How to Earn Passive Income on Bybit – Top-Notch Financial Products

[Link to register for a free Bybit account]

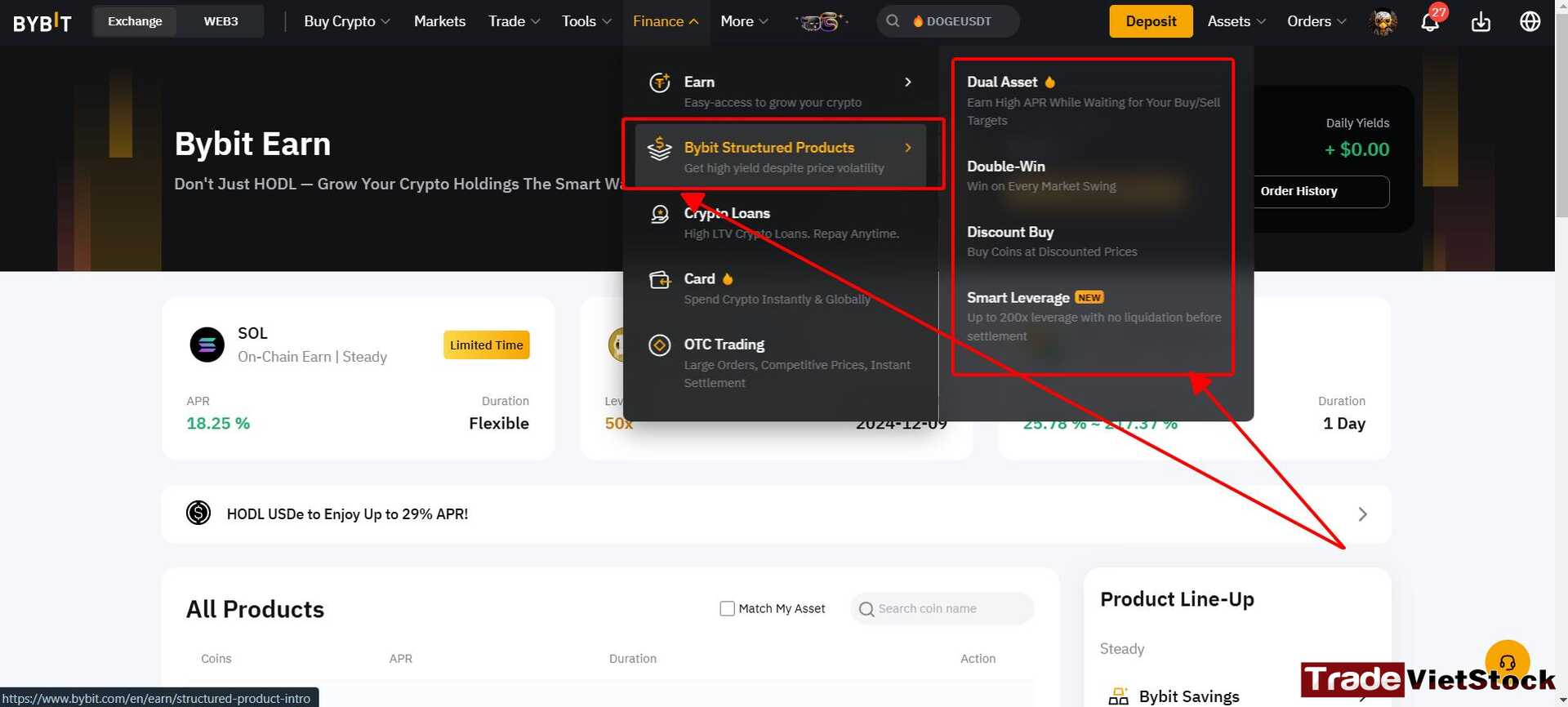

Hey everyone, it’s Tradevietstock again! Today, I’m here to walk you through how to earn passive income on Bybit using some of its standout features and financial products. These gems are tucked away in Bybit Structure Products, under the Finance section.

Since basic products like Simple Earn, On-Chain Earn, and Savings are pretty straightforward and available everywhere, I won’t bore you with those details. Let’s dive into the good stuff instead!

Here’s the lineup of key products we’ll cover:

- Dual Asset

- Double Win

- Discount Buy

- Smart Leverage

- Liquidity Mining

Before we jump in, let’s get familiar with some key terms you’ll need to know:

- Settlement Date: The payout day.

- Expiration Date: When the product wraps up.

- Breakeven Price: The price where you neither win nor lose.

- Settlement Price: The final price on settlement day.

- Target Price: Your goal price.

- Investment Period: How long your money’s locked in.

- Early Redemption: Cashing out before the settlement date.

- Buy Low: Snagging assets at a discount.

- Sell High: Offloading assets at a premium.

- APR: Annual percentage rate (your yearly profit percentage).

- Upper Range Price: The top end of the price range.

- Lower Range Price: The bottom end of the price range.

This is the APR formula and term-based profits

I. Dual Asset – Your Short-Term Money Maker

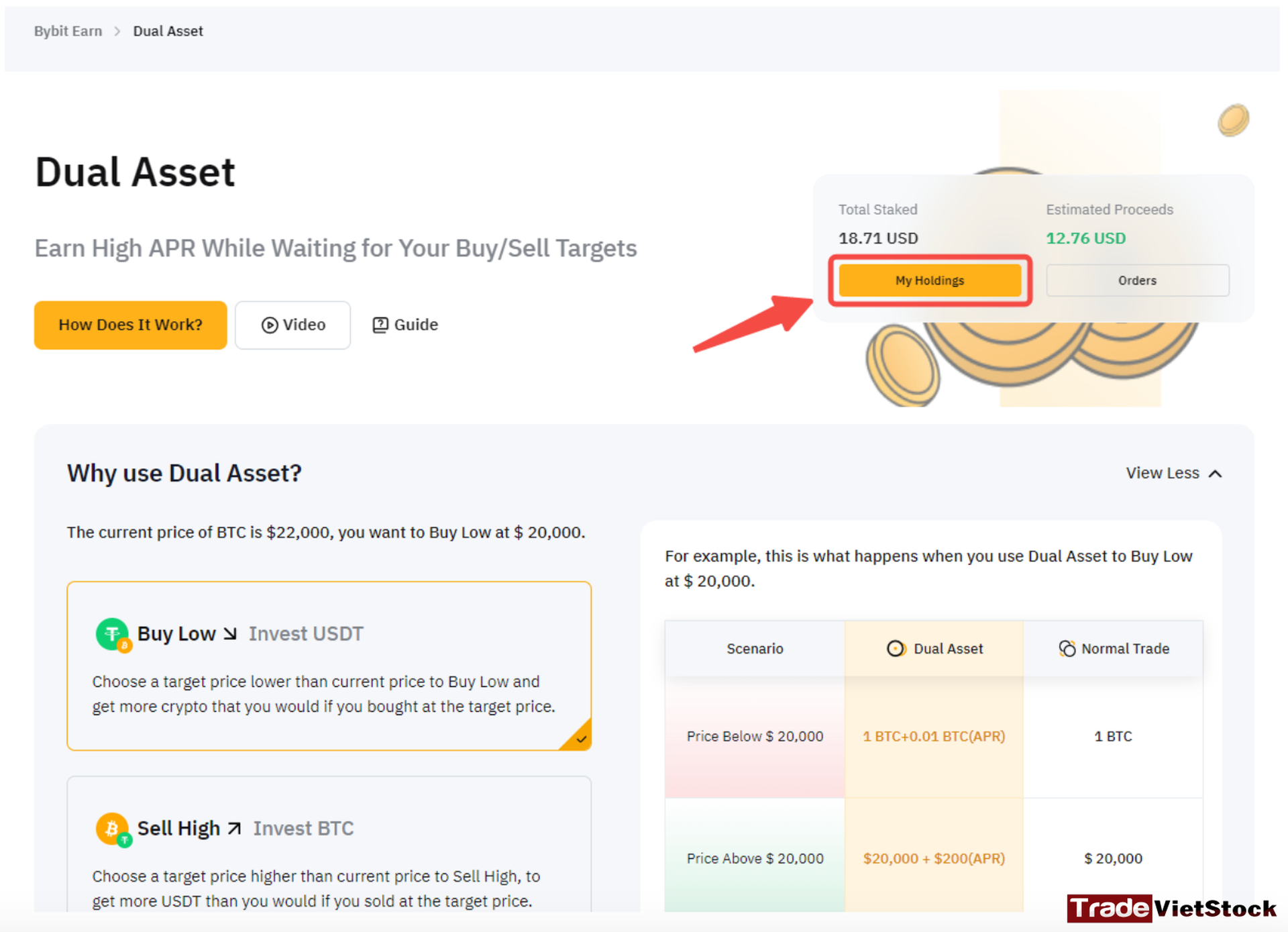

Dual Asset 2.0 is a slick, short-term trading tool designed to boost your investments with higher returns and more flexibility. All you need to do is pick your desired price for a crypto asset by the Settlement Date. Then, depending on your market vibe, you can go for Sell High or Buy Low. Easy, right?

1. How It Works

Here’s the breakdown of the two flavors in Dual Asset 2.0: Buy Low and Sell High. For Buy Low, you sign up with stablecoins (like USDT). For Sell High, you roll with crypto assets (think BTC or ETH).

