How to Earn Passive Income on Bitget – Earn Products

Hello everyone! Today, Tradevietstock is here to answer the question how to earn passive income on Bitget with high-interest rates and low risk on reputable crypto exchanges. This will be a dedicated series on the topic, and in today’s article, we’ll focus on Bitget.

📌 Warning: DO NOT READ if you’re not interested in asset allocation or earning passive interest.

These days, investors are no longer limited to just buying and holding (HODLing) crypto assets. With its advanced technology, Bitget provides various Earn products to help you generate passive income. From staking, savings, smart trend, dual investments, to shark fin, these tools allow you to maximize your returns while managing risks according to your preference.

Stay tuned as we break down each strategy in detail!

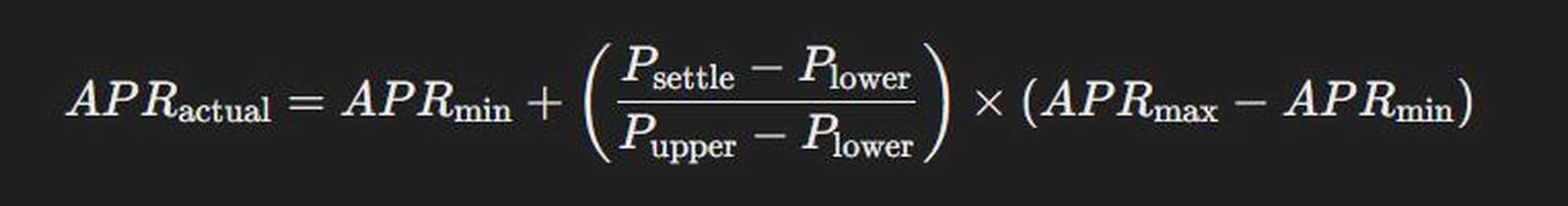

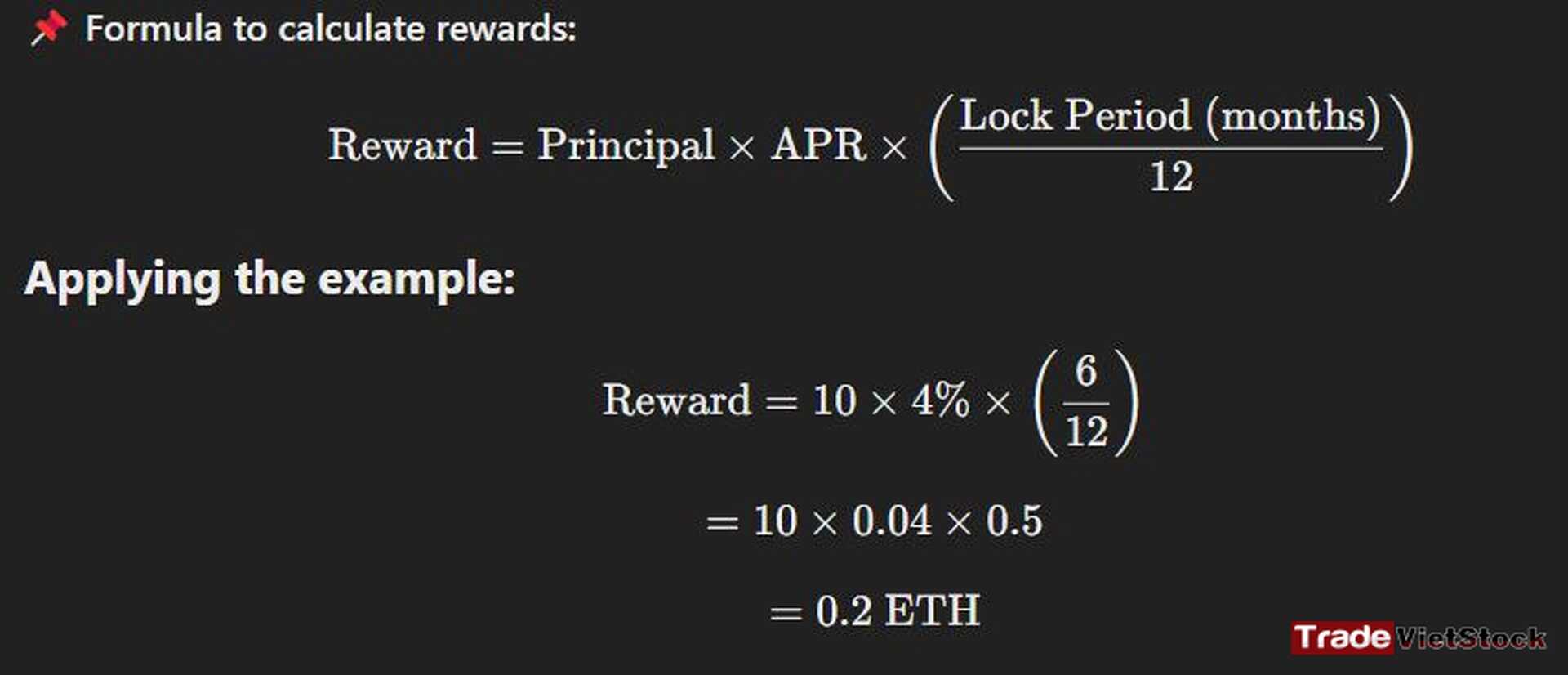

In this article, interest rate calculation is crucial, so the admin will provide the formula here along with some key terms you need to know.

- Settlement Price – The final price at which the asset is settled

- Upper Limit – Maximum limit

- Lower Limit – Minimum limit

- Max APR – Maximum annual percentage rate

- Min APR – Minimum annual percentage rate

i. Staking: Passive Income from Supporting Blockchain

1. What is Staking?

Staking is a method of earning passive income by locking your cryptocurrency assets to support blockchain network operations. When you stake, your assets are used to:

- ✅ Verify transactions

- ✅ Secure the blockchain network

In return, you receive staking rewards, usually paid in the same cryptocurrency you staked (e.g., ETH, SOL, ADA).

