Bitcoin Price Prediction 2025

| Date: 04/05/2025 | 1054 Views | Investment and Trading Academy, Investment and Trading Signal |

Bitcoin Price Prediction 2025 – What’s Next for BTC?

Today, at Tradevietstock, we’re diving into a hot topic: Bitcoin Price Prediction 2025 – What could be the next all-time high (ATH) for BTC? Whether you’re a seasoned investor or just starting out, this is a question that’s likely on your mind. In this article, I’ll guide you through a mix of fundamental analysis and my own quantitative and technical insights to help paint a clearer picture of where Bitcoin might be headed.

i. Fundamental analysis

1. Greed and Fear Index

Firstly, let’s take a look at the Bitcoin Fear and Greed Index. From the end of March to the first half of April, the index showed Bitcoin hovering around the Extreme Fear zone. Historically, whenever the market enters this territory, it often signals a mid-term bottom, presenting strong opportunities for long-term investors.

However, it’s worth noting that Bitcoin doesn’t always need to enter the Extreme Fear zone to form a bottom. More often, it only dips into the Fear zone, which is still enough to create a significant bottom and trigger a new upward move. Currently, we can expect Bitcoin to rise strongly and eventually reach the Extreme Greed zone. This is typically the stage where we look for exit points and consider taking profits.

According to the CNN Fear and Greed Index, the U.S. stock market has recently moved out of the Extreme Fear zone—similar to what we’ve seen with Bitcoin. This reinforces the view that Bitcoin and the U.S. stock market are relatively positively correlated. Just like Bitcoin or other financial markets, periods of Fear and Extreme Fear often present valuable opportunities to accumulate assets at discounted prices—setting the stage for potential gains in the next bull run.