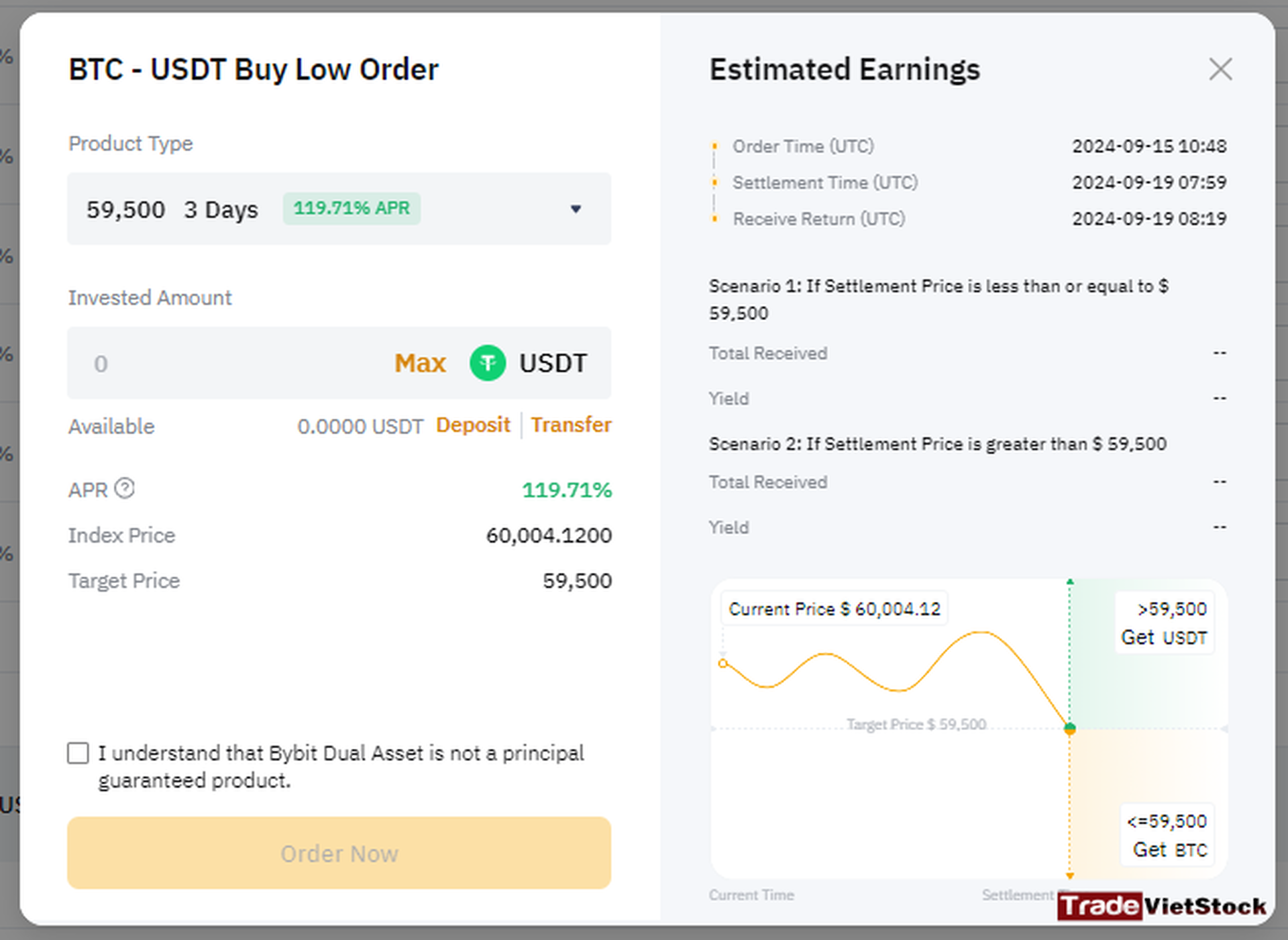

On the Settlement Date, you’ll either pocket profits in USDT or your chosen crypto, depending on whether the Settlement Price hits your Target Price. Quick note: The Settlement Price is the average price on Bybit’s Spot market for the 30 minutes leading up to 8:00 AM UTC on settlement day.

a. Buy Low Product

With USDT as your starting point, this lets you scoop up your favorite crypto at a lower price on settlement day while earning extra USDT at a juicy yield.

Two Scenarios on Settlement Day:

- Target Price Hit: If the Settlement Price ≤ Target Price, you’ll buy the crypto at your target price using your USDT, plus grab some interest on top. Sweet deal!

- Target Price Missed: If the Settlement Price > Target Price, no crypto for you—but you’ll still walk away with your original USDT plus interest. Not too shabby!

Profit Breakdown: Your gains come from two parts—your initial investment (USDT) and the interest earned.

b. Sell High Product

Here, you start with a crypto asset (like BTC or ETH) and aim to sell it at a higher price on settlement day, while stacking up more of that crypto with a solid yield.

Two Scenarios on Settlement Day:

- Target Price Hit: If the Settlement Price ≥ Target Price, your crypto (plus interest) gets sold at the target price, and you cash out in USDT. Big win!

- Target Price Missed: If the Settlement Price < Target Price, you keep your crypto, plus the interest, in the original coin. Still a solid outcome!

2. Guide to Using Dual Asset

Here’s how to get started with Dual Asset on Bybit. It’s a straightforward process—follow these steps and you’ll be set.

Step 1: Place an Order

Go to the navigation bar and click Finance → Dual Asset to access the Dual Asset page.

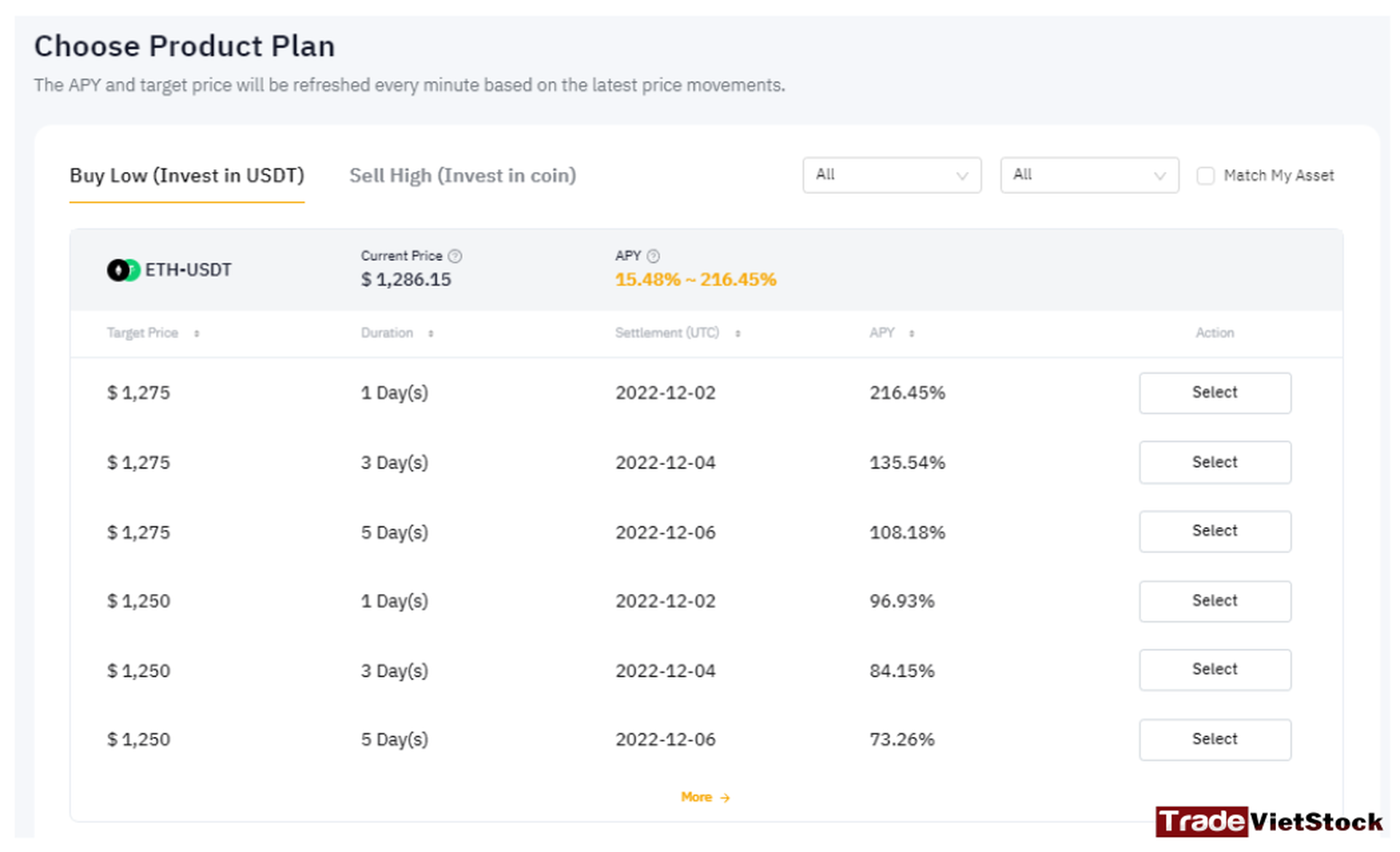

Step 2: Select Your Investment Plan

Decide on the details:

- Product type: Choose between Buy Low or Sell High.