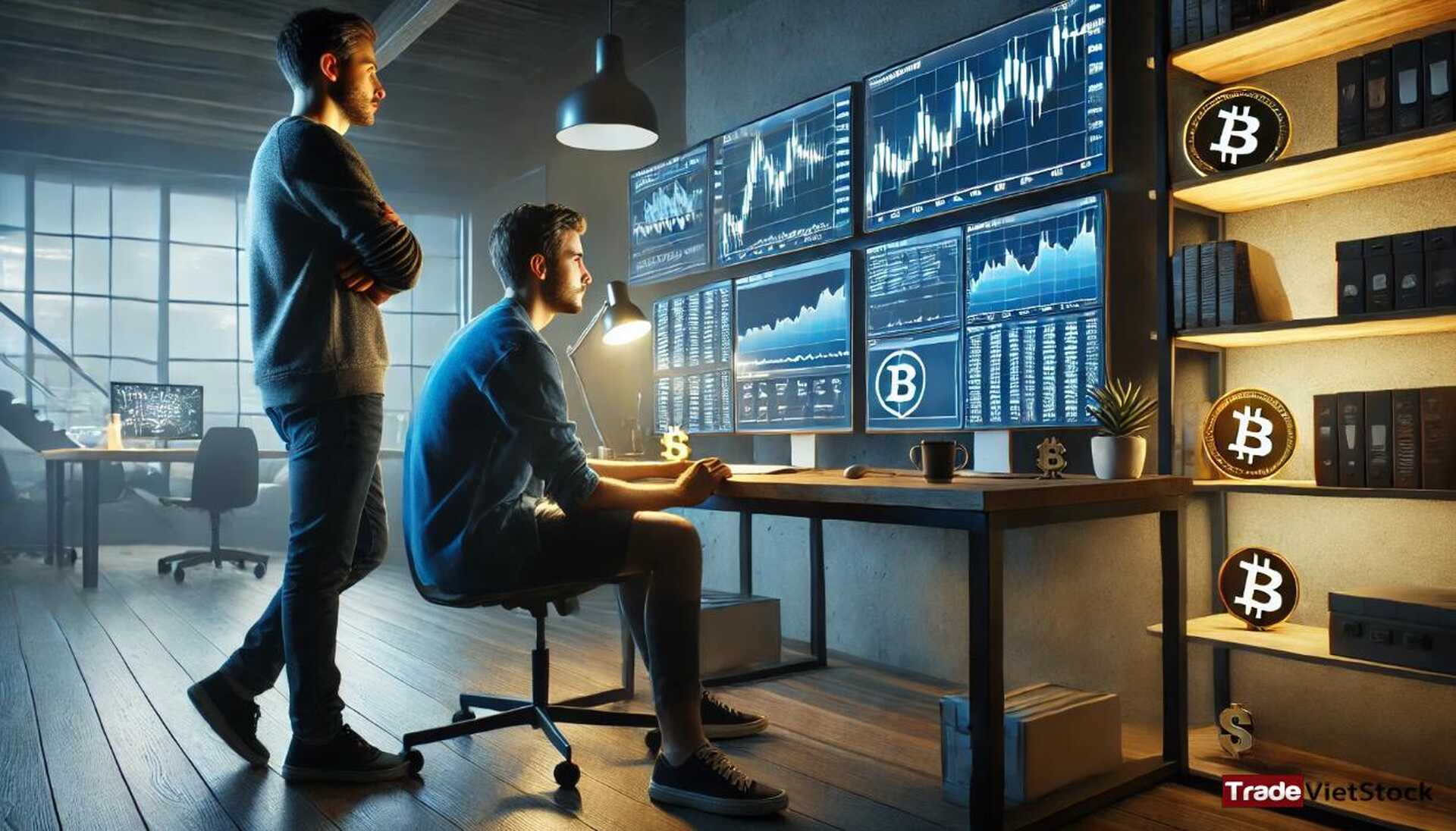

The image below is an example of staking SOL on the blockchain. The average annual interest rate for this blockchain is 7-10%.

📌 Example: Staking SOL

=> In other words, when you stake your assets in a blockchain network, you simply wait for your interest to be paid upon maturity. The underlying technology of cryptocurrencies will work automatically, requiring no further action from you.

2. How It Works

You lock your assets on the blockchain network (e.g., Ethereum or Solana) until maturity.

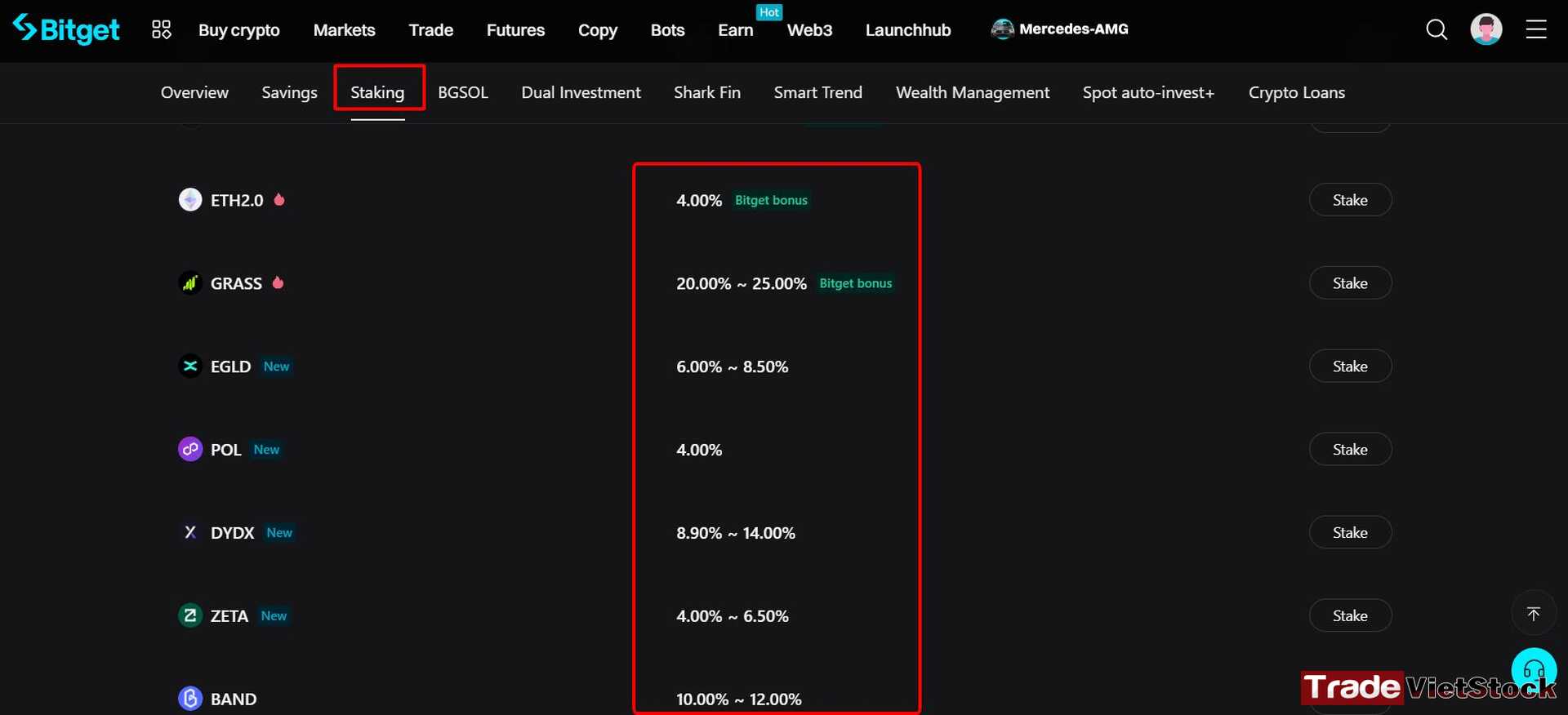

After maturity, you receive rewards based on the APR (Annual Percentage Rate). Each blockchain system offers different interest rates, as shown in the example below.

Reward Calculation Example:

- If you stake ETH with an APR of 4%, you will receive 0.04 ETH for every 1 ETH after one year.

3. Real-Life Example

You stake 10 ETH for 6 months with an APR of 4%.

Total ETH after 6 months:

- Principal: 10 ETH

- Reward: 0.2 ETH

- Total after maturity: 10 ETH + 0.2 ETH = 10.2 ETH

4. Advantages

- No need to sell your original assets: You still keep your assets and only receive additional rewards.

- Stable income: Profits are paid periodically (weekly, monthly).

5. Disadvantages

Price volatility: If the price of ETH drops significantly, the value of your rewards will also decrease.

Example: Before you stake, 1 ETH is worth 3,300 USDT. After maturity, ETH drops to 2,500 USDT. If you staked 10 ETH worth 33,000 USDT, after maturity, your 10.2 ETH would be worth only 25,500 USDT.

=> This means that even though you receive interest, the value in USDT is still lower than your initial investment and does not cover the loss. However, in the long term, 10 ETH may double in value, making this method beneficial for long-term investors.

Asset lock-up: In fixed staking, you cannot withdraw your assets before the maturity period.

=> No flexibility in staking. You cannot withdraw assets to adjust your strategy.

6. Conclusion on staking on Bitget

Staking is a relatively safe passive investment channel because you are putting your assets into a decentralized blockchain system. In return, you receive interest in the form of additional coins. This method is suitable for long-term investors who believe in the value of their cryptocurrency holdings and want to accumulate more of them.

On Bitget, some blockchain ecosystems offer higher interest rates than other exchanges, such as ETH, Grass, etc.

ii. Savings: A Safe and Flexible Choice

1. What is Savings?

Savings is the simplest passive income product. You just deposit funds into your account and receive periodic interest. This is a way to optimize unused assets without complicated management.