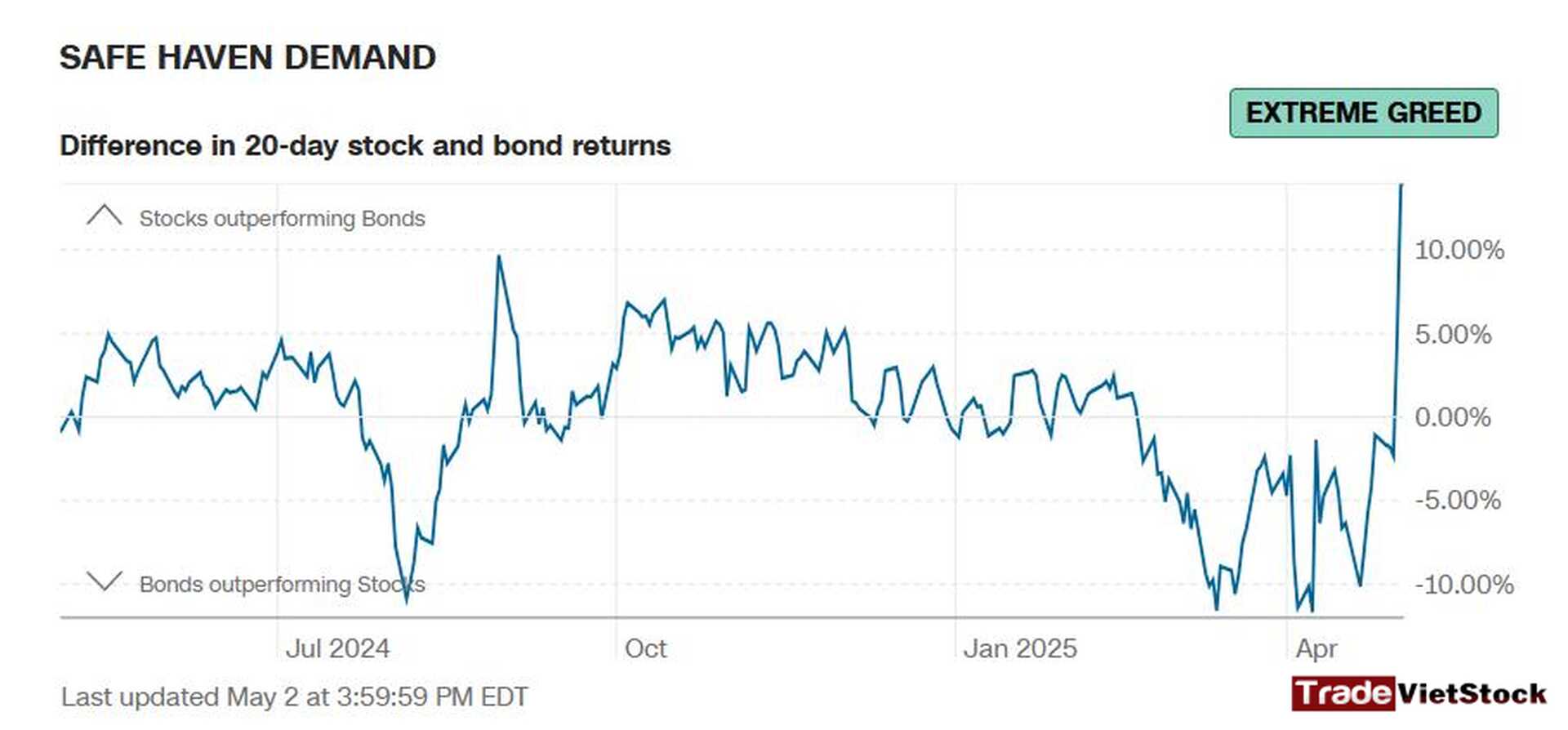

Due to the recent crash in the global stock market, driven largely by the tariff policies introduced by Trump’s administration, there has been a noticeable surge in demand for safe-haven assets. This reaction comes predominantly from the broader market participants—what we often refer to as the “crowd,” which typically represents around 90% of traders and investors. As the saying goes, only 5% consistently win in the markets, meaning the majority often moves in the wrong direction at the wrong time.

In response to the downturn, stocks have underperformed relative to bonds, leading many investors to liquidate their stock or crypto holdings in favor of bonds or cash. But as mentioned earlier, this behavior aligns with the market being in an Extreme Fear phase—historically, one of the best opportunities to accumulate undervalued assets before the next major bull run.

From August to late February, as Safe Haven Demand gradually declined—forming a pattern resembling a descending triangle—the U.S. stock market steadily climbed by approximately 7%, right up until the eventual crash. This illustrates a powerful irony in trading: the more fear there is in the market, the greater the opportunity to profit. It’s a tragic contradiction that defines much of investor behavior—while fear drives the majority to retreat, it often opens the door for the minority to capitalize on undervalued assets.

=> Bitcoin has just exited the Extreme Fear stage—a level it rarely reaches. Historically, such moments have represented some of the best opportunities to buy and hold for the long term. This rare dip into deep fear may signal one of the greatest buying chances for patient investors. The recent crash across global financial markets, including stocks and crypto, appears to be one of the biggest bluffs in recent history—a short-term panic rather than a long-term shift.

👉 You can read more about this in detail [HERE].

2. Coin Market Cap100 index

The CoinMarketCap 100 Index (CMC100) has just experienced a breakout, signaling a potential shift toward a new uptrend. Historically, each time the CMC100 has made such a decisive move, it has been followed by a significant bull run across the crypto market.

=> This breakout is more than just a technical pattern—it reflects renewed market momentum and a return of investor confidence. If history is any guide, we may be at the early stages of the next major rally.