- Trading pair: Pick the pair you want to trade (e.g., BTC/USDT, ETH/USDT).

- Target Price: Set the price you’d like to buy or sell your crypto at.

- Investment Period: Choose how long you’re committing for.

Once everything’s set, click Select.

Note: The APR and Target Price update every minute based on the latest market movements.

Step 3: Enter Your Investment Amount

Input the amount you’re investing, then hit Order Now to proceed.

Key Points:

- If your Target Price is reached, the order settles, and your payout is distributed—no automatic re-enrollment into the next product.

- Ensure your Funding Account has sufficient balance before starting. If it’s low, click the + next to “Available” to transfer assets from other accounts.

Step 4: Confirm the Details

Review all the info to make sure it’s correct, then click Order Now to finalize.

Note: Once the order is placed successfully, you can’t cancel or modify it.

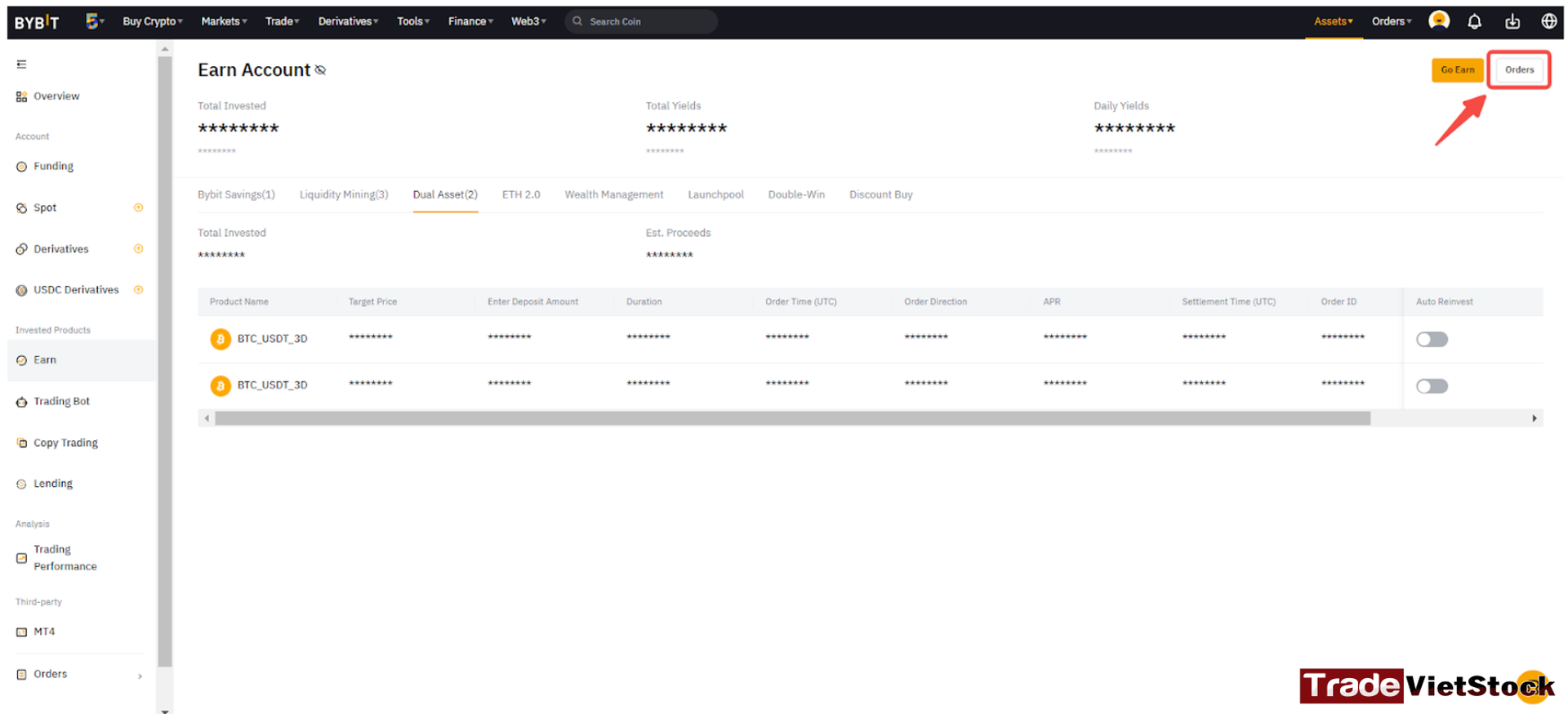

Step 5: Check Your Placed Orders

After the order goes through, click View Order in the notification to see the details.

You can also head to the top-right corner of the Dual Asset page and click My Holdings to visit the Dual Asset Orders section.

Order Details You Can View

Here’s what’s available:

- Dual Asset Tab: Product name, Target Price, invested amount, duration, order time (UTC), direction, annual percentage yield (APR), settlement time (UTC), order ID, and estimated profit.

- Dual Asset Order History: Order status, actual profit, and settlement price for all completed Dual Asset plans.

3. Conclusion

| Pros | Cons |

| High returns potential | Market dependency |

| Low effort, passive gains | No flexibility post-order |

| Flexible options (Buy/Sell) | Requires some market sense |

| Guaranteed base return | Funding account hassle |

| Short-term play | Profit caps |

=> Dual Asset is a solid pick for passive income if you like short-term moves with a strategic edge. It offers good upside and a safety net, but the market’s in charge, and you’re locked in once you commit. If you’ve got a basic feel for trends, it’s a strong option—just don’t expect effortless riches.

II. Smart Leverage

1. Definition

Let’s move to the next instrument in this How to Earn Passive Income on Bybit article. Smart Leverage is an interesting tool from Bybit designed to protect your investment range. In typical derivatives markets, if you’re using high leverage like 100x or 200x, a sudden short-term market swing or washout could liquidate your position before the market stabilizes and moves in the direction you predicted.

With Smart Leverage, you’re safeguarded from those sharp washouts in the short term, as long as it’s before the Settlement Date. Profit or loss only gets calculated after that date. I think Smart Leverage is a neat way to protect capital for traders who want to use high leverage to profit from price gaps.

| Direction | Scenario | Formula | Outcome |

| Long (Buy) | Settlement Price ≥ Breakeven Price | Profit = Investment + [Investment × Leverage × (Settlement Price – Breakeven Price) / Breakeven Price] | You get your investment back plus leveraged profit. |

| Long (Buy) | Settlement Price < Breakeven Price | Profit = max(Investment + [Investment × Leverage × (Settlement Price – Breakeven Price) / Breakeven Price], 0) | You might lose. Worst case, you lose the full investment. |

| Short (Sell) | Settlement Price ≤ Breakeven Price | Profit = Investment + [Investment × Leverage × (Breakeven Price – Settlement Price) / Breakeven Price] | You get your investment back plus leveraged profit. |

| Short (Sell) | Settlement Price > Breakeven Price | Profit = max(Investment + [Investment × Leverage × (Breakeven Price – Settlement Price) / Breakeven Price], 0) | You might lose. Worst case, you lose the full investment. |

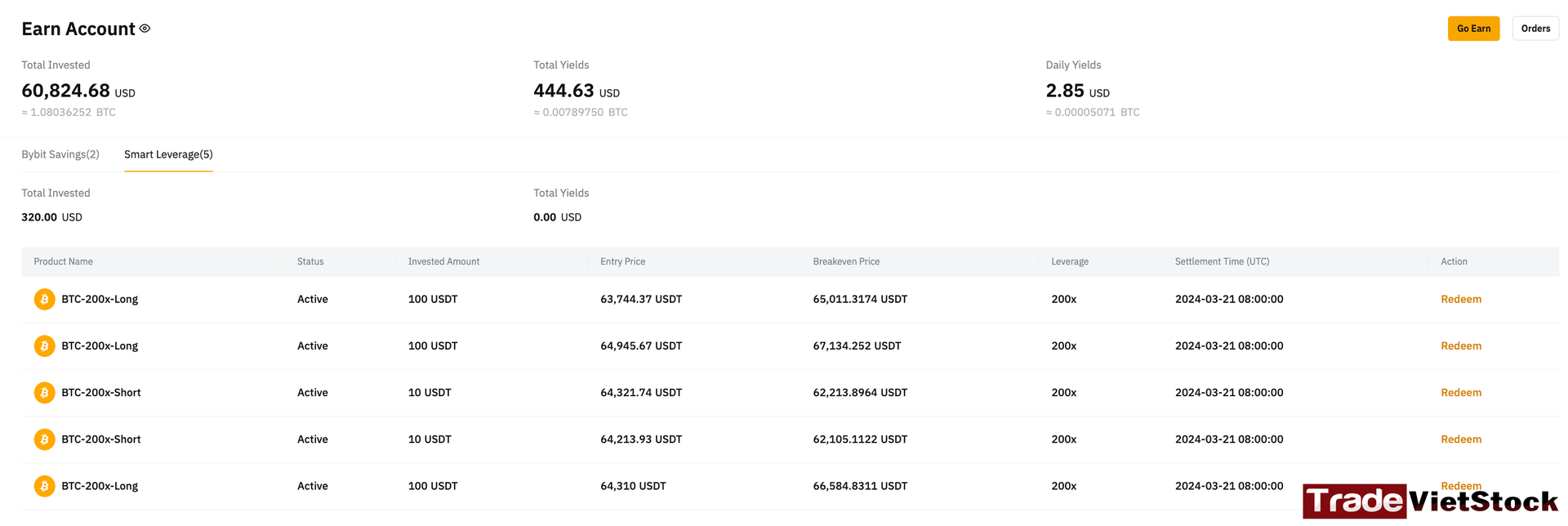

2. How to Use Smart Leverage

Here’s the step-by-step process to use Smart Leverage on Bybit. It’s pretty straightforward once you get it.