2. How It Works

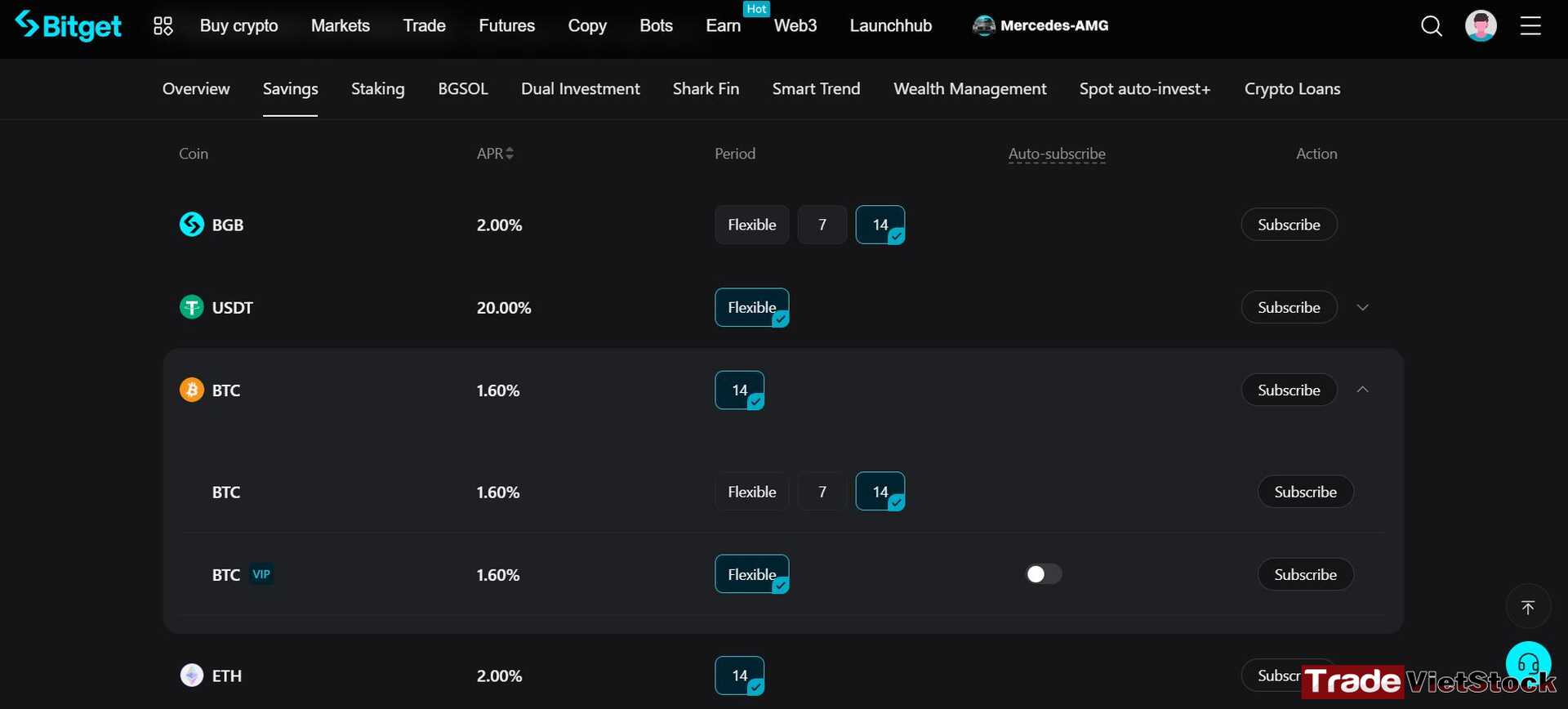

Deposit your assets (BTC, USDT, ETH) into a savings account.

Earn regular interest:

- With flexible savings, you can withdraw funds anytime.

- With fixed savings, you must wait until the maturity date, but the interest rate is higher.

In general, savings terms usually range from 7 to 14 days.

3. Advantages

- Simple and convenient: Suitable for beginners. Savings is much easier to use than staking or other complex investment methods.

- No need to lock assets: Unlike other methods that require you to lock your funds, Savings allows you to withdraw anytime while still earning interest (for flexible savings).

- Diverse interest rates: Compared to traditional banking savings, Bitget’s Savings allows you to choose from various interest rates depending on the cryptocurrency.

Example: When saving USDT, the annual interest rate can reach over 20%.

4. Disadvantages

- Lower returns compared to other products: Since Savings is extremely convenient and almost risk-free, the returns are naturally lower.

- Cannot take advantage of price volatility: Even if cryptocurrency prices surge, Savings interest rates remain fixed. The only way to maximize profits would be to withdraw your funds and invest in Spot trading or other Earn products.

5. Conclusion on the Savings Method

The admin sees Savings as the crypto equivalent of a bank savings product. The key difference is that instead of receiving interest in your local fiat currency, you receive interest in USDT or the cryptocurrency you deposited (e.g., BTC).

This provides a major long-term advantage, along with simplicity and convenience.

=> Savings is best suited for beginners, passive investors, and those with limited time. Additionally, this method is most beneficial for large asset holders.

