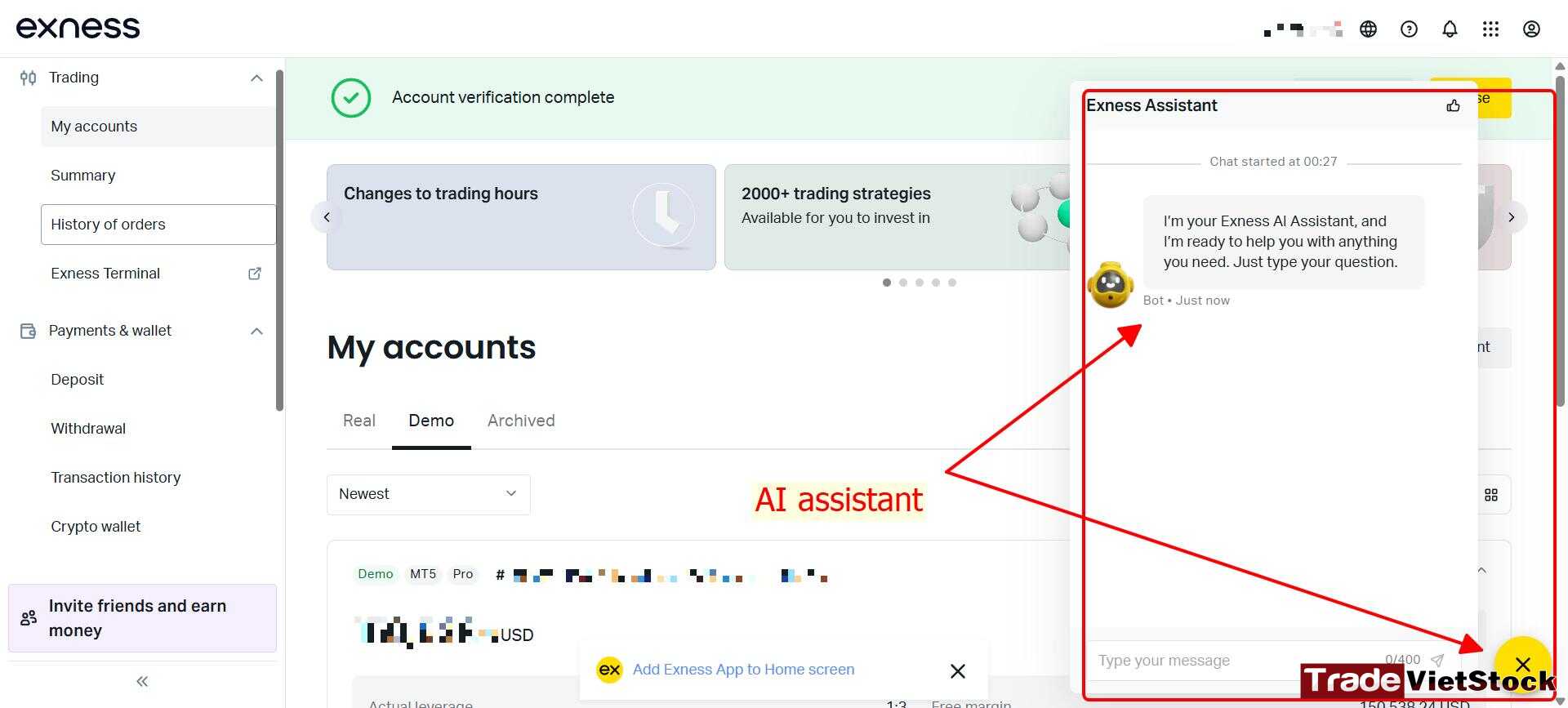

v. The Limitation of AI Assistant

Unlike XTB, Exness only provides an AI assistant on its website. For technical issues, the best way to get support is through email. I’ve been using Exness for two years, and whenever I face a technical problem or have a question, I contact them by email. Within minutes—depending on regional conditions—I usually receive a response either by email or phone call, which has been very helpful.