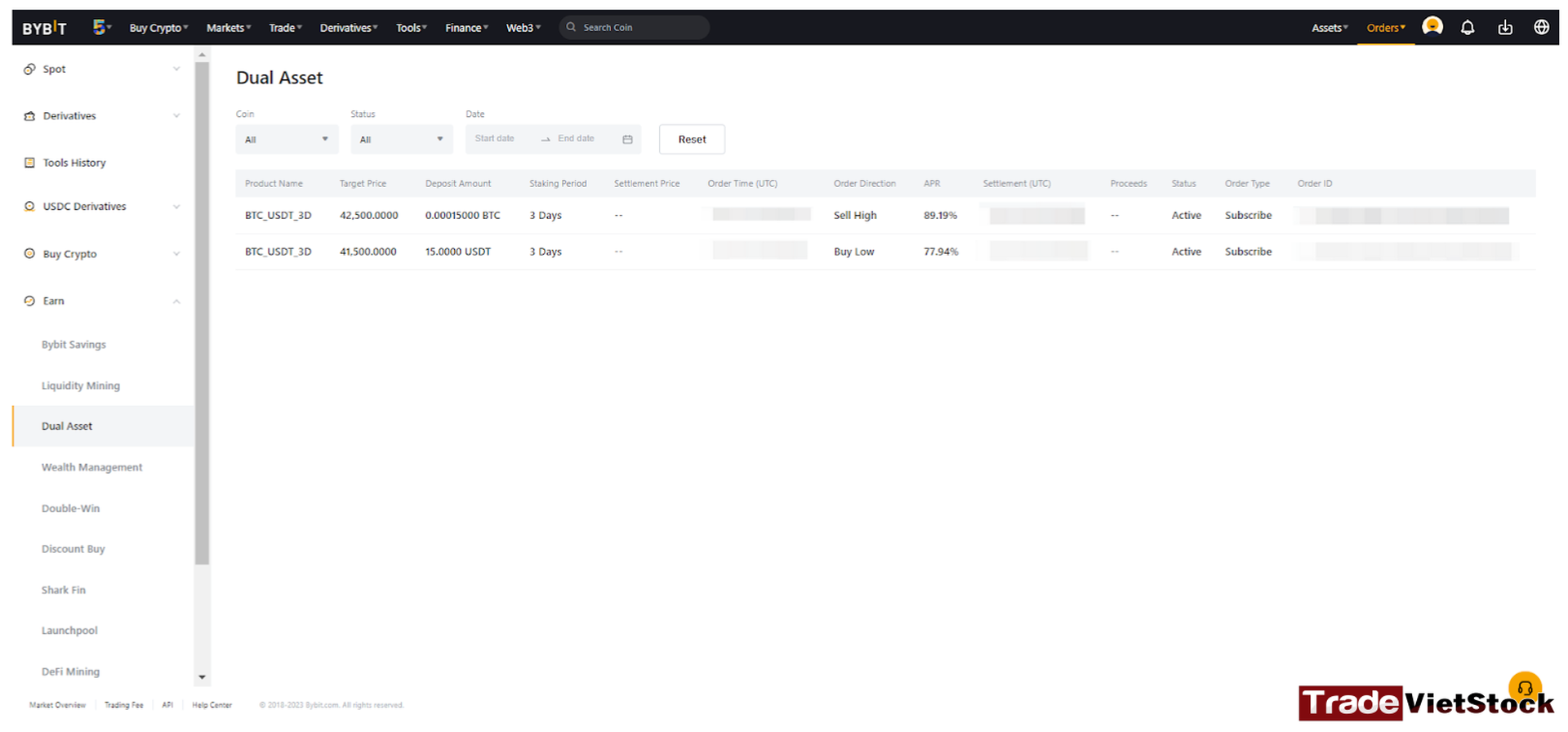

Step 1: Access the Smart Leverage Page

Click Finance → Earn → Smart Leverage on the navigation bar to get to the Smart Leverage page.

Step 2: Choose Your Smart Leverage Plan

You’ll see a list of plans with different coins, directions (long/short), leverage levels, breakeven prices, and terms. Pick what suits you, then click Buy Now.

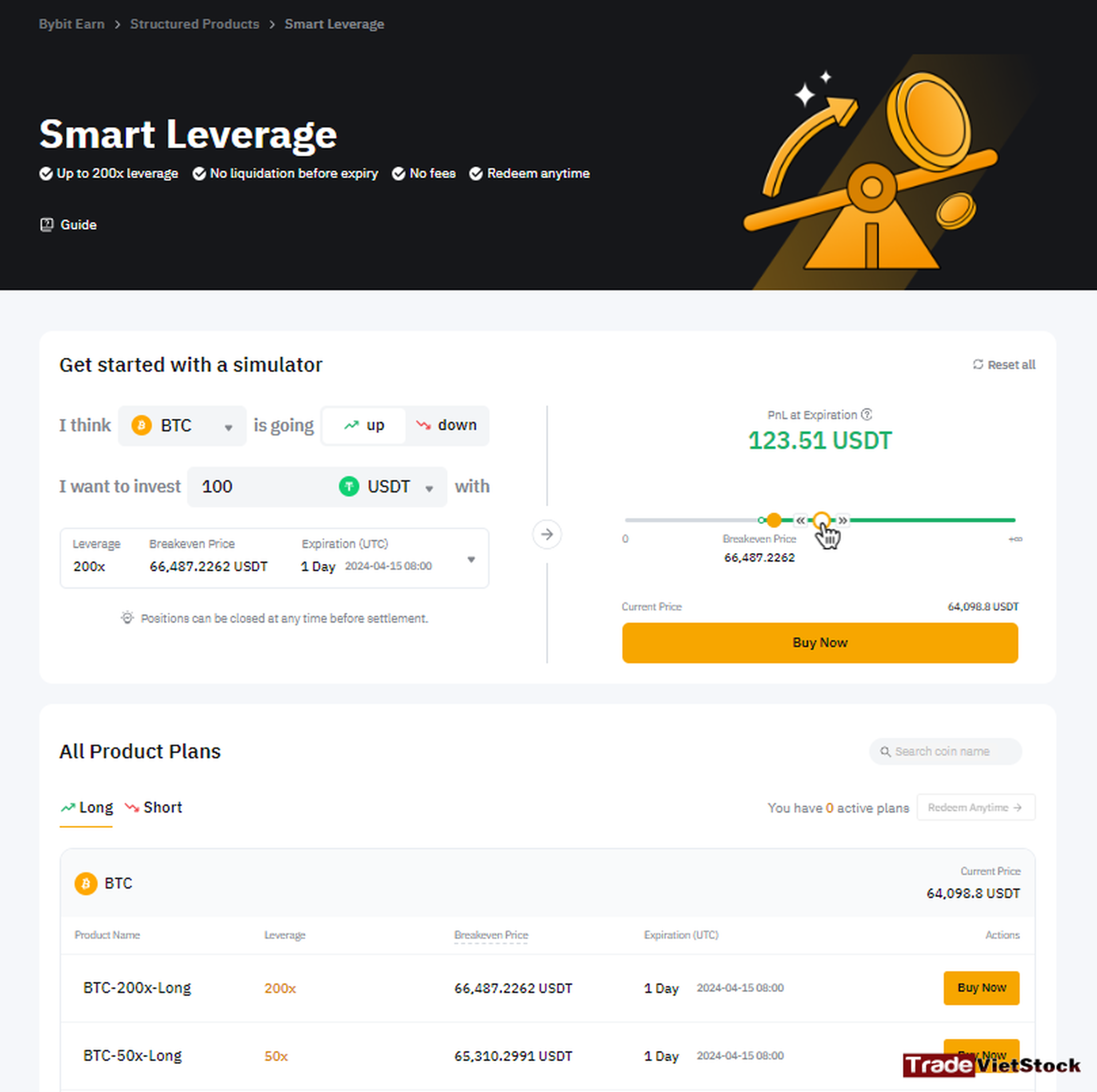

Step 3: Set Up Your Smart Leverage Plan

Enter the amount you want to invest and make sure you fully understand the parameters you’ve chosen. Then click Buy Now.

Tip: Use the simulator to estimate potential Profit and Loss (P&L). Just select a coin, set the direction, and input your investment amount.