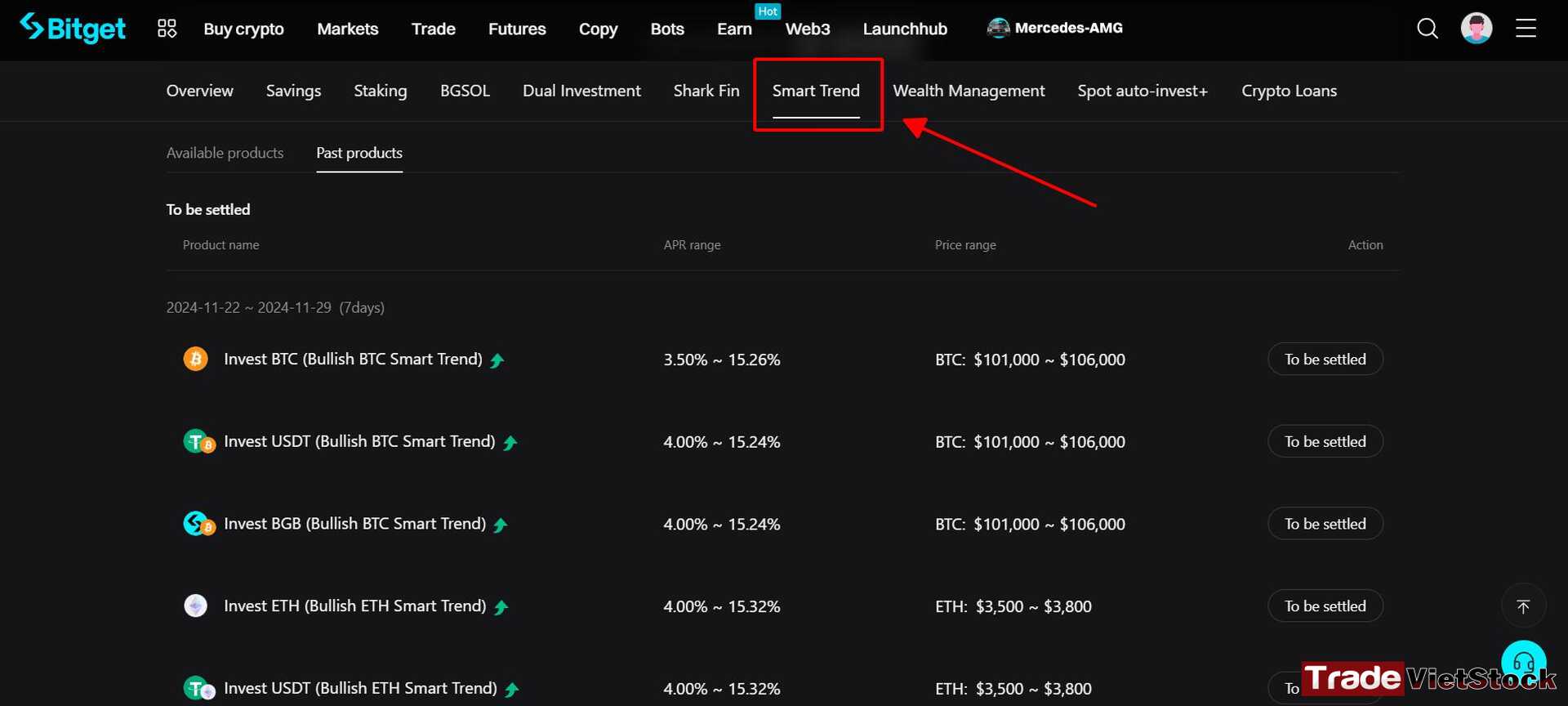

iii. Smart Trend: Interest Based on Settlement Price

1. What is Smart Trend?

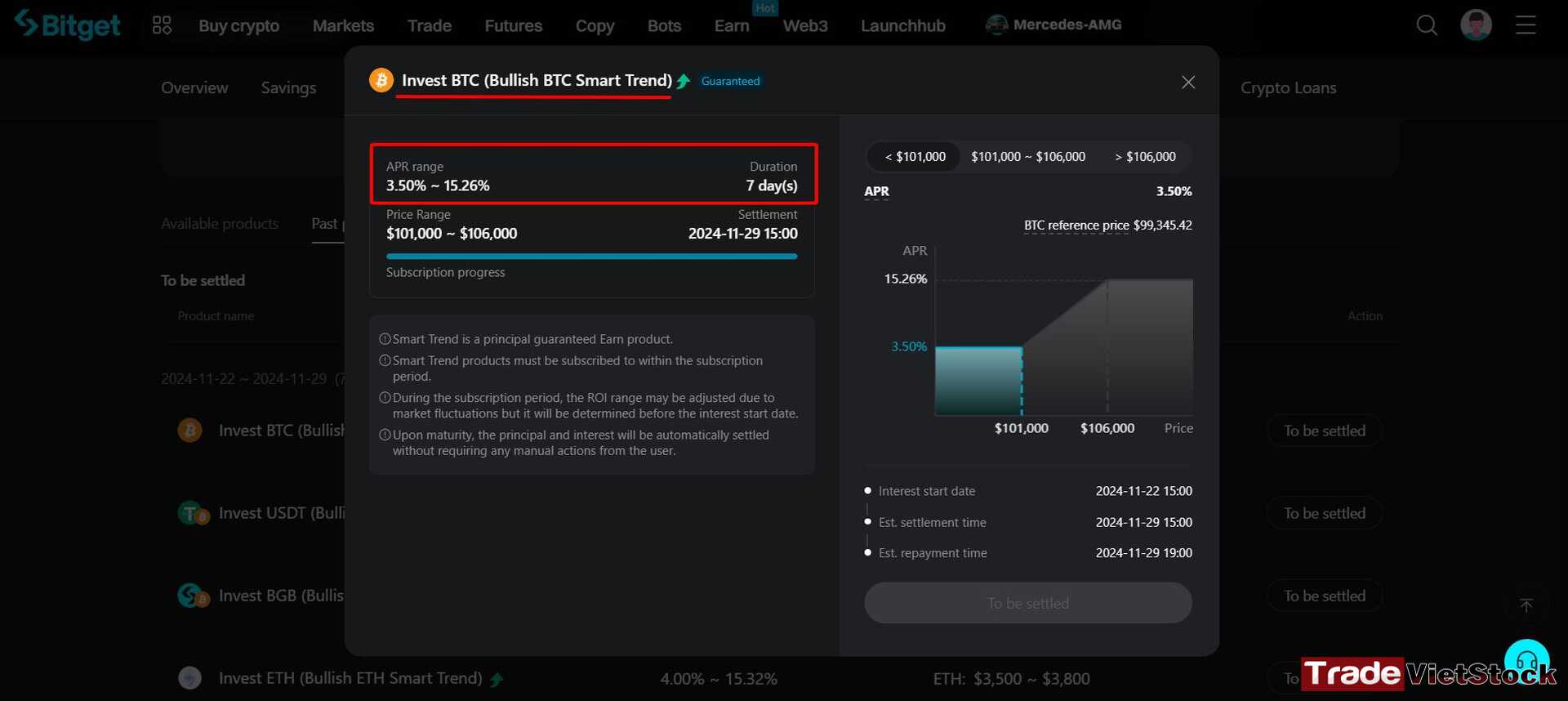

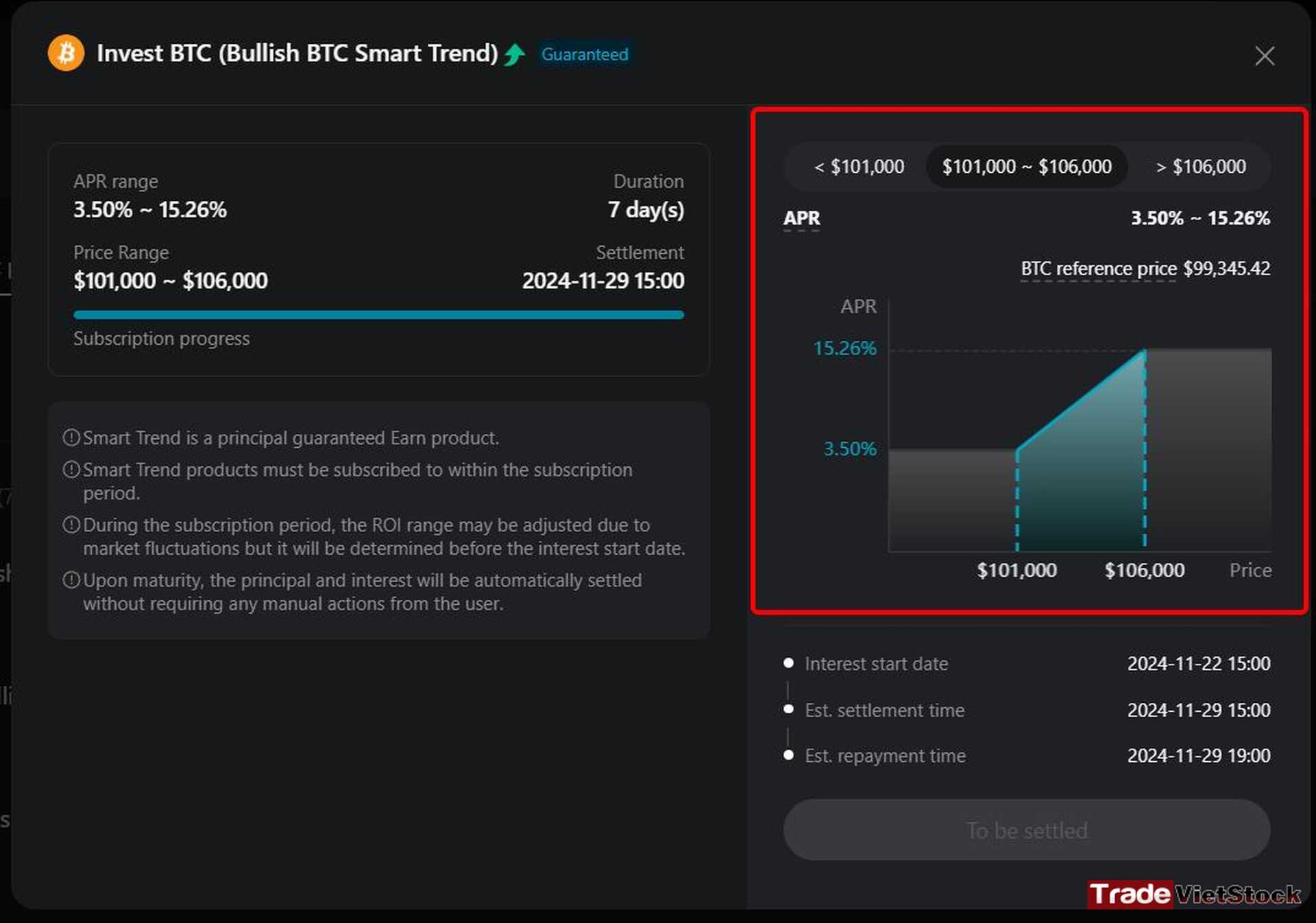

On Bitget, the admin is quite impressed with the Smart Trend feature. This product allows you to earn interest based on the Settlement Price of a cryptocurrency within a fixed price range (Range).

The closer the price is to the Upper Limit, the higher the APR.

What makes Smart Trend unique is that it allows you to earn profits and hold assets in both rising and falling markets.

2. How It Works

Smart Trend can be a bit confusing for beginners, so I will explain the mechanics in detail:

Choose an asset to deposit: BTC, ETH, or USDT. On Bitget, you can select the asset type freely, as shown in the example above.

Set a price range: Each time Smart Trend opens, different ranges (price limits) are provided for each currency pair.

Example: Suppose a range of $101,000–$106,000 is set for BTC (ranges vary over time).

- Lower Limit: $101,000

- Upper Limit: $106,000

Earn interest based on price movement:

- If the price is closer to the Lower Limit → Lower interest rate

- If the price is closer to the Upper Limit → Higher interest rate

3. Real-Life Example

Deposit: Here, the admin deposits 1 BTC.

Price Range: $101,000–$106,000.

Maximum APR: 15.26%.

Minimum APR: 3.5%.

We’re gonna have 3 possible scenarios:

Scenario 1: The Ideal Case

- At maturity, BTC reaches exactly $101,000 (APR min: 3.5%) or $106,000 (APR max: 15.26%).

- This scenario is straightforward, and no complex calculation is needed.

📌 Example Calculation:

- Settlement Price: $106,000

- Holding Period: 7 days

- Annual Interest Rate: 15.26%

- Actual Interest Earned: 0.3%

Total BTC after 7 days: 1.003BTC

Scenario 2: Price Ends Outside the Range

- This happens if BTC price exceeds $106,000 or drops below $101,000.

