Top 2 exclusive indicators for day trading

Hey traders! It’s Tradevietstock back again. I’ve noticed that many new traders clutter their screens with tons of technical indicators, only to end up confused—and still not making a profit. Today, I’m sharing my top 2 exclusive indicators for day trading—ones I personally coded, tested in live markets, and consistently profit from with a solid risk-reward ratio, about 1:2 (consistently) or maybe 1:5 (with some lucky).

I believe this top 2 exclusive indicators for day trading is the best choice for day traders, if you guys want to look for a logical algorithmic indicators and make consistent profits from your bedroom.

Disclaimer: This blog is all about sharing real knowledge, experience, and skills. The truth and integrity are our priorities. Let’s keep the comments respectful and supportive.

i. Introduction to this set of indicators

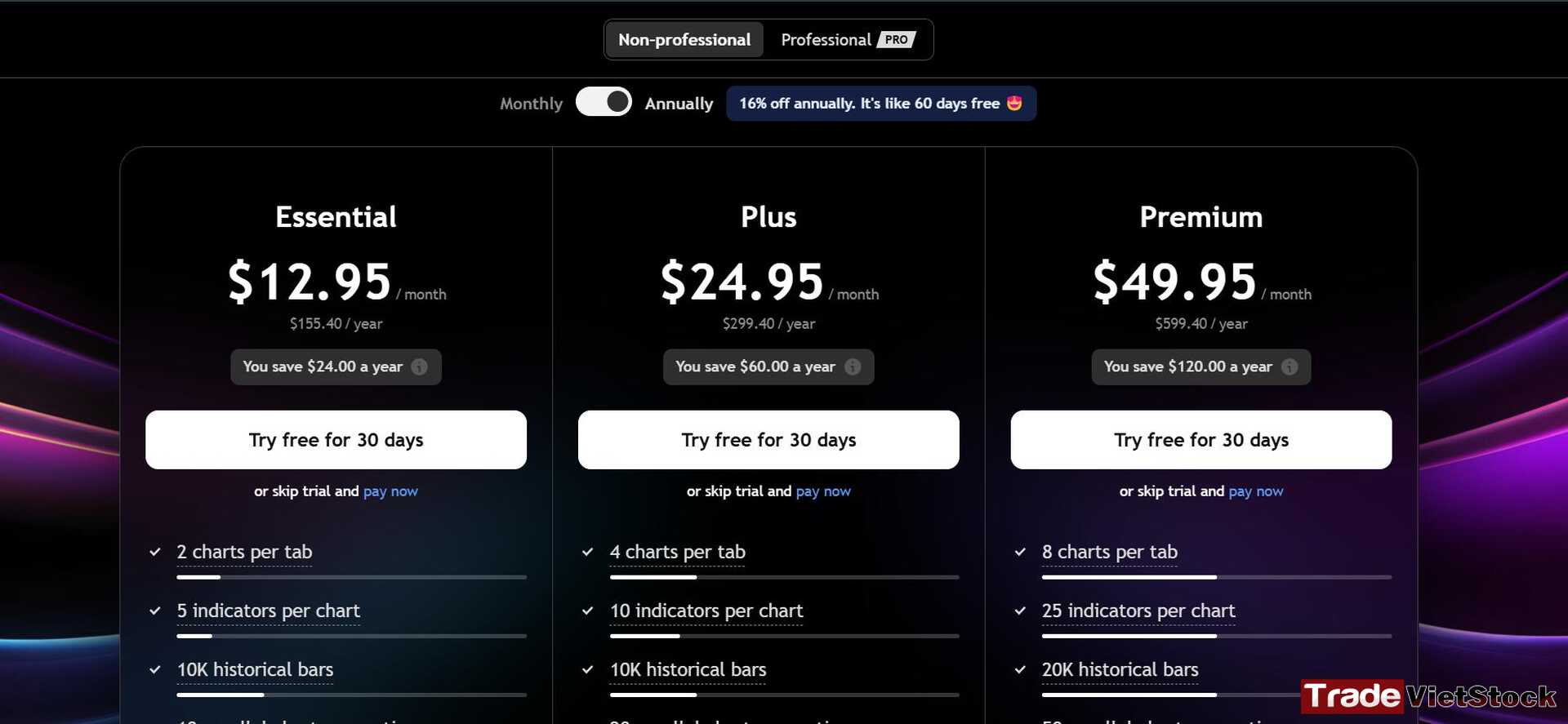

I designed this indicator to bypass TradingView’s restriction that requires an Essential, Plus, or Premium account to use more than two indicators.