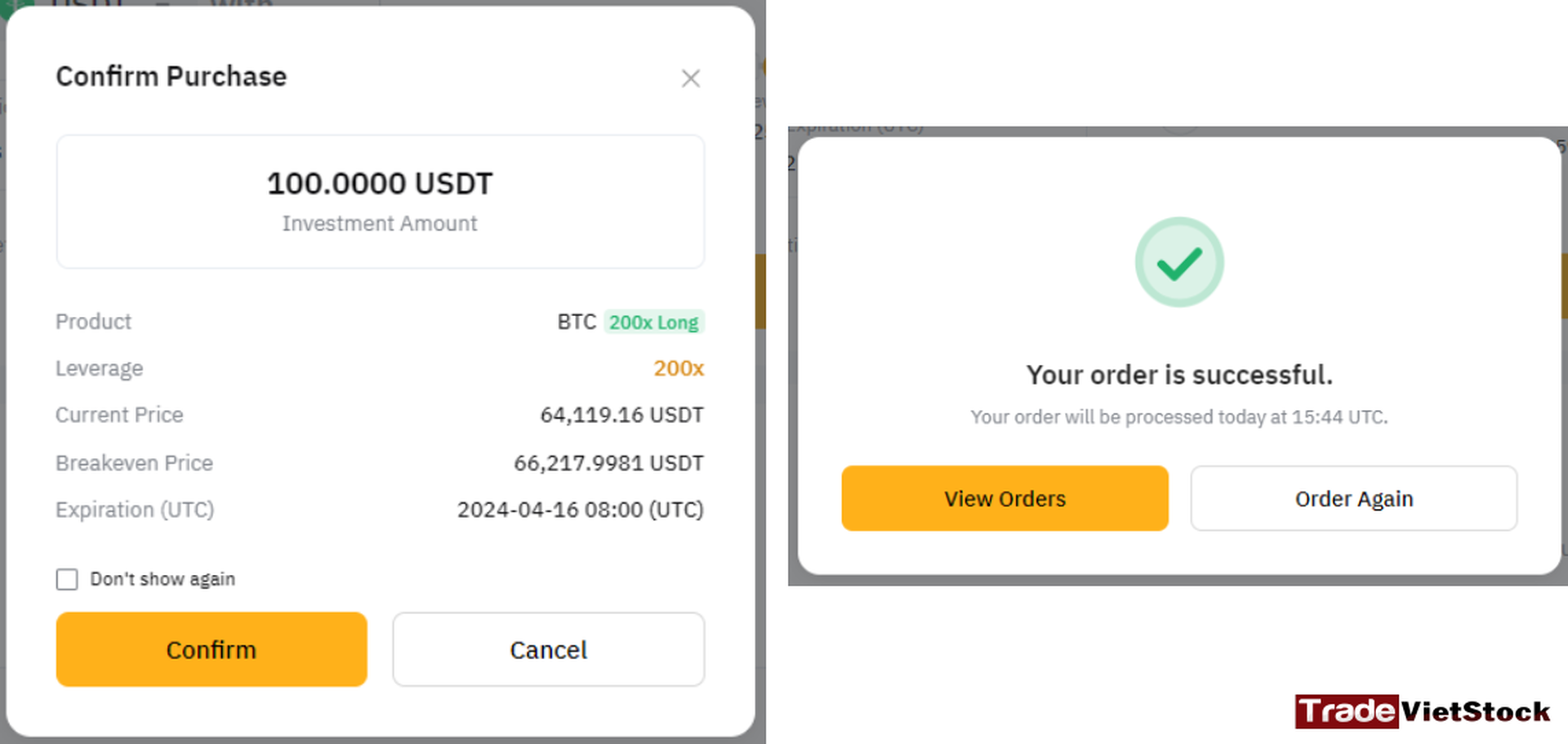

Step 4: Confirm Your Order Parameters

Check that all your order details are correct, then click Confirm.

Note: To view your orders, follow the same steps as with Dual Asset.

Early Redemption: Withdrawing Before Settlement

Step 1: Hover over Assets, select Earn under “Invested Products,” and click Smart Leverage to see your active plans.

Step 2: Click Redeem on the right side of your plan. Hit Confirm, and you’ve withdrawn early before the Settlement Date.

Notes:

- There might be a small difference in the actual amount (up to 0.5%) due to market movements.

- Early redemption isn’t allowed if your profit is negative or zero—you can’t pull out while losing. Also, you can’t redeem within one hour of the Settlement Date.

3. Conclusion

Here’s a table breaking down the pros and cons of using Smart Leverage on Bybit:

| Pros | Cons |

| Shields against short-term washouts | Risk of losing full investment if market goes wrong |

| High leverage boosts profit potential | Locked in until Settlement Date (or early redemption) |

| Flexible long or short positions | No early redemption if profit is negative or zero |

| Delays profit/loss until Settlement Date | Early redemption blocked 1 hour before settlement |

| Ideal for trading price gaps | Slight payout variance (up to 0.5%) from market shifts |

=> That’s the quick take—Smart Leverage gives you a safety net for high-leverage trades but comes with real risks if the market doesn’t play along. I suggest you should not use this instrument unless you truly understand what you are doing.

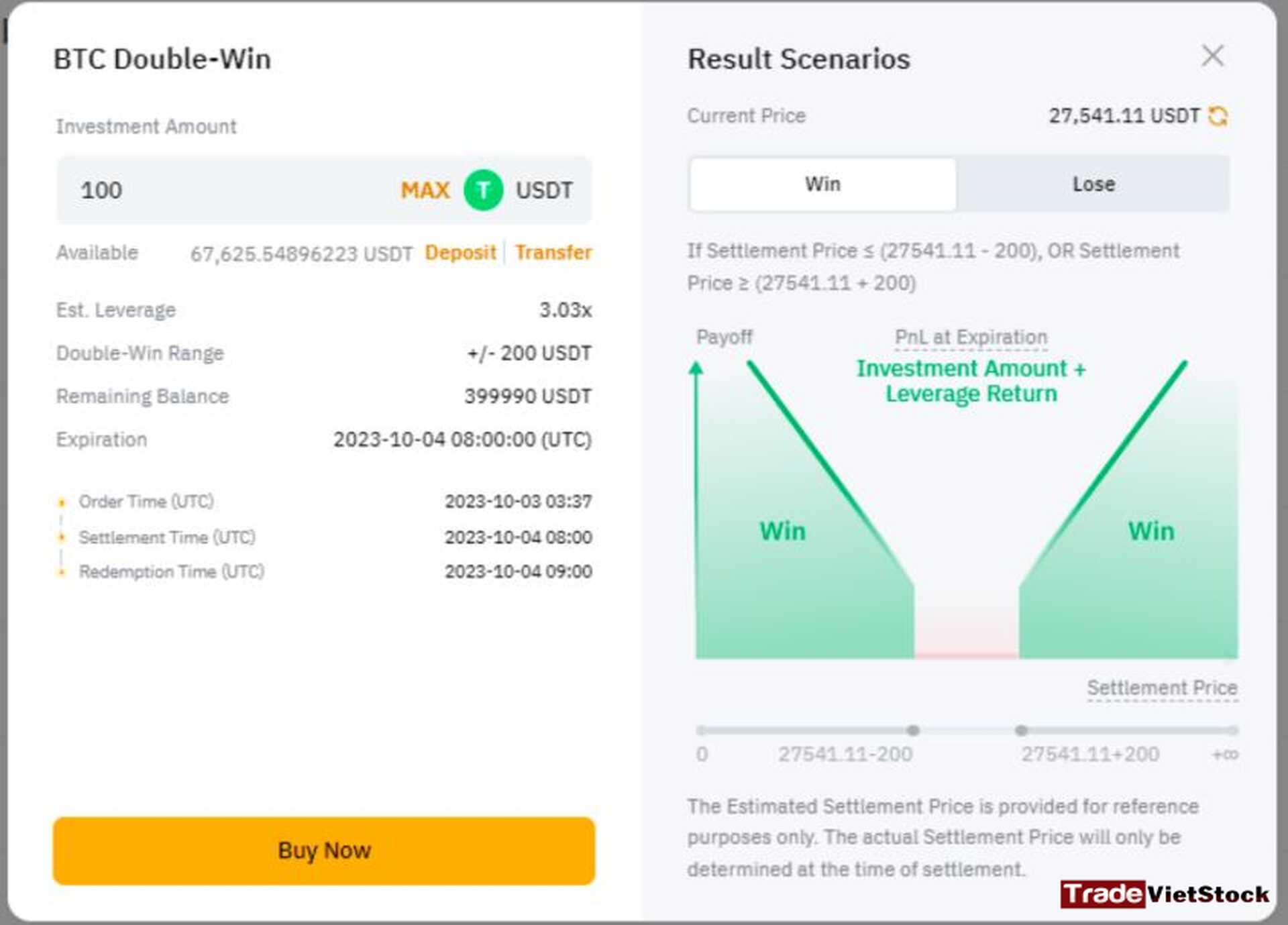

III. Double Win

1. Definition

Double Win is a unique financial product on Bybit that lets you profit regardless of market direction—up or down—as long as the price moves outside a predefined Price Range by the Settlement Date. The bigger the gap between the final price and the range, the fatter your payout gets, thanks to leverage amplifying your gains. However, if the price stays inside the range, you’re out of luck and lose your entire investment. It’s a high-stakes, high-reward setup that thrives on volatility.

Here’s the mechanics in a nutshell:

| Scenario | Formula | Outcome |

| Settlement Price ≥ Upper Range Price | Payoff = Investment + (Leverage × Investment × (Settlement Price – Upper Range Price) / Entry Price) | You get your investment back plus leveraged profit. |

| Settlement Price ≤ Lower Range Price | Payoff = Investment + (Leverage × Investment × (Lower Range Price – Settlement Price) / Entry Price) | You get your investment back plus leveraged profit. |

| Lower Range Price < Settlement Price < Upper Range | Payoff = 0 | You lose your entire investment. |

Illustrative Example:

- Investment Amount: 500 USDT

- Entry Price: 27,050 USDT

- Estimated Leverage: 20x

- Double-Win Range: ±200 USDT

- Lower Range Price: 27,050 – 200 = 26,850 USDT

- Upper Range Price: 27,050 + 200 = 27,250 USDT

- Expiration Date: 30/09/2023, 8:00 AM UTC

2. Scenarios at Expiration

Let’s break it down with some real numbers to see how this plays out:

a. Winning Scenarios:

Scenario 1: Settlement Price = 27,500 USDT

- The price is above the Upper Range (27,250 USDT).

