Top 3 promising cryptocurrencies of the year – cutting-edge technology and real-world applications

Hello everyone, it’s Tradevietstock here again! The crypto market isn’t a place where everyone makes money, but if you choose the right tokens—those with strong technology, real-world applications, and significant liquidity—then the opportunity to multiply your assets is absolutely within reach.

The tokens below are not just temporary trends. They have solid foundations, solve major blockchain challenges, and outperform their competitors. Now, let’s explore the Top 3 promising cryptocurrencies of the year!

I. WHY DO BLOCKCHAINS NEED TOKENS?

1. Are Tokens Only for Trading?

No! In a blockchain ecosystem, tokens are not just a medium for transactions. They play a crucial role in network security, transaction processing, and maintaining decentralization.

2. How Do Tokens Enable Blockchain Operations?

A blockchain cannot function without tokens. Tokens serve three essential purposes:

- Transaction Fees (Gas Fees): Ethereum requires ETH, Solana requires SOL, and Binance Smart Chain requires BNB to process transactions.

- Network Security (Staking & Validators): Without tokens for staking, the network cannot validate transactions or protect itself against attacks.

- Governance: Token holders have the right to vote on critical system upgrades and changes.

Major platforms like Ethereum, Solana, and Avalanche all have their own tokens because without them, their ecosystems would not function.

ii. How to identify a potential x2-x5 cryptocurrency?

1. Does It Have Breakthrough Technology?

Before diving into the top 3 promising cryptocurrencies of the year, it’s important to understand that for a token to experience strong growth, it must solve a real problem. Does it make blockchain faster, cheaper, or more secure? If it lacks innovation, it cannot compete with leading blockchains like Ethereum or Solana.

2. Does It Have Strong Real-World Utility?

Is the token actively used within its ecosystem, or is it just a speculative asset with no actual function?

Tokens with clear real-world applications, such as AAVE, UNI, and LINK, tend to maintain long-term value better than tokens that exist solely for trading purposes.

3. Does It Have a Strong Development Team and Reliable Investment Backing?

Does the project have an experienced team? Is it backed by major investment firms like Binance Labs, a16z, or Multicoin Capital? A project with a skilled team and strong financial backing has a much higher chance of long-term success.

4. Does It Have Strong Liquidity and Market Demand?

If a token’s trading volume is mostly generated by bots and lacks real liquidity, it won’t survive in the long run.

Tokens with strong communities and high trading volumes, like SOL, ARB, and OP, tend to have greater growth potential and market resilience.

Top 3 promising cryptocurrencies of the year you should know

I. LAYERZERO (ZRO) – A SAFER CROSS-CHAIN SOLUTION COMPARED TO BRIDGES

1. The Problems with Current Cross-Chain Solutions

Currently, when users want to transfer assets between different blockchains, they rely on bridges such as Wormhole and Multichain. However, these bridges come with two major issues:

- Security vulnerabilities: Between 2022 and 2023, over $2 billion was stolen due to bridge hacks.

- Slow transactions and high fees: Cross-chain transfers via bridges require multiple verification steps, resulting in delays and high transaction costs.

2. How Does LayerZero Outperform Traditional Bridges?

Unlike traditional bridges, LayerZero does not rely on third-party intermediaries. Instead, it uses Omnichain technology, allowing blockchains to communicate directly. This makes transactions faster, more secure, and eliminates the need for an intermediary bridge.

Key components of LayerZero’s technology:

- Ultra-Light Nodes (ULN): Enables blockchain networks to exchange data efficiently without running full nodes.

- Omnichain Messaging: Smart contracts on Ethereum, Solana, and BNB Chain can directly interact with each other.

3. Why Does ZRO Hold Value?

a) ZRO is Used to Pay Cross-Chain Transaction Fees

LayerZero enables direct blockchain-to-blockchain communication, but it requires transaction fees to function. ZRO serves as the primary token for paying these cross-chain fees, replacing traditional gas fees across multiple blockchains.

Example Use Cases:

- A user transferring USDT from Ethereum to Solana pays fees in ZRO, instead of paying separate Ethereum and Solana gas fees like when using a bridge.

- A dApp sending data from Ethereum to BNB Chain uses ZRO for inter-blockchain communication, reducing costs and transaction times compared to a traditional bridge.

Since LayerZero has the potential to become the industry standard for cross-chain transactions, the more transactions occur, the higher the demand for ZRO.

b) Staking ZRO to Secure the Network

LayerZero implements a staking mechanism to ensure network security. Validators must stake ZRO tokens to obtain the right to verify cross-chain transactions.

- Validators must lock up ZRO tokens to participate in the system. If they engage in fraudulent activities or act against network consensus, they face slashing (losing their staked ZRO).