vi. Funds And Account Management Features – Clear and Practical

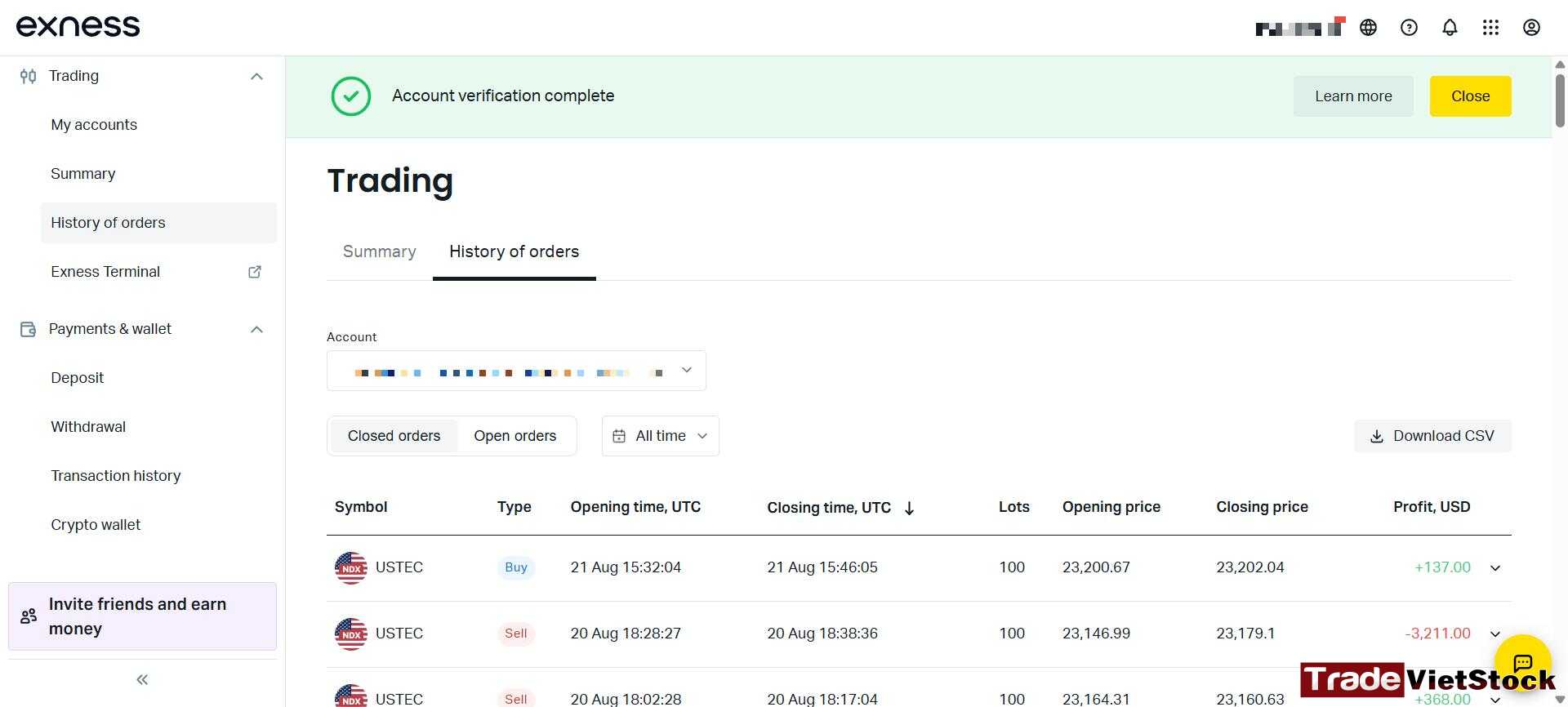

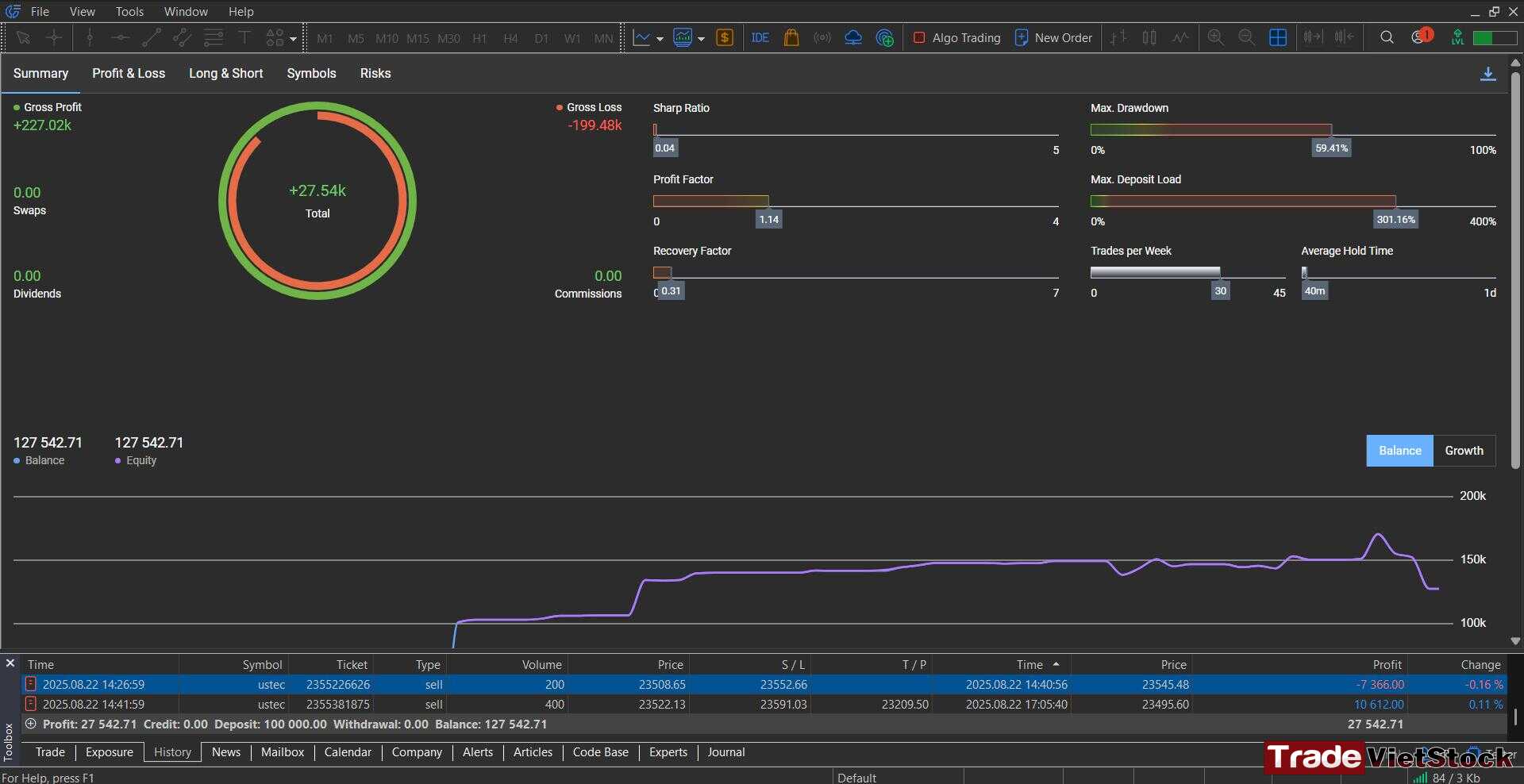

1. Account Management and Statistics

On Exness, the personal area dashboard already shows you performance stats, order history, and trade analytics. This is useful because it gives a clear view of how your strategies are performing over time — you can track profits, losses, consistency, and trading habits. Having this analysis helps traders identify strengths and weaknesses, adjust risk management, and refine their approach instead of trading blindly.

- Trading Statistics: Detailed insights into profit/loss, trade history, and performance metrics.

- Account Overview: Real-time updates on balance, margin, and open positions.

- Risk Management: Tools to monitor leverage and exposure, helping traders stay in control.

- Custom Reports: Filterable data by time or asset, presented in user-friendly charts.

The same can also be done directly on MT5 using the Exness server, where you can view your full order history, account statements, and even generate detailed reports (with balance curves, drawdown, etc.). Combining both the Exness web analytics and MT5 reports gives you a complete picture of your performance.