- In this case, you only receive the minimum APR (3.5%).

📌 Example Calculation:

- Holding Period: 7 days

- Actual Interest Earned: 0.07%

Total BTC after 7 days: 1.0007BTC

Scenario 3: Price Stays Within the Range

- If the settlement price is within the set range, we need to apply the APR formula from earlier.

📌 Example Calculation:

- Settlement Price: $105,000

- Actual APR: 12.9%

- Actual Interest Earned: 0.25%

Total BTC after 7 days: 1.0025BTC

4. Advantages

- Allows profit even in a bearish market: Bitget offers Smart Trend packages tailored for Bearish Market conditions, allowing you to earn even when prices decline.

- Relatively high interest rates with multiple asset choices: You can choose from a variety of assets with competitive APRs.

5. Disadvantages

No early withdrawals: Smart Trend investments are locked until maturity (usually 7 days).

Potential losses in case of sudden market reversal: If the market unexpectedly crashes and you had chosen a Bullish BTC Smart Trend package, the interest earned may not be enough to cover losses (this applies only when converting to USDT).

6. Conclusion on Smart Trends

For me, Smart Trends is an advanced tool that allows short-term investments with attractive interest rates. Additionally, the ability to earn even during market downturns makes it a strong advantage.

Instead of traders solely focusing on long and short positions during a bear market, investors can select Bearish BTC Smart Trend or other asset-based options to optimize their risk-return ratio.

=> Best suited for investors with low-risk appetite and large capital allocations. Additionally, those with limited experience and time for trading can also take advantage of Smart Trends on Bitget.

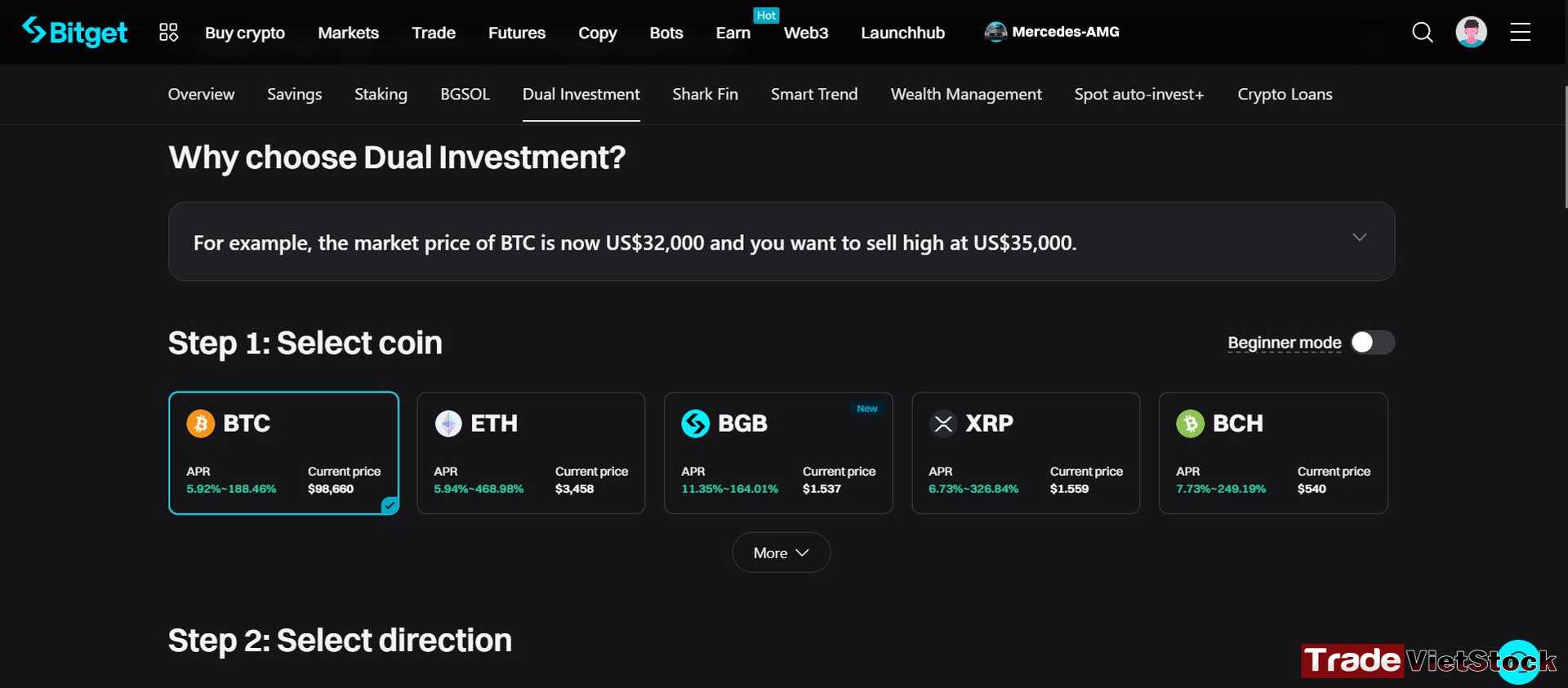

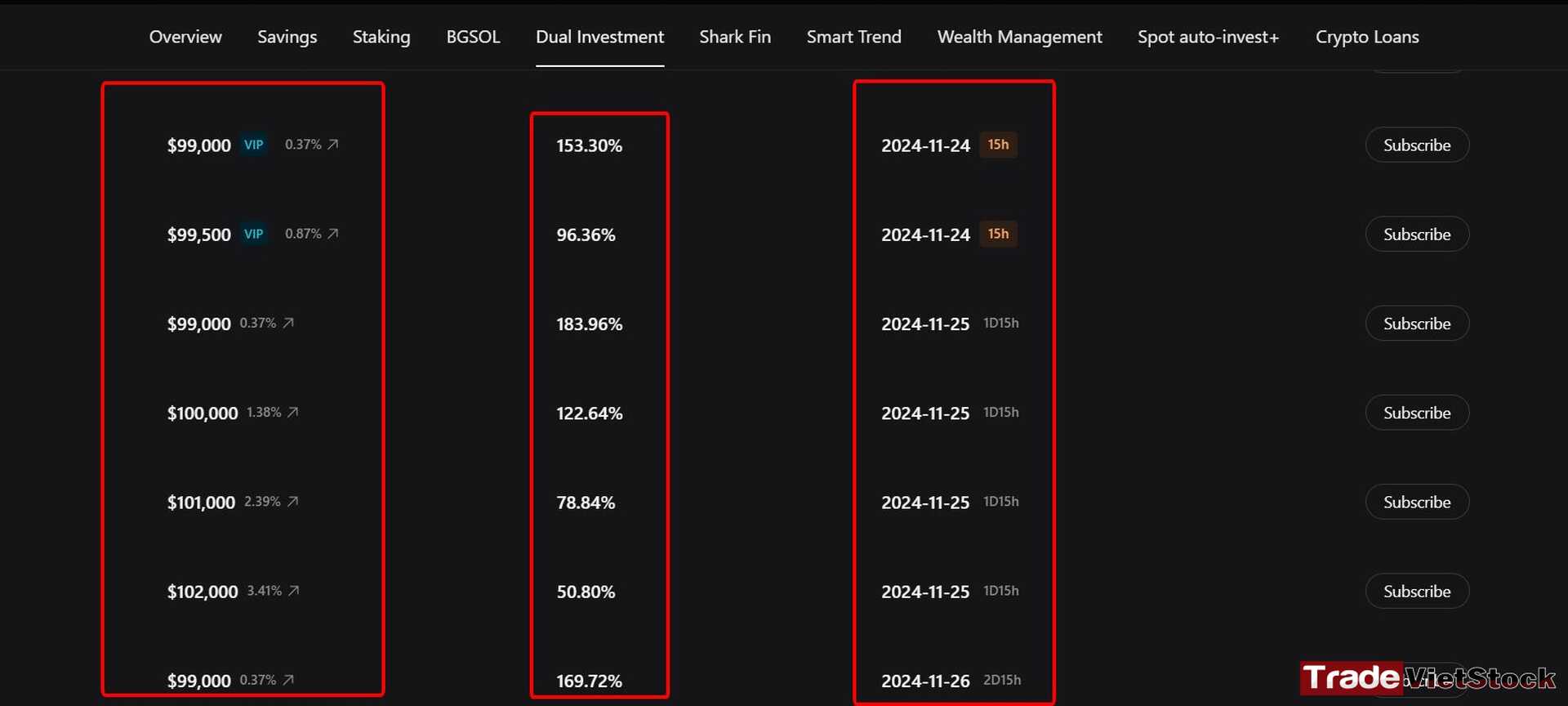

iv. Dual Investments: Betting on a Target Price

1. What is Dual Investments?

For the admin, Dual Investment is a very interesting product. This product allows you to bet on a target price. You earn very high interest rates if the asset price reaches the target price.