ii. Quant and technical insights

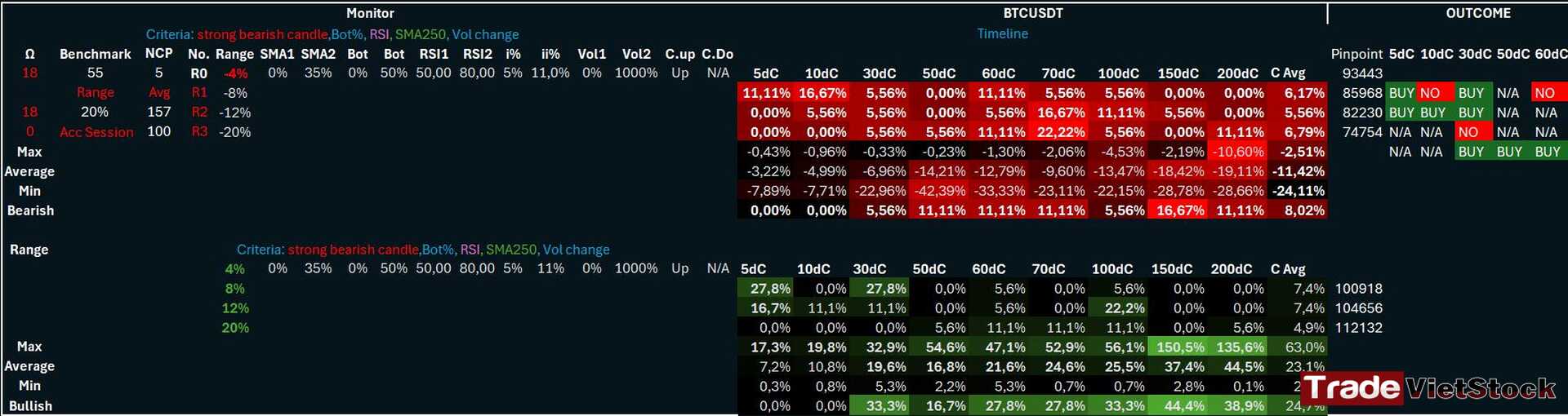

1. Statistical outcome

According to my own quantitative analysis, conducted using advanced statistical tools, the current outlook for Bitcoin is highly promising. The data consistently signals a strong BUY with minimal downside risk. Based on this analysis, we project that Bitcoin could rise to over $112,000 within the next 30 to 50 days. The statistical models show no probability of a downtrend, reinforcing the bullish case with a high degree of confidence.

=> There is very little—if any—chance of a downtrend for Bitcoin over the next 60 days. This makes it an ideal time to begin accumulating and positioning yourself for the next leg up