- Regular users can also stake ZRO to contribute to the network’s security and earn rewards from cross-chain transaction fees.

As the volume of transactions increases, more validators join the network, leading to a higher percentage of ZRO tokens being locked up. This reduces the circulating supply, potentially increasing the token’s value.

c) Governance – Community-Controlled Future Development

ZRO token holders have voting rights to decide on key updates within the LayerZero ecosystem, such as:

- Adjusting cross-chain transaction fees

- Expanding support for new blockchain networks

- Enhancing LayerZero’s technology

By holding ZRO, the community has direct influence over the future development of LayerZero, preventing control from being concentrated in a single company or centralized entity.

4. Comparison: LayerZero vs. Cross-Chain Bridges

| Platform | Speed | Transaction Fees | Security | Operation Model |

| Wormhole | Slow | High | Vulnerable | Centralized bridge |

| Multichain | Medium | Medium | Vulnerable | Requires multiple confirmations |

| LayerZero | Fast | Low | More Secure | Direct blockchain communication, no bridge required |

=> ZRO is not just another cross-chain token. It plays a critical role in making blockchain transactions faster, cheaper, and more secure. As more blockchains adopt LayerZero as a standard for cross-chain interactions, the value of ZRO is expected to grow significantly in the long run.

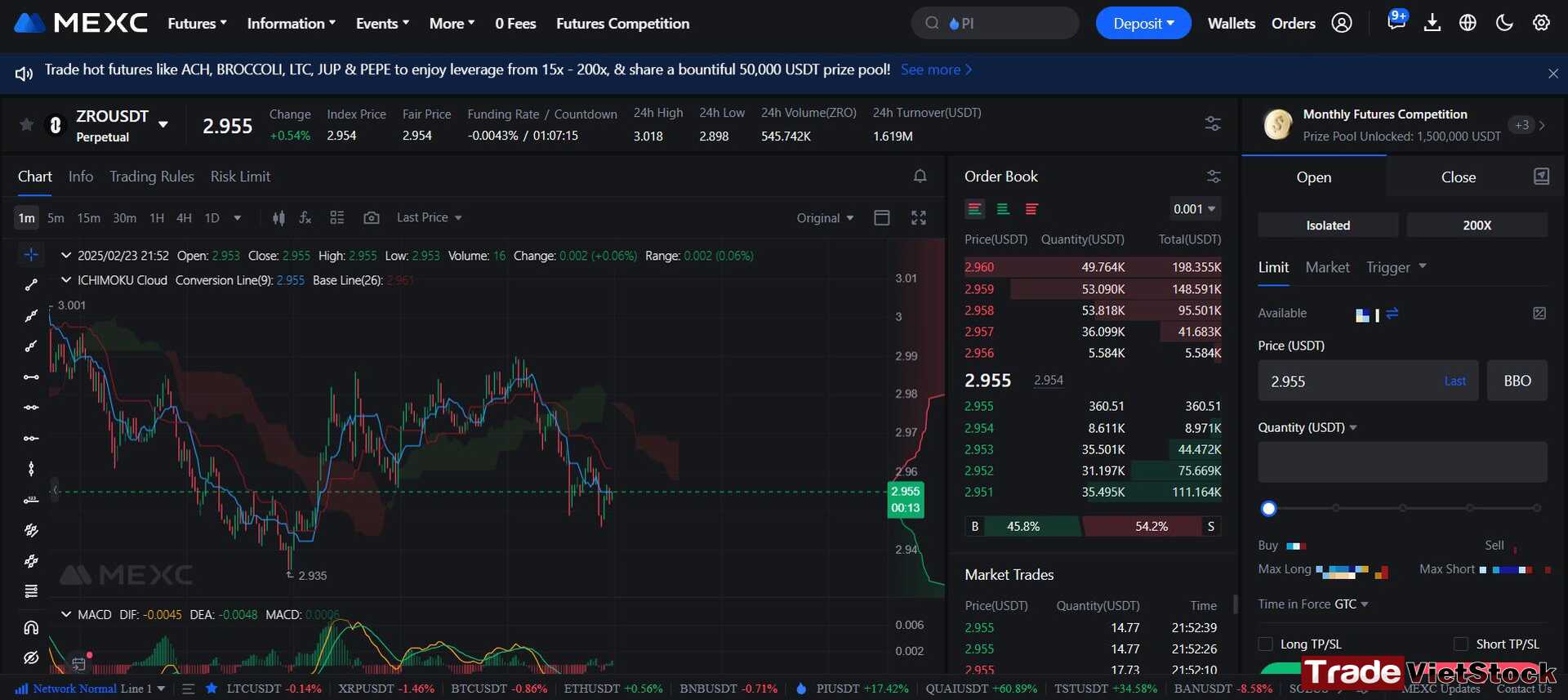

5. ZRO Price Chart and Investment Opportunities

Currently, ZRO is trading at its lowest level since launch, around $3 USDT.