Once the target price is reached, the system automatically converts the asset into USDT.

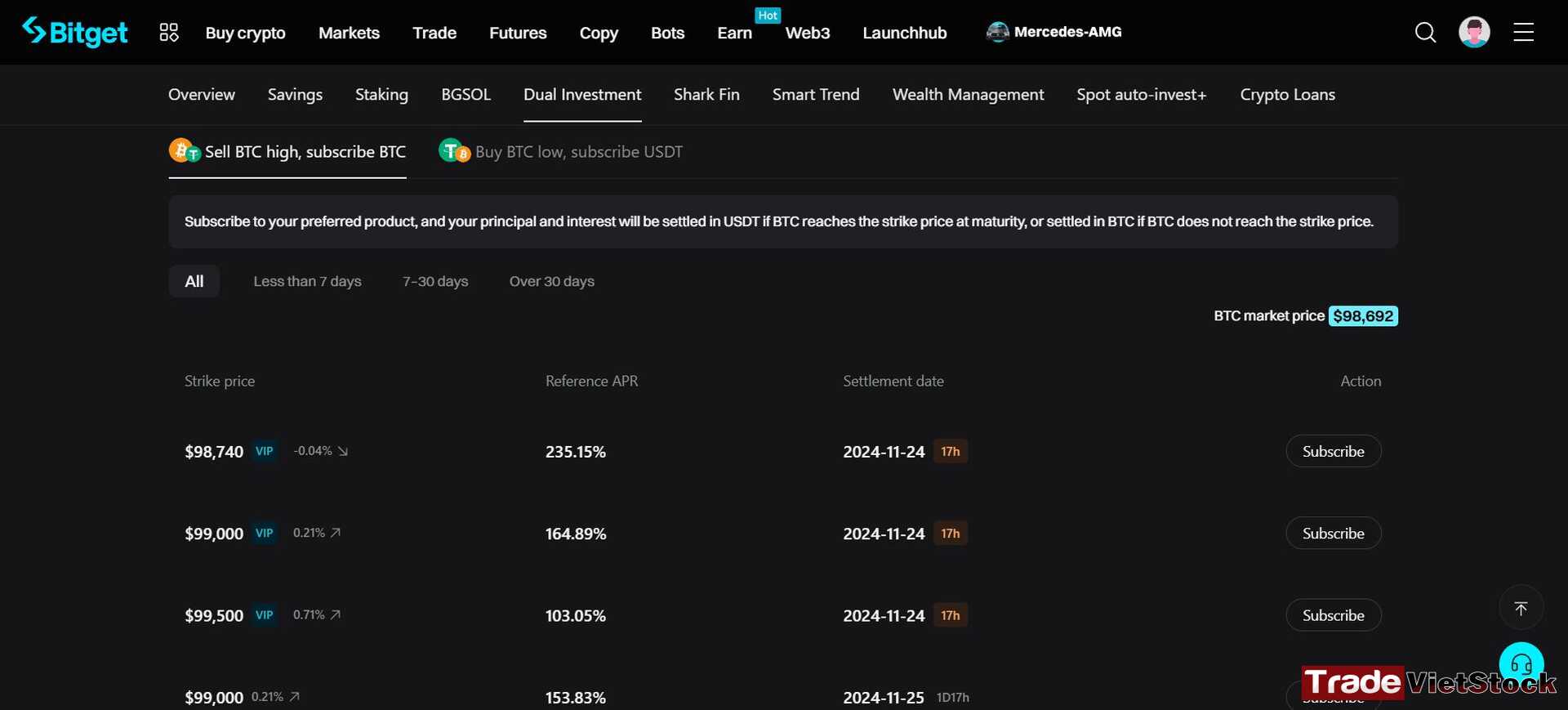

2. Real-Life Example

In this case, we choose “Sell BTC High”, meaning we want to sell BTC at a high price.

- Target Price: $98,670

- Current Price: $98,660

If we choose “Buy BTC Low”, it means we predict that BTC’s future price will drop.

Example Scenario

- Deposit: 1 BTC

- Target Price: $98,670

- APR: 188.38%

Possible Outcomes:

BTC reaches $98,670 within 17 hours

- BTC is converted into 98,670 USDT

- Interest earned: 0.5% BTC

- Total received: 98,670 USDT + 0.5% BTC interest = $99,163

BTC does not reach $98,670 within 17 hours

- You receive back 1 BTC + 0.5% BTC interest

- Total received: 1.005 BTC

3. Advantages

If price drop risks occur, your asset remains unchanged. As mentioned earlier, if the price does not reach the target upon maturity, you receive the same amount of BTC you initially deposited, along with interest paid in BTC.

This program offers a wide range of target prices and attractive interest rates. Most options have an APR of around 100%. The maturity period varies depending on the chosen target price.

In general, the interest rates of Dual Investments are much higher than those of Staking or Savings. This is arguably the most attractive interest-earning option in the Earn category.

4. Disadvantages

Like Staking, the Dual Investments program does not allow withdrawals before maturity.

Unlike spot trading, if BTC (or other assets) experiences sudden negative price movements, you also cannot adjust your asset allocation flexibly. This means the interest earned upon maturity may not fully cover losses if converted to USDT.

If BTC’s price surges past your chosen sell price, you will lose the difference because the system has already automatically sold your BTC for USDT.

For example, if you set a sell price at $101,000, but within that week BTC rises to $120,000, you will not benefit from the additional gains since the system has already sold your BTC at $101,000.

5. Conclusion on Dual Investments

Admin believes this program is suitable for those who want to increase the amount of crypto they hold. This program is not suitable for those who want to speculate on short-term price movements.

=> Dual Investments will be most effective for customers with large staked assets who believe in the long-term value of their cryptocurrency holdings.