- Payoff = 500 + (20 × 500 × (27,500 – 27,250) / 27,050)

- Payoff = 500 + (10,000 × 250 / 27,050) = 500 + 92.42 = 592.42 USDT

- Result: You walk away with 592.42 USDT—your 500 USDT investment plus a tidy 92.42 USDT profit.

Scenario 2: Settlement Price = 25,000 USDT

- The price is below the Lower Range (26,850 USDT).

- Payoff = 500 + (20 × 500 × (26,850 – 25,000) / 27,050)

- Payoff = 500 + (10,000 × 1,850 / 27,050) = 500 + 683.92 = 1183.92 USDT

- Result: You score 1183.92 USDT—your 500 USDT back plus a hefty 683.92 USDT profit. The further the price moves, the better it gets.

b. Losing Scenario:

Settlement Price = 27,000 USDT

- The price lands between 26,850 USDT and 27,250 USDT—inside the Double-Win Range.

- Payoff = 0

- Result: You lose the full 500 USDT. No payout, no mercy.

This shows Double Win’s all-or-nothing nature: you either cash in big or walk away empty-handed.

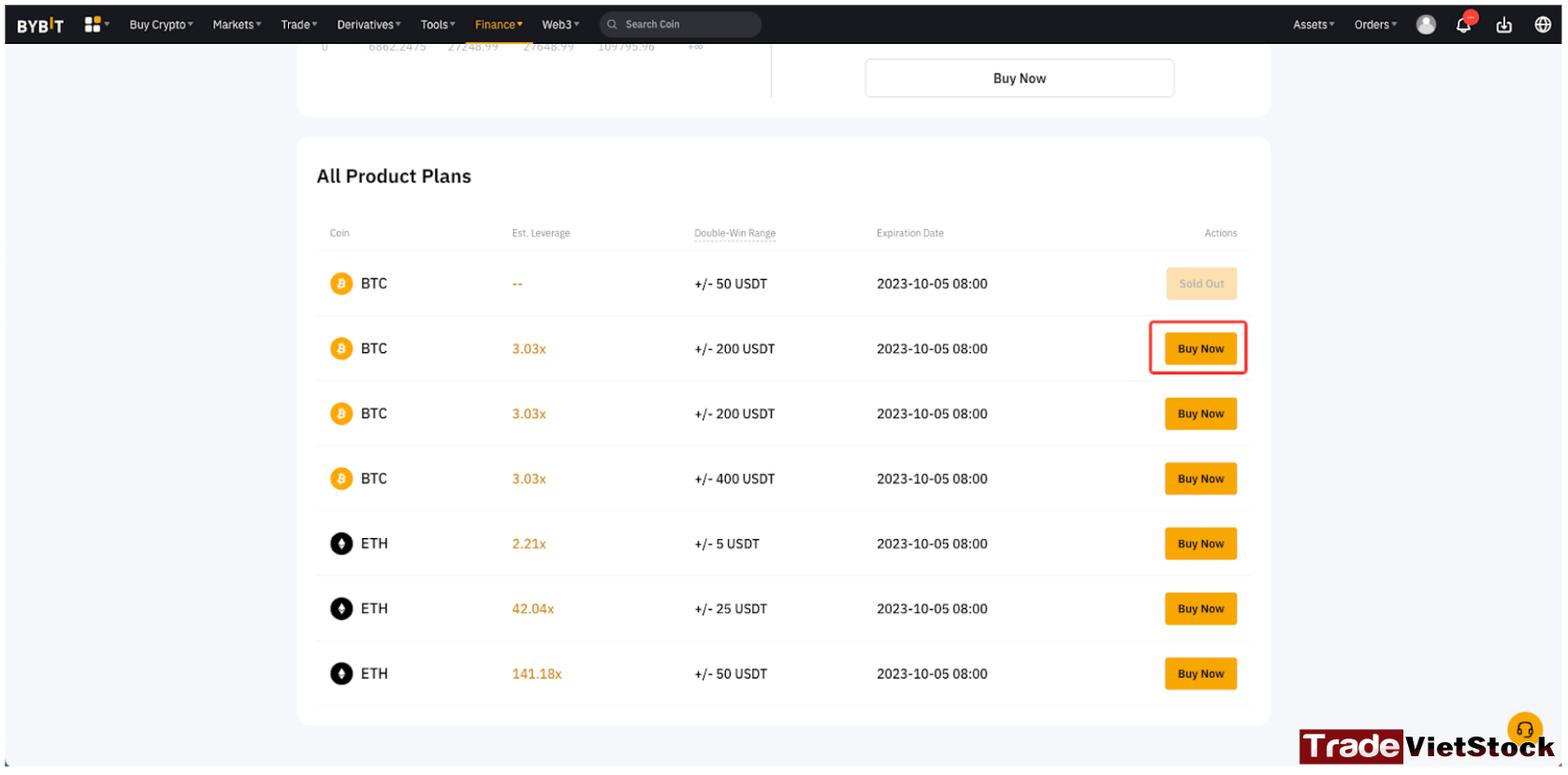

3. How to Use Double Win

Here’s the step-by-step guide to setting up Double Win on Bybit. It’s a smooth process if you follow along:

Step 1: Access the Double Win Page

Head to the navigation bar and click Finance → Double-Win to open the Double Win section.

Step 2: Choose Your Double Win Plan

You’ll see a list of available plans, each with details like:

- Coin (e.g., BTC, ETH)

- Estimated Leverage (e.g., 20x)

- Double-Win Range (e.g., ±200 USDT)

- Expiration Date and Time

Pick a plan that matches your goals—whether you’re betting on a big upward swing or a sharp drop—and click Buy Now.

Pro Tip: Use the built-in simulator to crunch the numbers:

- Enter your investment amount.

- Adjust the Double-Win Range.

- Input a predicted Settlement Price to see your potential profit or loss (PnL).

This helps you visualize outcomes before committing.

Step 3: Create Your Double Win Plan

Input how much you’re investing (e.g., 500 USDT) and review all the parameters—coin, leverage, range, expiration. Make sure you’re clear on what you’re signing up for, then hit Buy Now.

Step 4: Final Confirmation

Double-check everything one last time. Once you subscribe, there’s no editing or canceling—if the price lands in the range, your investment’s gone. Click Confirm to lock it in.

Notes on Early Redemption

If you want to pull out before the Settlement Date, here’s what you need to know:

- Process: Redemption is instant—just go to your plan, hit Redeem, and confirm.

- Timing Restriction: You can’t redeem within one hour of the settlement time.

- Payout Caveat: You might not get your full investment back. The Estimated Redemption Value (shown in the confirmation window) is based on current market conditions, but the actual amount could differ slightly.

- 90% Slippage Protection: Enabled by default. If the real redemption value drops below 90% of the estimate, the withdrawal fails, and your plan stays active. It’s a safety net to avoid getting shortchanged by wild market swings.

=> Double Win’s a bold play—perfect if you’re betting on volatility and can stomach the risk of losing it all if the market stays flat.

4. Conclusion

| Pros | Cons |

| Profits whether price goes up or down—as long as it’s outside the range | You lose everything if price stays inside the range |

| Leverage boosts gains the further price moves | No way to edit or cancel once confirmed |

| Perfect for volatile markets—big swings mean big wins | High risk—all-or-nothing deal |

| Simulator lets you test potential outcomes before jumping in | Early redemption might not return full investment |

| Flexible range and expiration options to suit your strategy | Can’t redeem 1 hour before Settlement Date |

=> Double Win is a gutsy move for those who thrive on market chaos. If the price rockets past the range—up or down—you’re cashing in big with leverage pumping up your payout. But if it lounges inside the range, kiss your investment goodbye. The simulator’s a nice touch to preview your shot, but this isn’t for the faint-hearted—it’s a high-stakes bet on volatility with no middle ground. Play it if you’ve got the nerve and a solid read on the market.