We all know how essential basic technical indicators are—RSI, MACD, Aroon, ADX, EMAs, SMAs, HMAs, Bollinger Bands, Ichimoku Clouds… you name it. These aren’t just for retail traders; even hedge funds and institutional investors rely on them to make buy or sell decisions. So don’t underestimate their power—each has its own unique advantage.

1. So what’s in this set of indicators?

As I mentioned, this indicator includes all the essential technical tools traders and investors need. But that’s not all—I’ve also upgraded some of them to overcome their individual weaknesses, taking them to the next level. So, you could say this is a premium set of trading indicators, designed for smarter and more efficient decision-making.

Breakdown of the Top 2 exclusive indicators for day trading

Lower Panel Components:

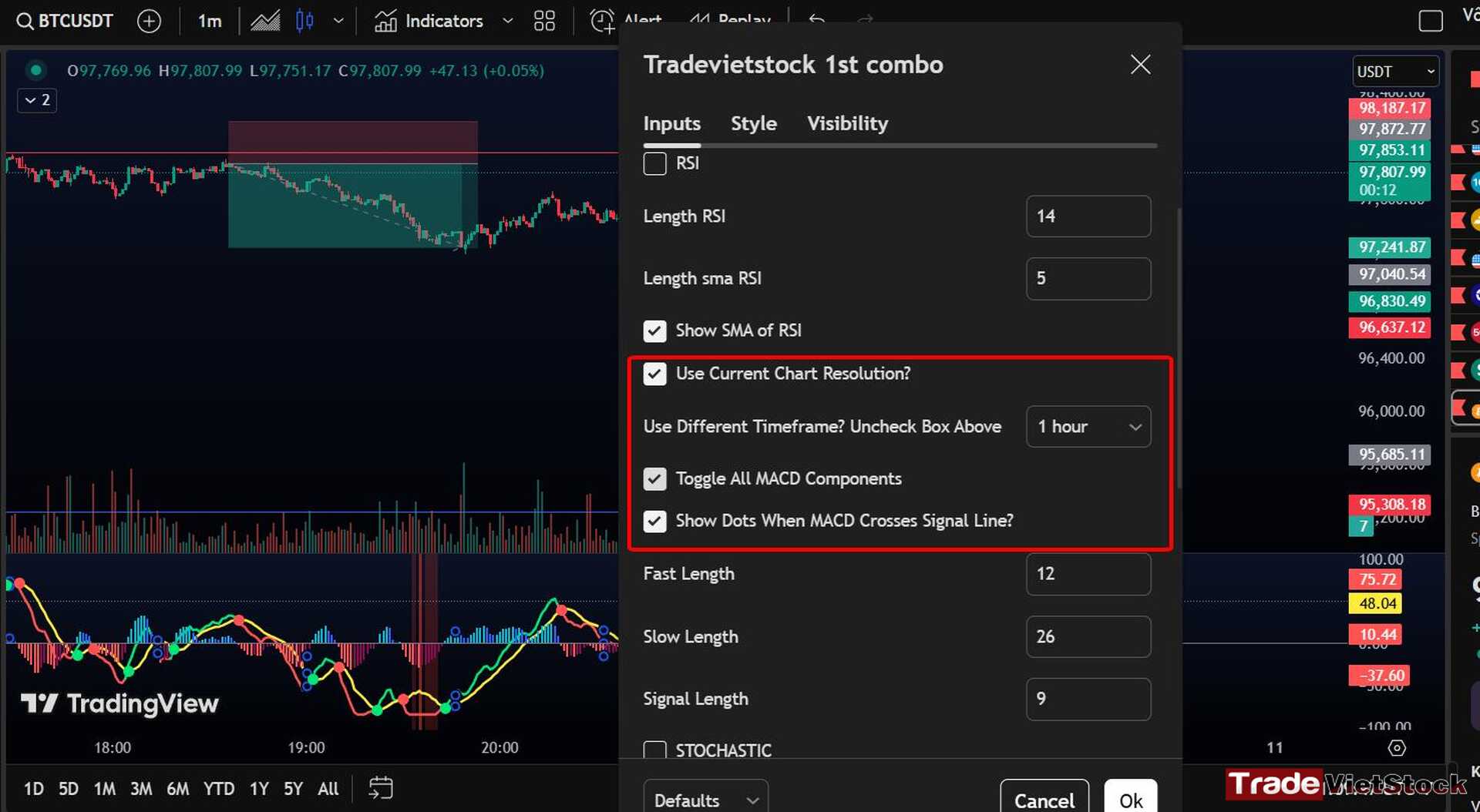

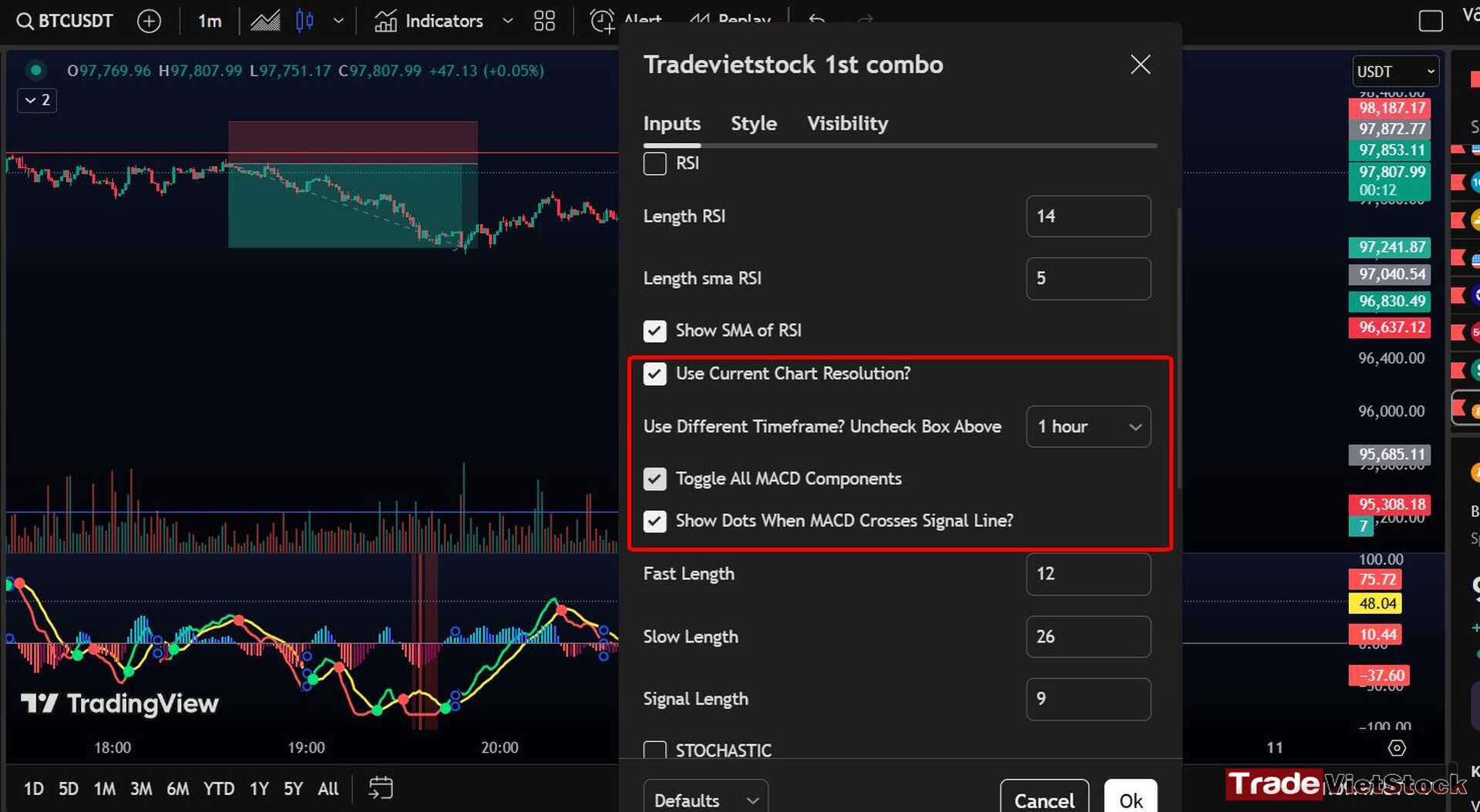

✅ MACD – Upgraded with multi-timeframe analysis and customizable display settings.

✅ Basic RSI – Can be shown alongside other components (if you don’t mind a busy chart).

✅ ADX DI – Helps measure trend strength.

✅ Aroon – Identifies trend changes and consolidations.

✅ Stochastic – Useful for spotting overbought and oversold conditions.

✅ Extreme Bullish/Bearish Phase – The most important feature for maximizing profits by signaling the best exit points.