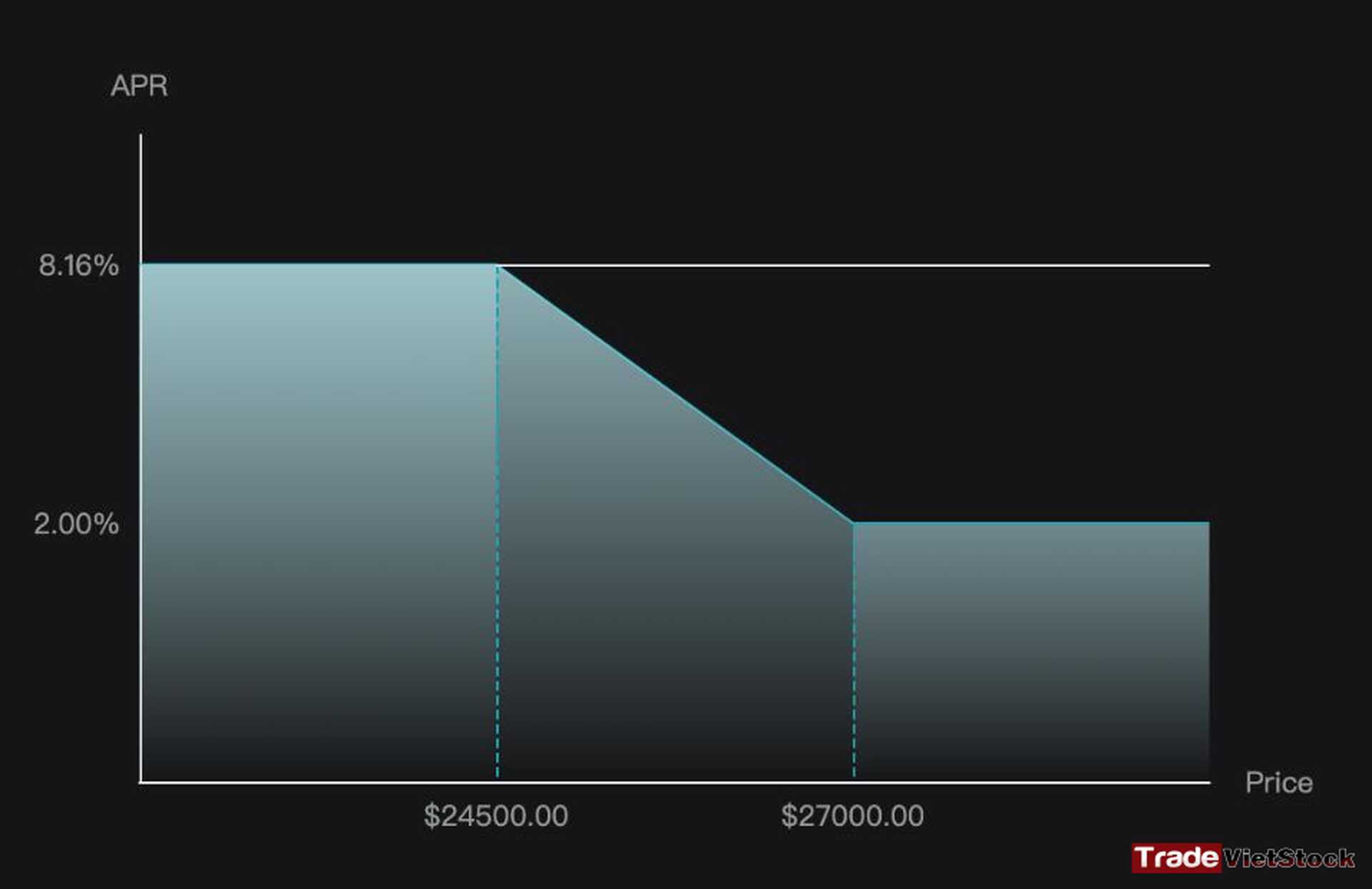

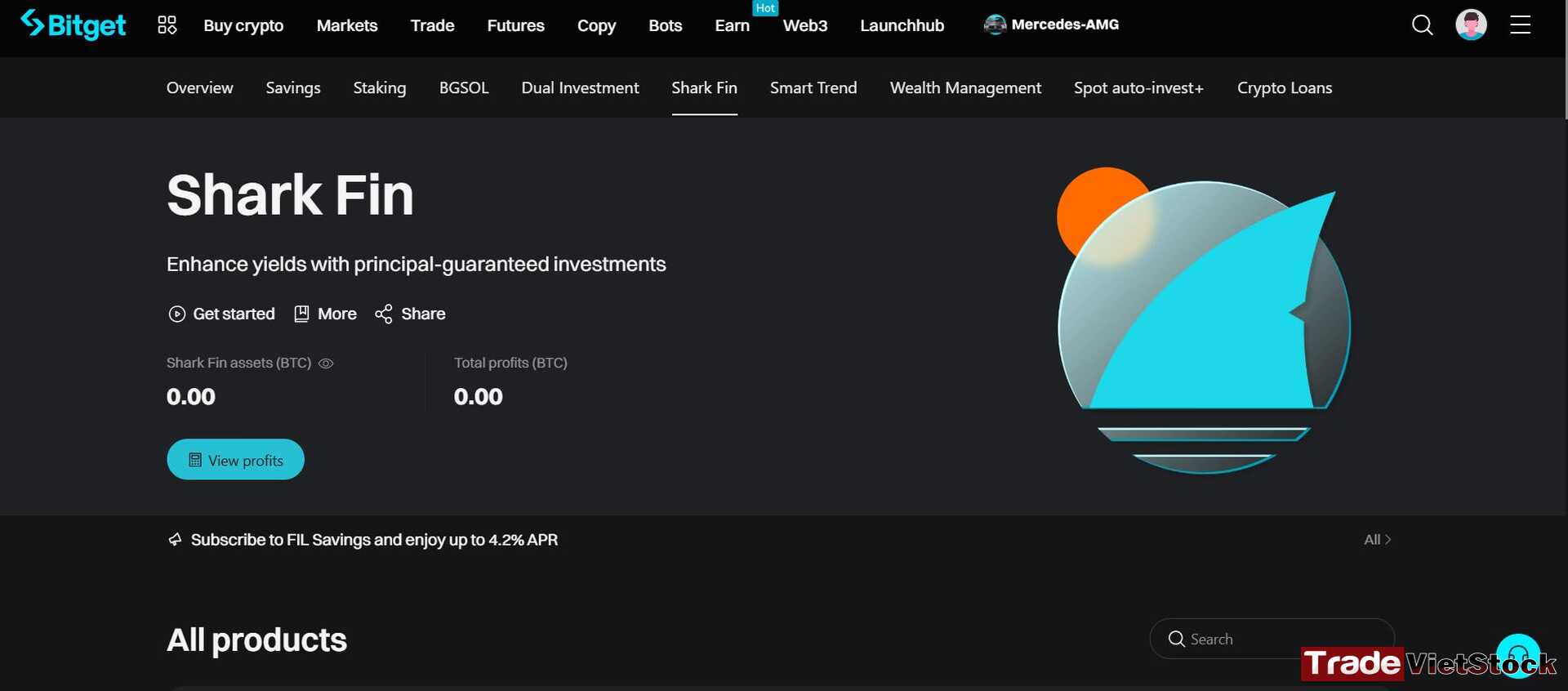

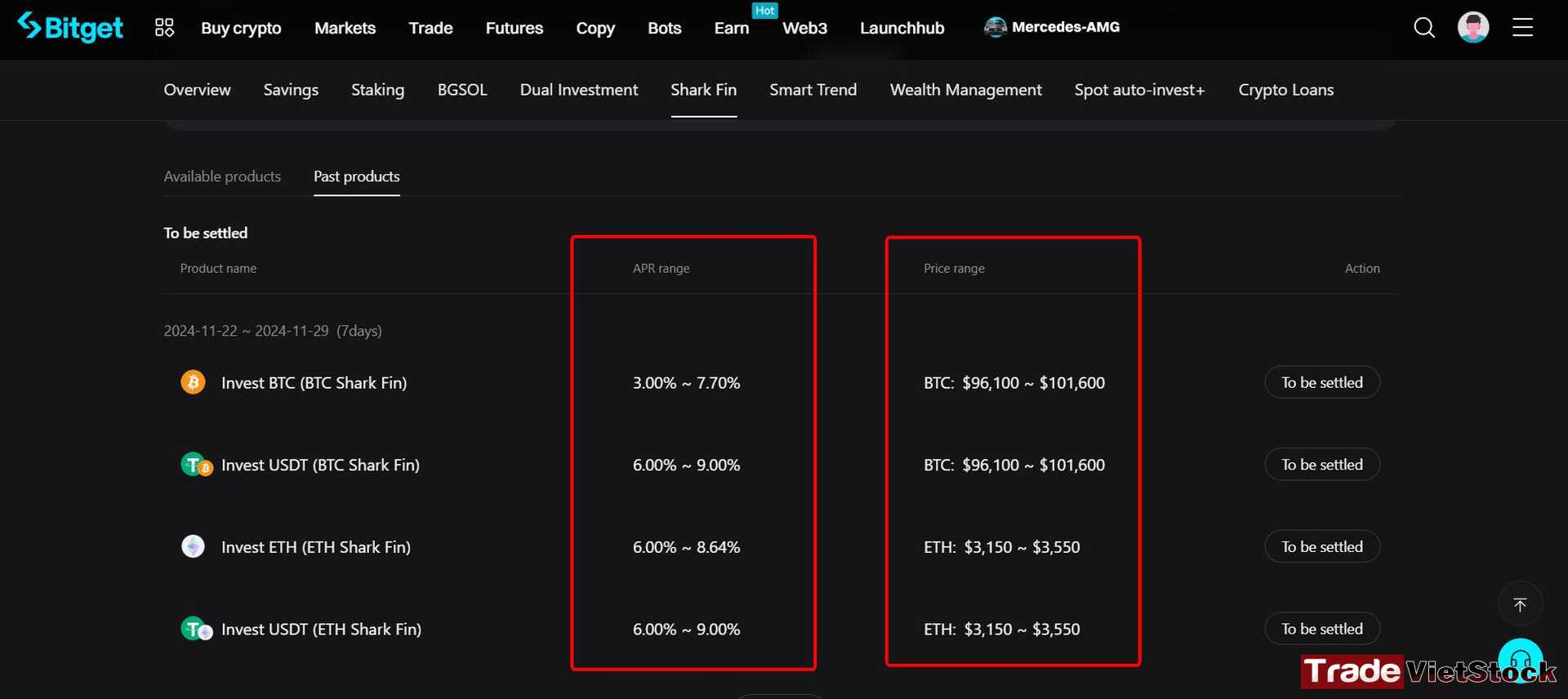

v. Shark Fin: Capital Protection

1. What is Shark Fin?

Another standout product is Shark Fin. This is a capital-protected product that offers higher interest rates if the asset price remains within a fixed range.