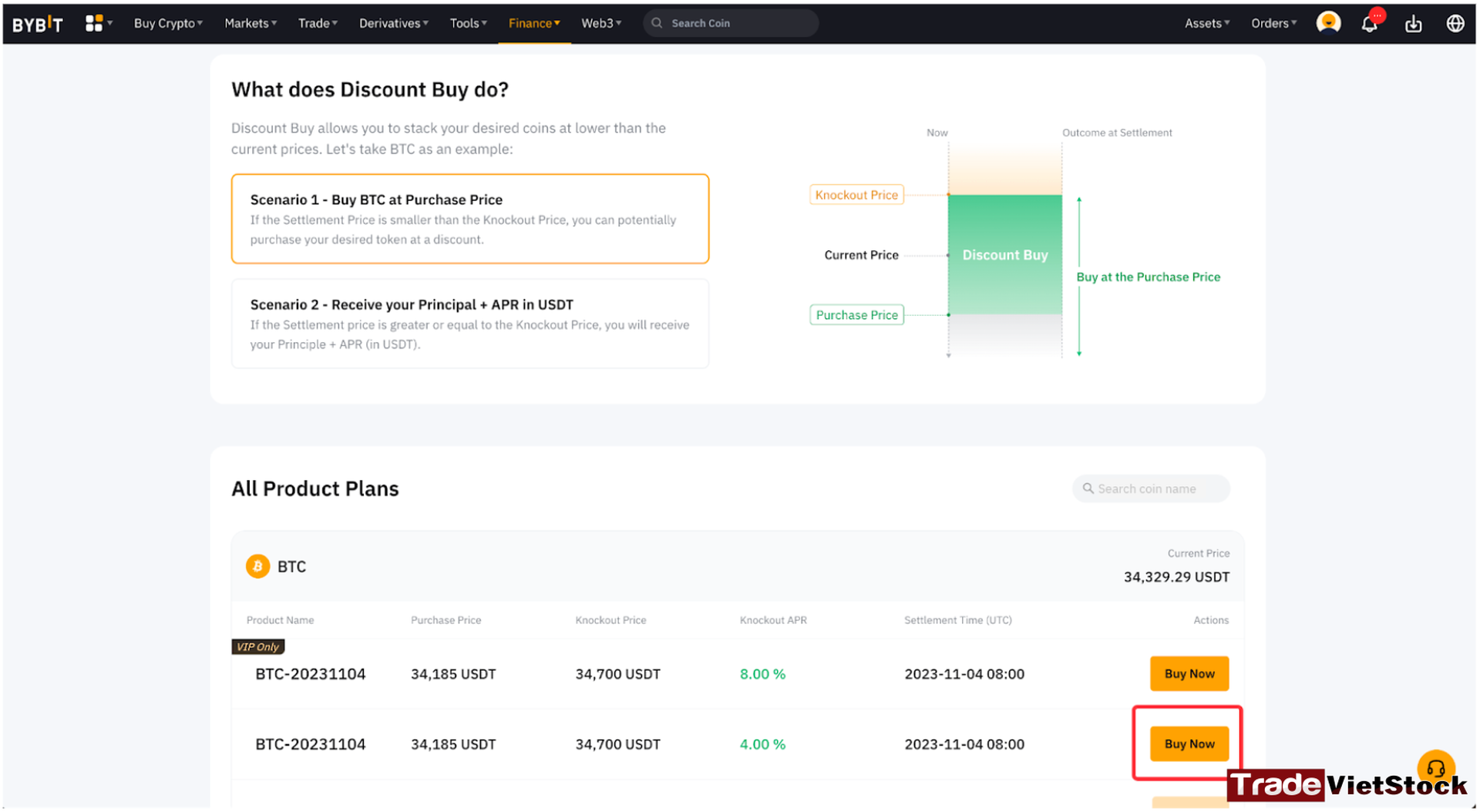

IV. Discount Buy

1. Definition

Discount Buy is a cool financial product from Bybit worth digging into. It lets you buy crypto at a discounted price compared to the market rate, especially during calmer market phases. Plus, if you don’t snag the price you want, you still pocket some interest.

It hinges on two key prices:

- Purchase Price: The discounted price you’ll pay for the crypto (below market value).

- Knockout Price: The ceiling price. If the market price tops this, you don’t buy the crypto but get your investment back plus interest.

2. How It Works

Here’s the breakdown of what happens at settlement:

| Scenario | Condition | Outcome at Settlement |

| Knockout Scenario | Settlement Price ≥ Knockout Price | Profit = Principal + Additional Interest (APR) in USDT |

| Buy Scenario (Profit) | Purchase Price < Settlement Price < Knockout Price | Buy your desired coin at Purchase Price (with profit) |

| Buy Scenario (Loss) | Settlement Price < Purchase Price | Buy your desired coin at Purchase Price (no profit) |

How It Plays Out:

You put in a set amount (say, 10,000 USDT) to join a Discount Buy plan. The outcome depends on the Settlement Price:

- If Settlement Price ≥ Knockout Price: No crypto for you, but you get your initial investment back plus a small APR bonus in USDT.

- If Settlement Price < Knockout Price: You buy the crypto at the Purchase Price. If this is below the market price at settlement, you profit. If it’s above, you take a loss.

Real Example:

- Investment: 10,000 USDT to buy Bitcoin (BTC)

- Purchase Price: 29,900 USDT (discounted from market)

- Knockout Price: 31,000 USDT

Possible Outcomes:

- Settlement Price = 30,800 USDT

- Between Purchase Price and Knockout Price.

- You buy BTC at 29,900 USDT (below market), scoring a profit.

- Settlement Price = 29,000 USDT

- Below Purchase Price.

- You buy BTC at 29,900 USDT (above market), taking a loss.

- Settlement Price = 32,000 USDT

- Above Knockout Price.

- No BTC purchase; you get 10,000 USDT back + interest.

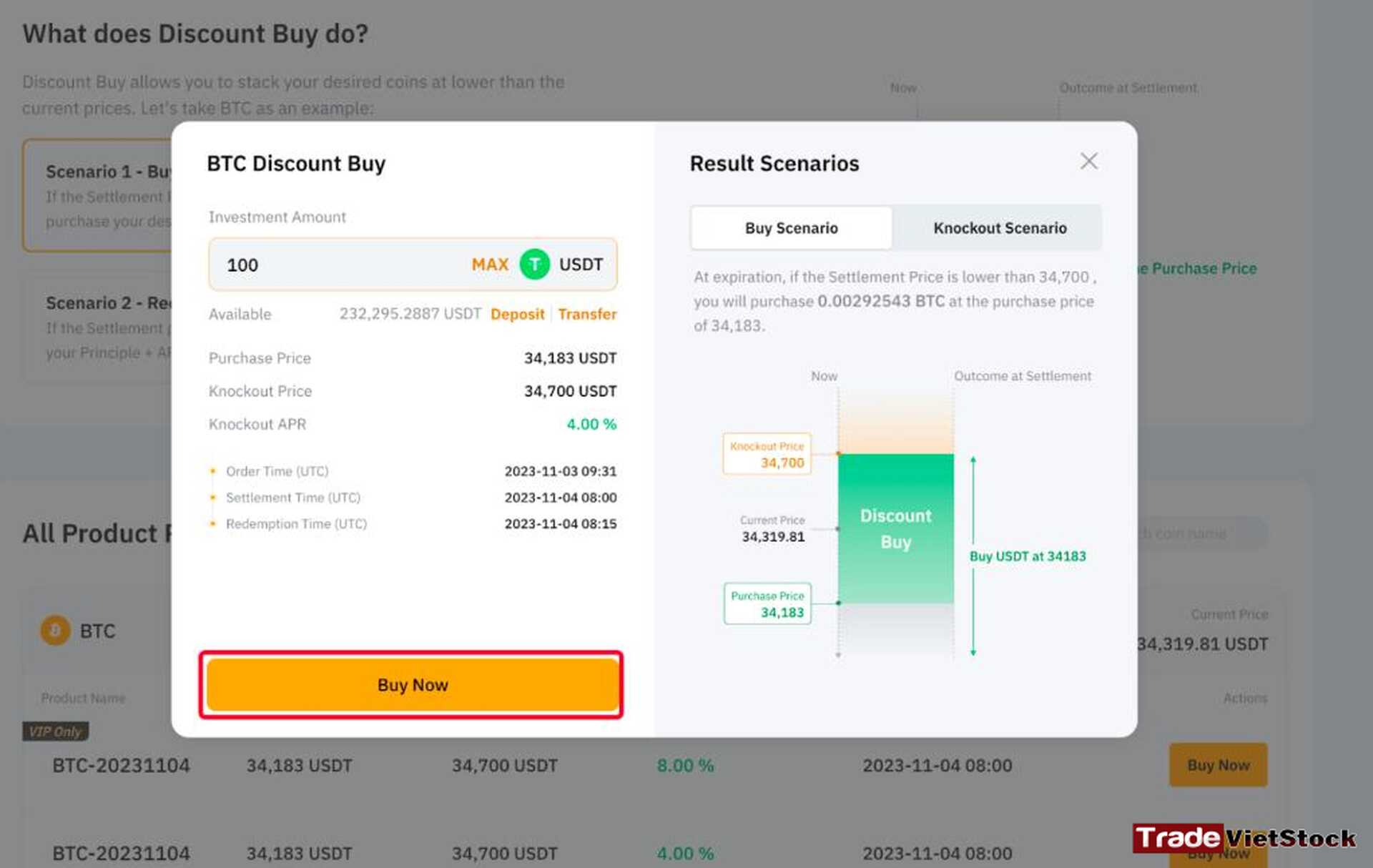

3. How to Use Discount Buy

Step 1: Access the Discount Buy Page

Head to the Finance section and select Discount Buy.

Step 2: Pick Your Discount Buy Plan

Browse plans based on:

- Coin (e.g., BTC, ETH)

- Purchase Price

- Knockout Price

- Knockout APR

Choose your plan and click Buy Now.

Step 3: Set Up Your Discount Buy Plan

Enter your investment amount (e.g., 10,000 USDT) and review the details.

Tip: Check potential outcomes with the Buy Scenario or Knockout Scenario tabs:

- If Settlement Price < Knockout Price: You get the tokens at the discounted Purchase Price.

- If Settlement Price ≥ Knockout Price: You get your principal back plus APR in USDT.