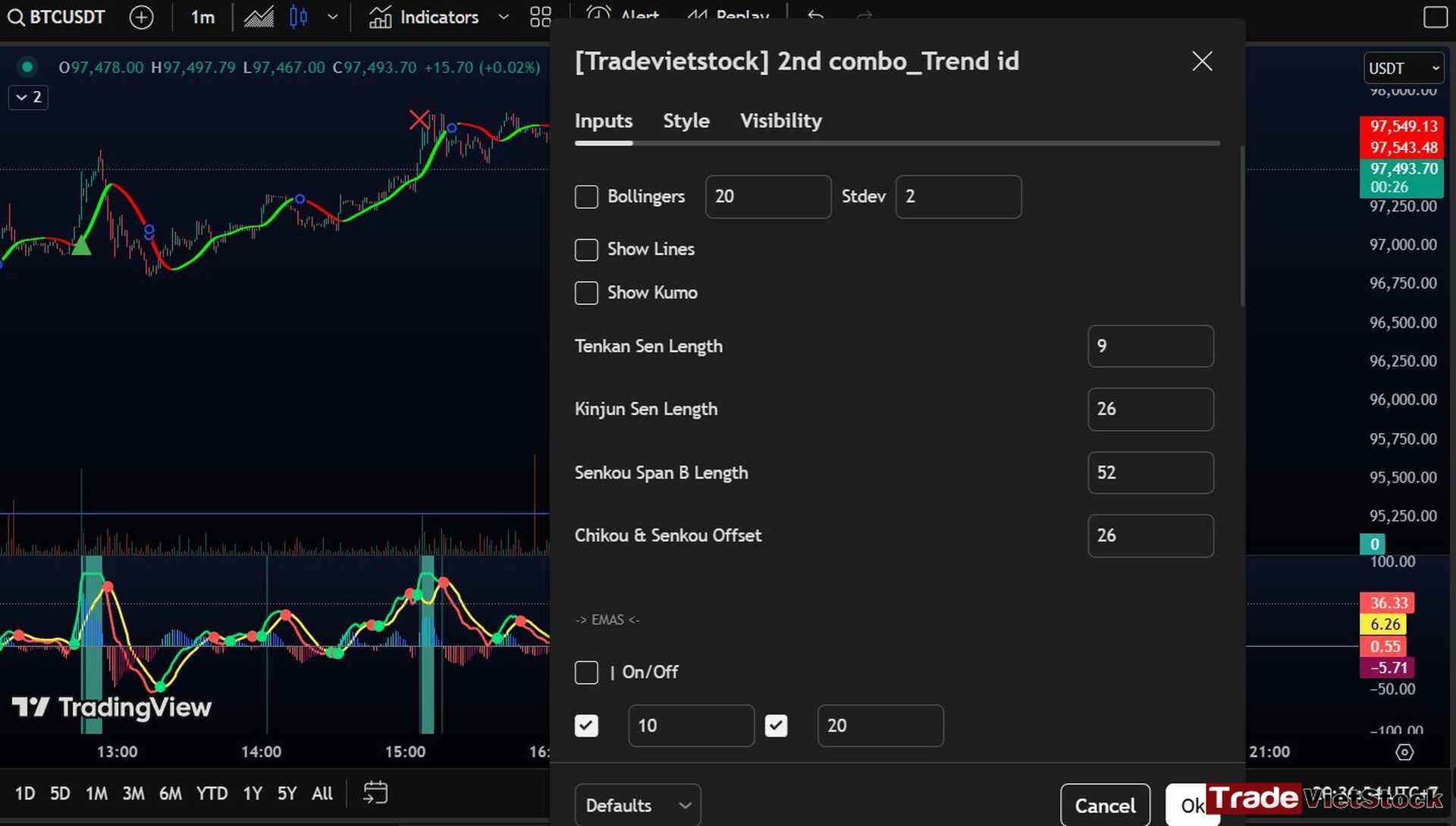

Top Panel Components:

✅ Bollinger Bands – Fully customizable standard deviation settings.

✅ Ichimoku Cloud – Provides deep market structure insights.

✅ 6 EMAs/SMAs – For dynamic trend tracking and confluence zones.

✅ HMA (Hull Moving Average) – Significantly upgraded to detect price stages, uptrend/downtrend shifts, and liquidity sweeps.

✅ Liquidity Identification & Trading Signals – The game-changer for day traders, helping you pinpoint liquidity zones and trade opportunities with precision.

This last component is what makes this indicator set truly unique and practical—giving traders an edge in the market like never before.

2. Essential features for day trading

The simplicity is one of my priorities. Although the set of indicators include a wide range of essential components, day traders just need to use 2 features to make consistent profits. And don’t forget about Risk management because nothing can survive in this market without risk management.

Here is the tutorial:

First, turn off all components except Liquidity Features and MACD.

Then turn these features on only. “Use different timeframe? Uncheck box above” is the update for MACD, which allows you to cover MACD’s movement of other timeframes. If you do day trading, just turn on “use current chart resolution”.

ii. How to use

The key idea behind this strategy is that price naturally gravitates toward the day’s liquidity zones—specifically, the highest high and lowest low of the session. These zones hold the liquidity necessary for price to continue moving in a particular direction, making them the ideal spots for trade entries.