Technical indicators from Tradevietstock suggest that ZRO is forming a bottom, making it an ideal entry point for long-term investors.

=> Long-term investors may consider accumulating ZRO around the $3 USDT range. Avoid short-term speculation and focus on long-term investment strategies. Investors can choose MEXC for the lowest trading fees or Binance for asset storage.

📌 Register an account on MEXC here

📌 Register an account on Binance here

II. ARKHAM (ARKM) – THE MOST POWERFUL AI-BASED BLOCKCHAIN ANALYTICS TOOL

1. The Problem with Current Blockchain Analytics Tools

On-chain data analytics platforms like Nansen, Glassnode, and Dune Analytics face several significant limitations:

- Human-dependent labeling: These systems require blockchain experts to manually tag data, which slows down updates.

- No decentralized data marketplace: Currently, no platform allows users to buy and sell blockchain data in a decentralized manner.

- Limited accessibility: Most blockchain analytics services are expensive, making them inaccessible to individual investors.

2. How Does Arkham Outperform Competitors?

Among this year’s top 3 promising cryptocurrencies of the year, Arkham stands out by leveraging AI to analyze blockchain data in real time, eliminating the need for human intervention. Additionally, Arkham has developed the Arkham Intel Exchange, where users can buy and sell blockchain data in a decentralized marketplace.

- Automated AI Analysis: Arkham can detect unusual transactions, track whale wallets, and predict capital flows without human input.

- Arkham Intel Exchange: For the first time, users can buy and sell on-chain data, creating a decentralized data economy.

3. Why Does ARKM Hold Value?

a) Used to Pay for AI Blockchain Analytics Access

Users must pay ARKM to access data from Arkham’s AI system, which helps them monitor capital flows, whale wallet identities, and market movements.

b) ARKM is the Native Token for Transactions on the Arkham Intel Exchange

Users can sell blockchain intelligence on the Arkham Intel Exchange, with ARKM being the primary currency for transactions.

Example Use Cases:

- A blockchain analyst discovers a whale accumulating a new token and sells this information in exchange for ARKM.

- A large institution wants to monitor money laundering activities on the blockchain and purchases the data using ARKM.

c) Staking ARKM for Access to Premium Data

Users who stake ARKM can unlock premium blockchain reports, including:

- Price prediction models based on whale transaction flows.

- Lists of wallet addresses owned by major institutions.

- DeFi analytics categorized by platform and sector.

4. Comparison: Arkham vs. Competitors

| Platform | AI-Based Analysis | Data Marketplace | Automated Whale Tracking |

| Nansen | No | No | Manual tracking only |

| Glassnode | No | No | No |

| Arkham | Yes | Yes | AI-driven tracking |

=> In the Top 3 promising cryptocurrencies of the year, ARKM is not just a tradable token—it is the core of a decentralized blockchain intelligence economy. As blockchain analysis becomes more important for both individual investors and institutions, demand for ARKM will increase over time.

5. ARKM Price Chart and Investment Opportunities

Currently, ARKMUSDT is at its lowest price since listing, around $0.7 USDT.

Technical indicators from Tradevietstock suggest that ARKM has formed a bottom, making it a good entry point for long-term investors.

=.>Long-term investors may consider accumulating ARKM around the $0.7 USDT range. Avoid short-term speculation and focus on long-term holding strategies. Investors can choose MEXC for the lowest trading fees or Binance for asset storage.

📌 Register an account on MEXC here

📌 Register an account on Binance here

III. JUPITER (JUP) – THE MOST POWERFUL PRIVACY-FOCUSED TRADING TOOL

1. The Problem with Current Privacy-Focused Trading Platforms

Existing privacy solutions like Monero and Tornado Cash offer anonymous transactions, but they have major drawbacks:

- Monero operates on its own blockchain, meaning it does not support cross-chain transactions.

- Tornado Cash is under strict government scrutiny, making it legally risky to use.

Jupiter uses Zero-Knowledge Proofs (ZKP) to ensure fully private transactions while remaining legally compliant.

2. Why Does JUP Hold Value?

a) JUP Is Used to Pay for Private Transactions

Among the top 3 promising cryptocurrencies of the year, Jupiter is not just a privacy tool—it is the backbone of anonymous transactions across multiple blockchains.

All transactions that use Jupiter’s privacy features require JUP as a transaction fee.

The biggest advantage of Jupiter over Monero or Tornado Cash is that Jupiter supports multi-chain transactions. Users can execute private transactions on Ethereum, Solana, and BNB Chain, instead of being restricted to a single blockchain like Monero.