Step 4: Final Confirmation

Double-check everything. Once confirmed, you can’t tweak or cancel the order. Hit Confirm to lock it in.

4. Conclusion

| Pros | Cons |

| Buy crypto at a discount when it works out | Loss if market drops below Purchase Price |

| Interest earned even if no purchase (Knockout) | No flexibility—orders are final once placed |

| Low-risk profit in stable or rising markets | Profit depends on Settlement Price alignment |

| Clear scenarios to preview outcomes | Requires funding setup beforehand |

| Good for snagging deals in calm markets | Limited upside compared to high-leverage tools |

=> Discount Buy is a smart pick if you want a low-effort shot at discounted crypto with a safety net of interest if it flops. It shines in steady or slightly up markets, but you’re at the mercy of the Settlement Price—drop too low, and you’re buying high. Solid for cautious players, not a wild money-maker.

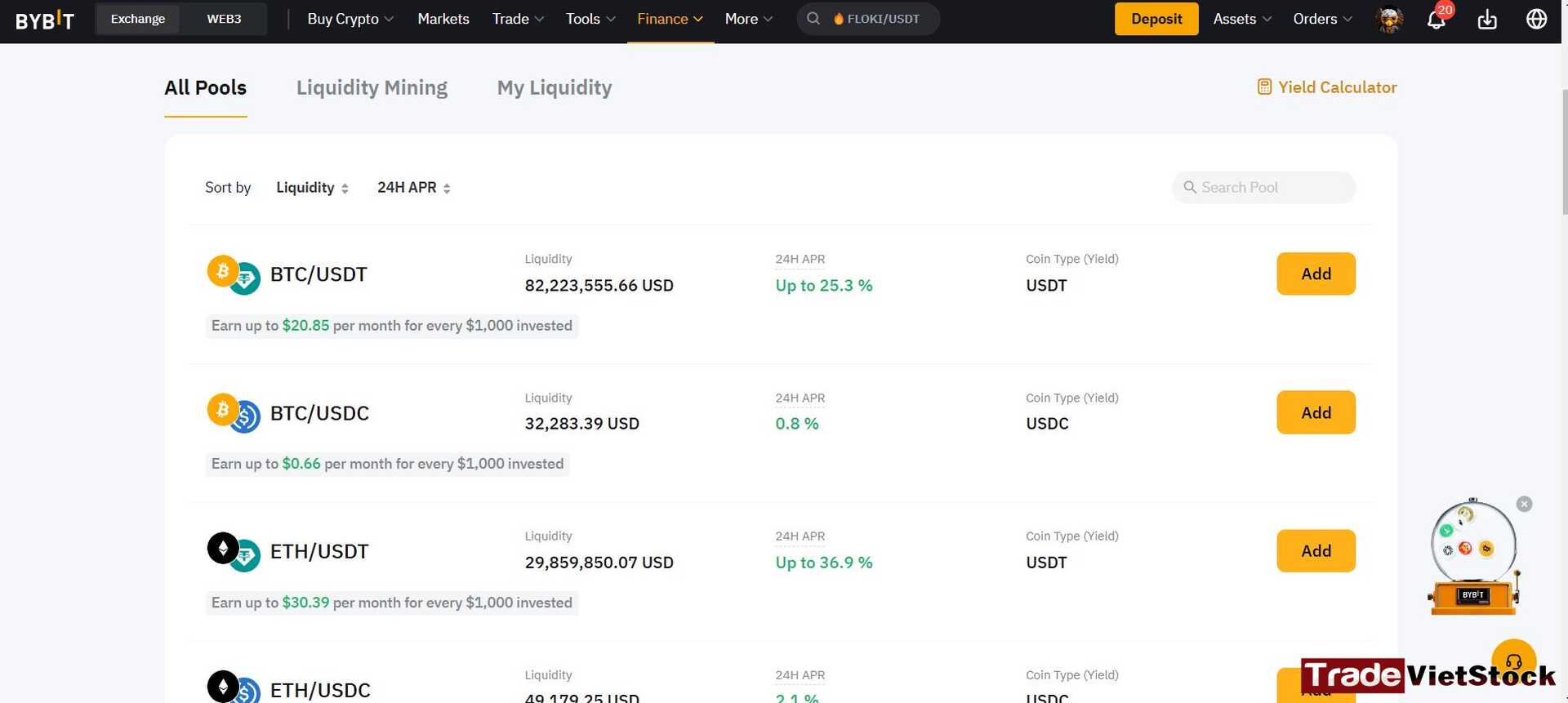

V. Liquidity Mining

1. Definition

The last product in this How to Earn Passive Income on Bybit article today is Liquidity Mining. This is a straightforward product that’s pretty easy to wrap your head around. It’s all about tapping into the platform’s liquidity pools. Basically, you step in as a market maker—someone who provides liquidity—and your profit comes from the trading fees generated.

To juice up your returns, Bybit lets you use leverage, up to a max of 10x. But here’s the catch: leverage means you’re opening the door to liquidation risk if things go south. Compared to the other products, it’s simpler to jump into—just pick your token and get started.

2. How to Use Liquidity Mining

Step 1: Go to Liquidity Mining

Head over to the Liquidity Mining section on Bybit.

Step 2: Pick Your Crypto

Choose the cryptocurrency you want to mine liquidity for. You’ll see a list of available tokens to work with.

Step 3: Set It Up

Fill in the details:

- Amount of assets you’re putting in (your deposit).

- Leverage level (from 1x for minimal risk up to 10x for higher returns).

Then confirm to kick things off.

3. Conclusion

| Pros | Cons |

| Steady passive income from trading fees | Liquidation risk if using high leverage |

| Simple setup—no complex strategies needed | Returns can be modest without leverage |

| Leverage option to boost profits (up to 10x) | Dependent on trading volume for fees |

| Low effort once it’s running | Market downturns could hit leveraged positions |

| Flexible asset and leverage choices | No guaranteed profit floor |

=> Liquidity Mining is a chill way to earn steady fees with minimal hassle—great if you want passive income without overthinking it. Adding leverage can pump up the gains, but it’s a double-edged sword; a bad market move could wipe you out. Perfect for those who like a low-maintenance gig with some tweakable risk.

VI. Product Conclusion

Here’s a summary table of Bybit’s passive income products in this How to Earn Passive Income on Bybit article:

| Product | Main Goal | How It Works | Advantages | Risks | Best For |

| Dual Asset | Short-term trading with high returns (Buy Low/Sell High) | – Target Price hit: Buy/Sell at target + profit.

– Target missed: Get capital + interest. |

– Flexible Buy Low/Sell High options.

– Higher returns than stablecoins. |

– No buy/sell if target isn’t met. | Investors seeking safe, flexible profits. |

| Discount Buy | Buy crypto below market price or earn interest | – Price < Knockout: Buy crypto at discount.

– Price ≥ Knockout: Get capital + interest. |

– Cheaper crypto purchases.

– Fixed interest if no buy. |

– Buy above market if price drops below Purchase Price. | Investors wanting discounted crypto or guaranteed interest. |

| Smart Leverage | Boost leveraged trade profits, shield from short-term swings | – Price ≥ Breakeven: Leveraged profit.

– Price < Breakeven: Potential loss of capital. |

– High leverage optimization.

– Protection from washouts. |

– Full capital loss if price goes wrong at settlement. | Traders maximizing leverage with short-term protection. |

| Double Win | High profits when price exits range | – Price outside Range: High profit.

– Price in Range: Lose all capital. |

– Big profit potential beyond range. | – Total loss if price stays in range. | Investors betting on strong price swings. |

| Liquidity Mining | Provide liquidity, earn trading fees | Investors add assets to liquidity pool, earn fees, with optional leverage up to 10x. | – Passive income from fees.

– Leverage to boost returns. |

– Liquidation risk with high leverage. | Investors after stable profits with low risk. |

- Dual Asset: Safe bet with fixed returns and flexibility—Buy Low or Sell High keeps it versatile.

- Discount Buy: Your chance to grab crypto on the cheap or pocket interest if it doesn’t pan out.

- Smart Leverage: Cranks up efficiency with high leverage and a buffer against short-term chaos.

- Double Win: High rewards if the price breaks out, but you’re wiped out if it stays put.

- Liquidity Mining: Steady, low-risk income with a leverage option for extra kick.

=> I’d say these Bybit products are a solid pick for investors short on trading time—especially long-term holders and investors. They all offer ways to snag crypto at a discount or earn interest, helping you stack more coins over time. That’s the core goal for most investors anyway—building up those holdings.

To support the admin’s effort in creating high-quality, informative content, you can register a Bybit account HERE. If you’re interested in other exchanges, you can also find registration links under the Crypto section on the left-hand side.

[Link to register for a free Bybit account]

Thank you for your support! We will continue to provide valuable and unbiased articles for the community. Wishing you successful investments!

If you have any question regarding the indicators set, please contact us via Telegram group: [HERE]

Wishing everyone successful trades!

📌 Interested in learning more about different crypto exchange platforms and its products? Check out our educational resources HERE

Register for the Top 5 Best Crypto Exchanges Now

[Link to register for a free Binance account]

The largest exchange currently

[Link to register for a free Bitget account]

Exchange with many financial products

[Link to register for a free Mexc account]

Exchange with the lowest costs in the world

[Link to register for a free Bybit account]

Exchange with professional financial technology

[Link to register for a free OKX account]

Exchange connected with DEX

Tiếng Việt

Tiếng Việt