Liquidity zones are areas where large unfilled limit orders accumulate, meaning there’s a high concentration of capital waiting to be triggered. When price reaches these zones, the surge of executed orders creates momentum, propelling the market further. This is where day traders find the best opportunities to profit.

By only trading within these liquidity zones, you:

✅ Avoid unnecessary trades, reducing stop-outs.

✅ Improve your win rate by targeting high-liquidity areas.

✅ Strengthen your trading psychology by minimizing emotional and impulsive decisions.

In short, this approach helps you trade efficiently, focusing on areas where price is most likely to make significant moves.

At this stage, we have two possible scenarios:

Scenario 1: Liquidity Grab & Reversal

- Price reaches the liquidity zone, absorbs the available orders, and then reverses direction (bullish or bearish).

- This happens because the market has gathered enough liquidity (money) to fuel a movement in the opposite direction.

- In this case, we look for confirmation signals to enter a reversal trade.

In the image above, the price dropped sharply and touched the liquidity line (the lowest low of the day). At this crucial level, the indicator signaled a potential trade opportunity by displaying a green cross (X).

⚠️ Important: The green cross is not an entry signal—it only indicates a potential trade setup. Since price can still sweep liquidity and make volatile moves, jumping in too early could lead to losses.

Trade Execution:

✅ Confirmation: After spotting the green cross at the liquidity level, I monitored price action for stability before entering.