2. Algorithmic indicator signals

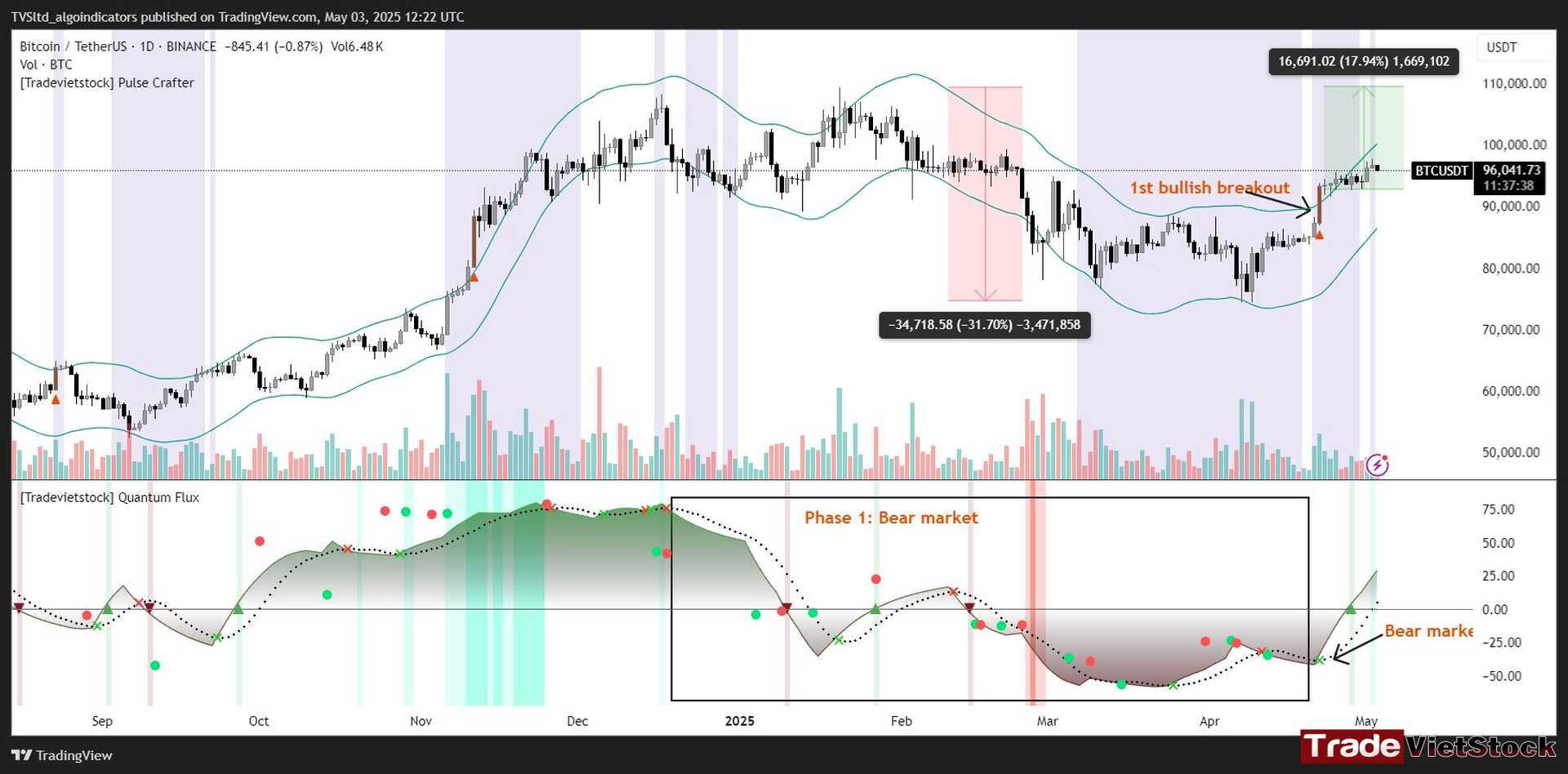

Our Bitcoin price prediction 2025 is supported by the help of exclusive algorithmic indicators, we’ve received clear buy signals pointing toward bullish momentum.