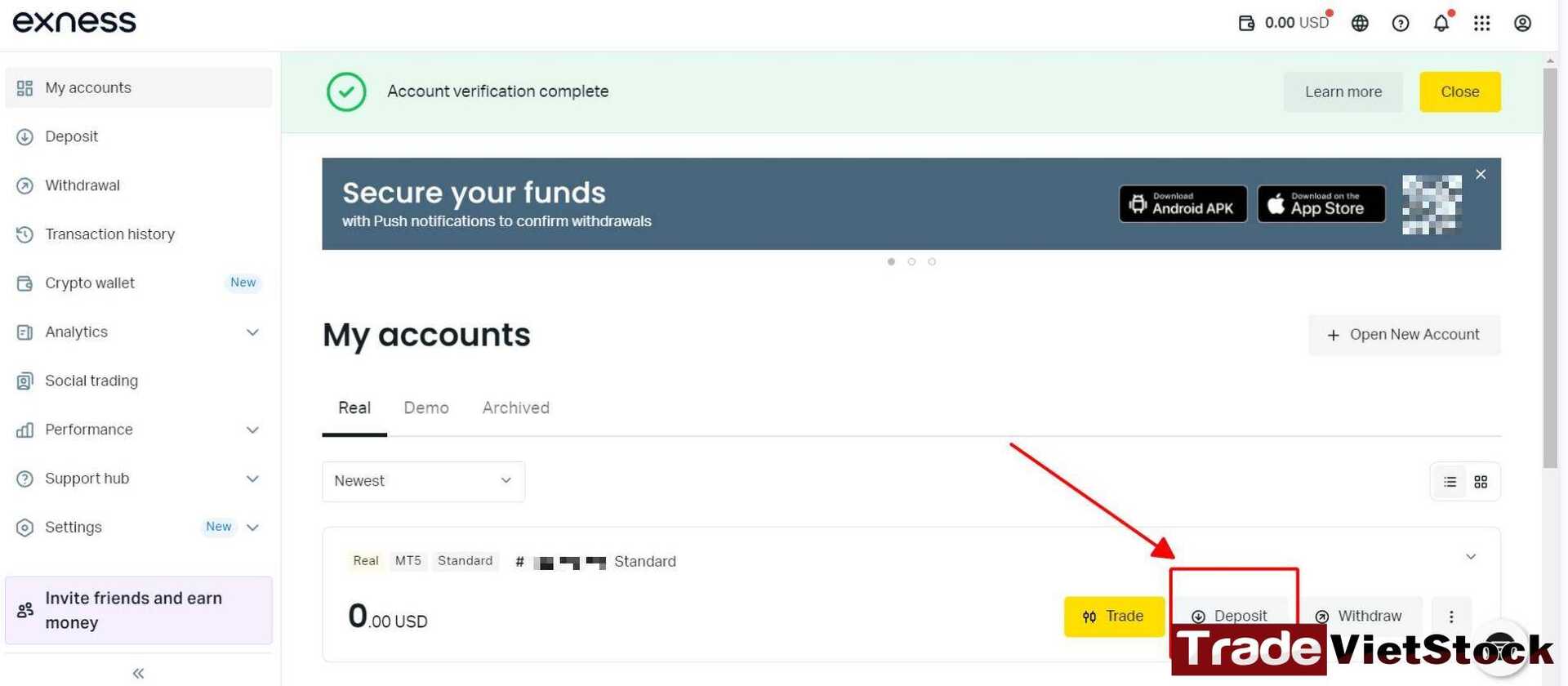

2. Deposits and Withdrawals – Lightning-Fast and Fee-Free

Exness excels in its deposit and withdrawal system, as noted in this Exness Broker Review. Key points:

- Speed: Transactions process in 3-5 minutes, even on weekends.

- Methods: Supports Internet Banking, Visa, Skrill, Neteller, and BinancePay for crypto integration.

- No Fees: Zero charges for deposits or withdrawals, unlike brokers like FxPro.

This Exness Broker Review sees this as a major advantage, especially for Asian traders who value quick, cost-free transactions.

vii. Who Should Choose Exness?

1. New Traders and Small-Capital Players:

This Exness Broker Review highlights its low fees, $1 minimum deposit, and user-friendly platforms, perfect for beginners.

2. Crypto Enthusiasts:

Swap-free crypto trading and 24/7 availability make Exness a solid choice, though its crypto range is smaller than Binance or Bybit.

Exness isn’t ideal for traders seeking extensive product catalogs or advanced tools, where XTB or FxPro shine.

3. Conclusion:

This Exness Broker Review concludes that Exness isn’t the flashiest broker, but its low costs, transparency, and beginner-friendly vibe make it a top pick for Asian and African traders. Its human-powered support and fast transactions add to its appeal.

While I’ve used XTB for broader markets, Exness remains my go-to for cost-effective trading. Pros seeking more products may prefer XTB or FxPro. If you want to read more about top 4 brokers, you can view HERE.

Ready to try Exness? Sign up for a free account by clicking the link below. Stay tuned for more broker reviews.

Happy trading!

[Link to register for a free Exness account]

Tiếng Việt

Tiếng Việt