✅ Entry: Once conditions aligned, I placed a buy trade with a strong risk-reward ratio (R:R).

✅ Exit Strategy: My take-profit decision was based on MACD and the Extreme Bullish Phase.

✅ Final Signal: When the green background (Extreme Bullish Phase) disappeared, it indicated the uptrend was losing momentum, so I closed the trade and secured my profit.

Outcome:

This trade delivered an R:R of approximately 1:5 to 1:6, meaning my profit was 5-6 times my initial risk—a great example of trading with liquidity zones and confirmation signals for high-probability setups.

Scenario 2: Breakout & Trend Continuation

- Price breaks through the liquidity line and continues in the same trend direction.

- However, this situation can be tricky—sometimes, price fakes a breakout, only to reverse later after trapping traders on the wrong side.

- To filter out fake breakouts, I’ve added ATR-based criteria (Average True Range).

- If the price meets specific ATR conditions, it confirms a valid breakout.

- After that, we wait for a bounce-back entry before placing our trades.

This ATR confirmation system helps prevent false breakouts and ensures we trade with high accuracy, avoiding unnecessary losses. 🚀

In the image above, the price broke through the liquidity level, which meant I needed confirmation before taking any action. The indicator provided this confirmation with a green triangle, signaling a valid breakout rather than a fake move.

Trade Execution:

✅ Confirmation: After spotting the green triangle, I waited for a bounce-back to enter my trade at a favorable price.

✅ Entry: Once the retracement occurred, I placed my position with a risk-reward ratio (R:R) of 1:2—a safer target given the increased risk in breakout trades.

✅ Exit Strategy: My take-profit decision was based on MACD and the Extreme Bullish Phase.

✅ Final Signal: When MACD undercrossed and the Extreme Bullish Phase ended, I exited the trade to secure profits.

Outcome:

With this top 2 exclusive indicators for day trading, I successfully locked in profits with an R:R of 1:2, ensuring a balanced risk approach in this breakout scenario.

The image above shows some examples of successful trades that I made recently with decent R:R ratio, about 1:2 to 1:3.

The same principles apply when trading in a bearish market:

✅ Step 1: Wait for price to approach the liquidity level (key support zones).

✅ Step 2: Look for confirmation signals from the indicator set before entering a trade.

This top 2 exclusive indicators for day trading is very effective. Yet, proper risk management is crucial, and you should never risk more than 1-2% of your total account on a single trade. The most practical risk-reward ratio (R:R) is 1:2, which is both achievable and safe. While a higher R:R like 1:5 is possible, it comes with significantly more risk, requiring you to closely monitor MACD and the Extreme Bullish/Bearish Phase for the right exit points.

Lastly, never let greed dictate your trades—ignoring risk management and chasing unrealistic profits can lead to devastating losses. Stick to your strategy, respect your stop-losses, and take profits when your indicators confirm it. A disciplined approach will always lead to long-term success in trading.

Trading is a science, not gambling. I hope you approach it with the mindset of a science enthusiast, applying logical thinking, rather than being driven by greed and fear.

iii. Get this set of indicators and Register for a trading account

Since these are internal indicators, you won’t find them on the Tradingview community. However, if you want to use this top 2 exclusive indicators for day trading, you can choose one of two ways:

- Open a trading account using the link below or from the left-hand menu

- Pay a fee of 19USD to receive the full source of the indicators and free setup. Contact Telegram to pay the fee and get set up.

If you are interested, contact us via Telegram group: HERE

Telegram: Link to discuss details and obtain the source of the Top 2 exclusive indicators for day trading.

Become a TradeVietstock client today to receive valuable investment recommendations. Earn stable income from the stock market! Some partner units with TradeVietstock below:

1. For trading accounts

[Link to register for a free Exness account]

[Link to register for a free XTB account]

2. For cryptocurrency exchange

[Link to register for a free Binance account]

[Link to register for a free Bitget account]

[Link to register for a free Mexc account]

[Link to register for a free Bybit account]

[Link to register for a free OKX account]

Tiếng Việt

Tiếng Việt