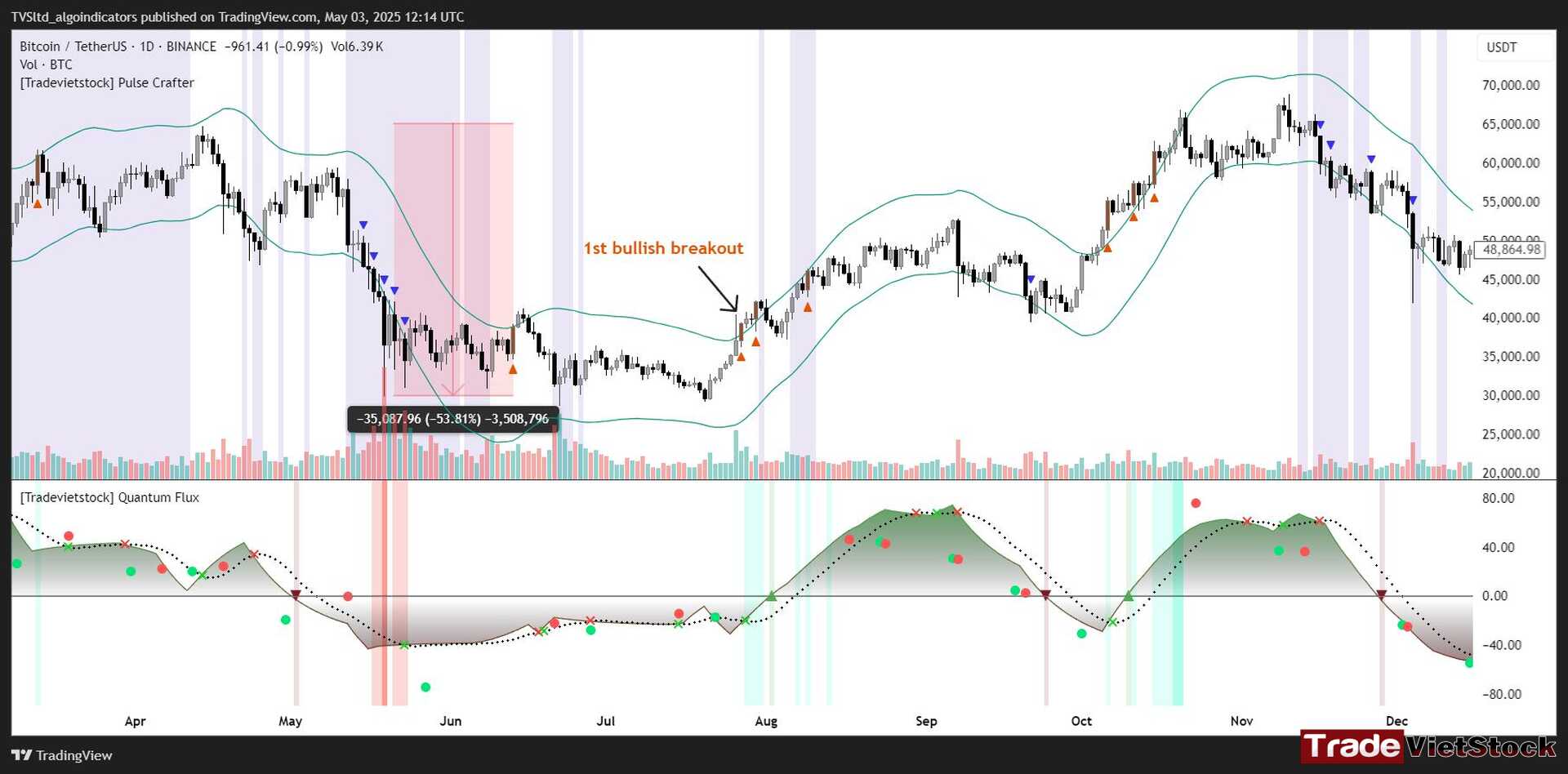

The first major sign is the appearance of a Bullish Breakout, marked by an orange candlestick and upward arrow. This breakout indicates a strong price movement breaking out of a previous sideways or bearish structure, and it often serves as a reliable confirmation of a trend reversal. In our experience, a Bullish Breakout is one of the most dependable indicators of an emerging uptrend—a key signal for initiating long positions.

Looking back at 2021, Bitcoin experienced a significant correction, dropping by approximately 53%—a clear downtrend. However, it’s important to examine this scenario more deeply and contextually. Initially, the decline was gradual and extended, not sudden.

The market appeared to be bleeding slowly rather than collapsing. But as the bear market approached its final stage, the selling pressure intensified dramatically—Bitcoin started falling 5–8% in a single day, and this pattern repeated for over a week. It was, without a doubt, a brutal and chaotic phase, marked by Extreme Fear across the market. And yet—ironically—this period of panic and despair proved to be one of the best buying opportunities in recent memory. Historically, when sentiment hits rock bottom, smart investors begin to accumulate quietly, setting the stage for the next bull cycle.

After the insanity of the bear market, Bitcoin gave off multiple Bullish Breakout signals before its massive surge. It jumped from around $25,000 to nearly $70,000 in a short time. Does that sound familiar? This scenario looks strikingly similar to what we’re seeing today. What’s your Bitcoin price prediction 2025?

Another factor to consider now: Has Bitcoin truly escaped Phase 1 – the Bear Market? I believe it has. Alongside the first Bullish Breakout, BTC had a ~31% correction—not too aggressive—but more importantly, we saw multiple BUY signals from the Quantum Flux Indicator (Market Cycle Detector). These signals strongly suggest the bear market is over.

Take a look at a similar pattern in 2020—Bitcoin dropped by 53%, then flashed multiple Bullish Breakouts and BUY signals from the Quantum Flux Indicator. After those signals, BTC quickly climbed about 30%—right before another major discount took place.

=> With current patterns in play, Bitcoin has broken out of the bear market—no debate. Our target? $112,000. This rally won’t wait for anyone. Crypto bull runs are brutal, fast, and unforgiving—blink and it’s gone. Right now, we see zero real chance of a downtrend. It’s go time.

iii. Conclusion and Trading Account Registration

All signs point to one thing: Bitcoin is back. The breakout is real, the fear has faded, and the momentum is building.

With historical patterns aligning, algorithmic signals firing, and market psychology in our favor, we’re staring at a rare moment—a perfect storm for the next big move.

- Our Bitcoin Price Prediction 2025? The recent target is around $112,000.

- Our timeline? 30–50 days.

- Our margin for hesitation? Zero.

Crypto doesn’t wait. You’re either in, or you’re late.

We have our fan page on Facebook for Forex CFDs trading signals and analysis for every week, you can check this out: [HERE]

Furthermore, if you want real-time signals everyday, you can check out our small Investment and Trading community on Telegram: [HERE]

Don’t forget to follow this Investment and Trading Signal for free investment analysis and trading crypto and forex CFDs signals.

📌 Interested in learning more about different account types or crypto trading knowledge? Check out our educational resources HERE

📌 Want to see detailed reviews of the top 5 best crypto exchanges? Read the full review HERE

I know trading isn’t an easy game, especially for those who take it seriously. That’s why I believe you should practice consistently before finding the trading strategies that suit you best. You can start risk-free by opening a demo FX account to get familiar with the market.

Below are registration links for two of the best brokers:

- XTB Online Trading — the top broker for traders in the EU

- Exness — the best choice for traders in Asia

You can also experience world-class services and trusted reputations from some of the top 5 crypto exchanges:

- Binance — The largest crypto exchange on Earth

- Bybit — A well-established name known for its long-standing reputation and diverse financial instruments

- Bitget — User-friendly interface combined with a strong reputation

- MEXC — The lowest trading fees with one of the most beginner-friendly interfaces

- OKX — A major name known for secure asset storage and powerful DEX tools

Tiếng Việt

Tiếng Việt