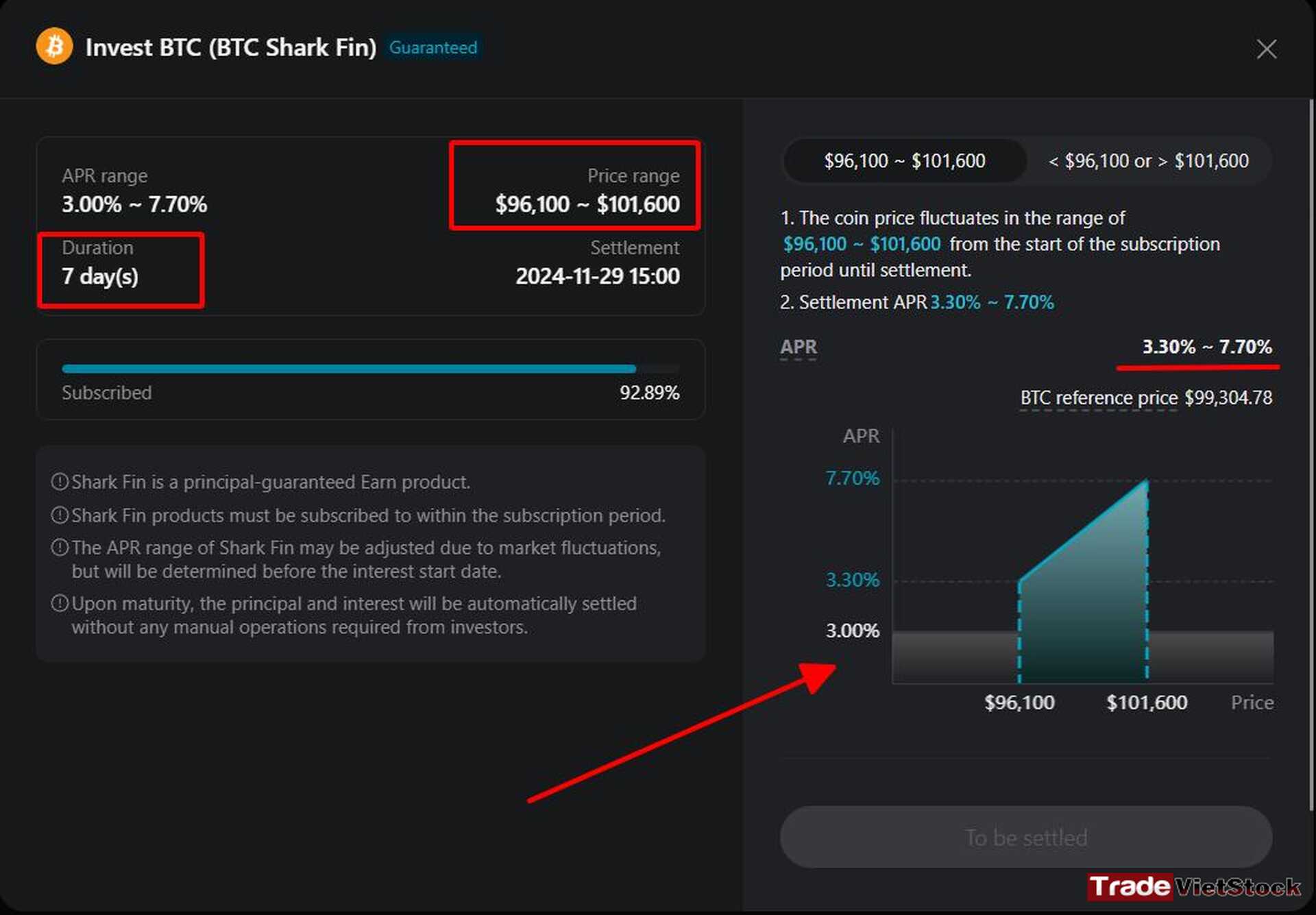

2. Real-Life Example

You select the BTC Shark Fin investment package.

- Maturity period: 7 days

- Price range: $96,100 – $101,600

- APR: 3.3% – 7.7%

Scenarios

a. If BTC price = $101,600

- APR: 7.7%

- Actual interest earned: 0.15%

- Total BTC after maturity: 1.0015 BTC

b. If BTC price = $96,100

- Only the minimum APR (3.3%) is received

- Actual interest earned: 0.06%

- Total BTC after maturity: 1.0006 BTC

Ic. f BTC price is outside the Price Range

- If BTC price drops below $96,100 or rises above $101,600

- Only the minimum APR of 3% is received

d. If BTC price remains within the Price Range

- Example: The settlement price is $100,000

- APR: 6.3%

- Actual interest earned: 0.12%

- Total BTC after maturity: 1.0012 BTC

3. Advantages

When using Shark Fin, assets remain unchanged after maturity and are not converted into USDT, unlike Dual Investments, which automatically converts assets to USDT when the trade succeeds. This allows you to take advantage of a strong price rally if BTC surpasses the Upper Limit. This is Shark Fin’s biggest advantage compared to Dual Investments.

The overall interest rate is higher than Savings or Staking. There are various asset choices available for staking.

4. Disadvantages

Like most Earn products, Shark Fin does not allow early withdrawals before maturity.

It is slightly complex, as users need to fully understand the price range chart and interest rate structure of Shark Fin.

As with other Earn products, if BTC experiences unexpected volatility, the interest earned may not fully offset losses when converted to USDT.

5. Conclusion on Shark Fin

In this “How to Earn Passive Income on Bitget” article, Shark Fin is a suitable investment channel for asset allocation and earning interest, regardless of market conditions. It serves as an alternative to Dual Investments.

=> Admin believes that compared to Dual Investments and other Earn products, Shark Fin has a major advantage in its interest structure and non-conversion to USDT. Additionally, Shark Fin is best suited for investors looking for a steady passive income with relatively good interest rates. Investors who want to accumulate BTC can also consider Shark Fin.

vi. Overall Comparison

| Product | Best For | Profitability | Disadvantages | Advantages |

| Staking | Long-term investors | Medium | High asset price volatility | Generates passive income from idle assets |

| Savings | Beginners | Low | Lower returns compared to other products | Easy to join, low risk |

| Smart Trend | Stable, short-term market | Medium | If price moves out of range, profits decrease | Suitable for investing in stable markets |

| Dual Investments | Investors with a specific target price | High | Asset conversion risk | Opportunity for high returns when price target is met |

| Shark Fin | Safety-focused investors | Good | High asset price volatility; Returns may not cover losses when converted to USDT | Capital protection, maintains asset quantity in volatile markets |

vii. Conclusion and Bitget Account Registration

As analyzed in the article “How to Earn Passive Income on Bitget“, these products are best suited for long-term investors, especially those looking to accumulate large amounts of assets.

I believe that traders aiming for short-term trading and leveraging strategies should not use Earn products or choose Bitget. This type of user is better suited for platforms like MEXC.

However, if you believe in the long-term potential of investment assets like BTC, ETH, BNB, or any other cryptocurrency, you should consider combining Spot investments with Earn products. For example, if you regularly buy Spot each month, you can transfer your assets into Earn products in between purchases to generate additional interest.

To support the admin’s effort in creating high-quality, informative content, you can register a Bitget account here. If you’re interested in other exchanges, you can also find registration links under the Crypto section on the left-hand side.

Thank you for your support! We will continue to provide valuable and unbiased articles for the community. Wishing you successful investments!

If you have any question regarding the indicators set, please contact us via Telegram group: [HERE]

Wishing everyone successful trades!

📌 Interested in learning more about different crypto exchange platforms and its products? Check out our educational resources HERE

Register for the Top 5 Best Crypto Exchanges Now

[Link to register for a free Binance account]

The largest exchange currently

[Link to register for a free Bitget account]

Exchange with many financial products

[Link to register for a free Mexc account]

Exchange with the lowest costs in the world

[Link to register for a free Bybit account]

Exchange with professional financial technology

[Link to register for a free OKX account]

Exchange connected with DEX

Tiếng Việt

Tiếng Việt