This significantly expands JUP’s market demand, as DeFi users can anonymize their assets without switching blockchains.

Example Use Cases:

- A user transferring USDC from Ethereum to Solana pays a JUP fee to anonymize their transaction history.

- A DeFi trader swapping tokens privately can use JUP to hide transactions from whale trackers.

=> As more people seek privacy in DeFi transactions, the demand for JUP will increase exponentially.

b) Staking JUP to Enhance Privacy and Network Security

Jupiter is not just a privacy tool; it also has a decentralized security layer, where users can stake JUP to support the Zero-Knowledge Proof (ZKP) system.

Staking JUP helps strengthen Jupiter’s network and allows users to earn rewards from transaction fees within the ecosystem.

c) Benefits of Staking JUP:

- Earn rewards from transaction fees: The more users execute anonymous transactions, the more staking rewards are distributed.

- Enhance network security: A larger amount of staked JUP strengthens Jupiter’s decentralized privacy layer, making it more resistant to attacks.

- Reduce JUP’s circulating supply: When more JUP tokens are staked, fewer tokens are available for trading, creating price stability and potential growth.

d) Jupiter Offers Premium Privacy Services

Beyond anonymous transactions, Jupiter provides high-end privacy solutions for institutions and individuals who require top-level security.

Users can pay JUP fees to access premium privacy features, such as:

- Untraceable DeFi transactions: No one can track your funds, even when using on-chain analytics tools like Arkham or Nansen.

- IP protection when trading: Avoid being monitored when connecting your wallet to a DEX or executing transactions on a blockchain.

- Anonymous OTC transactions: Conduct large-scale trades without revealing transaction details on the blockchain.

=> These services do not only benefit retail users—they also attract investment funds, large institutions, and crypto whales, who require the highest level of privacy.

3. Comparison: Jupiter vs. Other Privacy Solutions

| Platform | Cross-Chain Support | Government Restrictions | Privacy Technology | DeFi Integration |

| Monero | No | No | Private chain | No |

| Tornado Cash | No | Banned in the US | Mixer model | No |

| Jupiter | Yes | Fully legal | ZKP-based | Yes |

=> JUP is not just a privacy token—it is the first fully legal anonymous transaction solution that integrates with DeFi and supports multiple blockchains. As more users seek privacy protection, JUP’s value will grow significantly in the long run.

4. JUP Price Chart and Investment Opportunities

Currently, JUPUSDT is trading near its lowest price since launch, around $0.77 USDT.

Technical indicators from Tradevietstock suggest that JUP is forming a bottom, making it an ideal entry point for long-term investors.

=> Long-term investors may consider accumulating JUP around the $0.77 USDT range. Avoid short-term speculation and focus on long-term holding strategies. Investors can choose MEXC for the lowest trading fees or Binance for asset storage.

IV. CONCLUSION & REGISTRATION FOR THE TOP 5 BEST CRYPTO EXCHANGES TODAY

Overall, among this year’s top 3 promising cryptocurrencies of the year, we see that LayerZero (ZRO), Arkham (ARKM), and Jupiter (JUP) are not just trendy coins but also have solid technological foundations, real-world applications, and long-term growth potential.

Each of these tokens solves a key problem in the blockchain space:

- LayerZero (ZRO): A secure, fast, and cost-effective cross-chain solution that connects different blockchains without requiring traditional bridges.

- Arkham (ARKM): A breakthrough in on-chain data analytics powered by AI, creating a decentralized marketplace for blockchain intelligence, allowing investors to track capital flows more effectively.

- Jupiter (JUP): The leading legally-compliant privacy solution, utilizing Zero-Knowledge Proofs (ZKP) to protect user privacy while integrating seamlessly with the DeFi ecosystem.

=> Each token in the list of top 3 promising cryptocurrencies of the year has its own ecosystem, real-world use cases, and strong staking mechanisms, creating long-term value stability. With prices currently at their historical lows, this could be an ideal time for long-term investors to accumulate these tokens. However, the crypto market remains highly volatile, so always conduct thorough research, allocate capital wisely, and invest with a clear strategy.

Wishing everyone successful trades!

📌 Interested in learning more about different account types or crypto trading knowledge? Check out our educational resources HERE

📌 Want to see detailed reviews of the top 5 best crypto exchanges? Read the full review HERE

Register for the Top 5 Best Crypto Exchanges Now

[Link to register for a free Binance account]

The largest exchange currently

[Link to register for a free Bitget account]

Exchange with many financial products

[Link to register for a free Mexc account]

Exchange with the lowest costs in the world

[Link to register for a free Bybit account]

Exchange with professional financial technology

[Link to register for a free OKX account]

Exchange connected with DEX

Tiếng Việt

Tiếng Việt