Avoid stop hunt in trading

| Date: 17/05/2025 | 1831 Views | Investment and Trading Academy |

How to avoid stop hunt in trading and identify the perfect entry

Today, at Tradevietstock, we’re diving deeper into the theory of day trading, liquidity, and the conspiracy of stop hunts—specifically, whether market makers target your stop loss. Later, we’ll explore how to avoid stop hunt in trading, find your best entry points, and determine where to place your stop loss to ensure a high risk-to-reward ratio and minimize the chances of being stopped out prematurely.

i. Essential insights

1. Liquidity Theory

Liquidity Theory is based on the principle that market makers require liquidity to move prices efficiently. In financial markets, liquidity refers to the availability of orders that can be executed quickly without causing large price fluctuations. To create meaningful price movements without committing excessive capital, market makers rely on sufficient liquidity—especially large volumes of buy or sell orders.

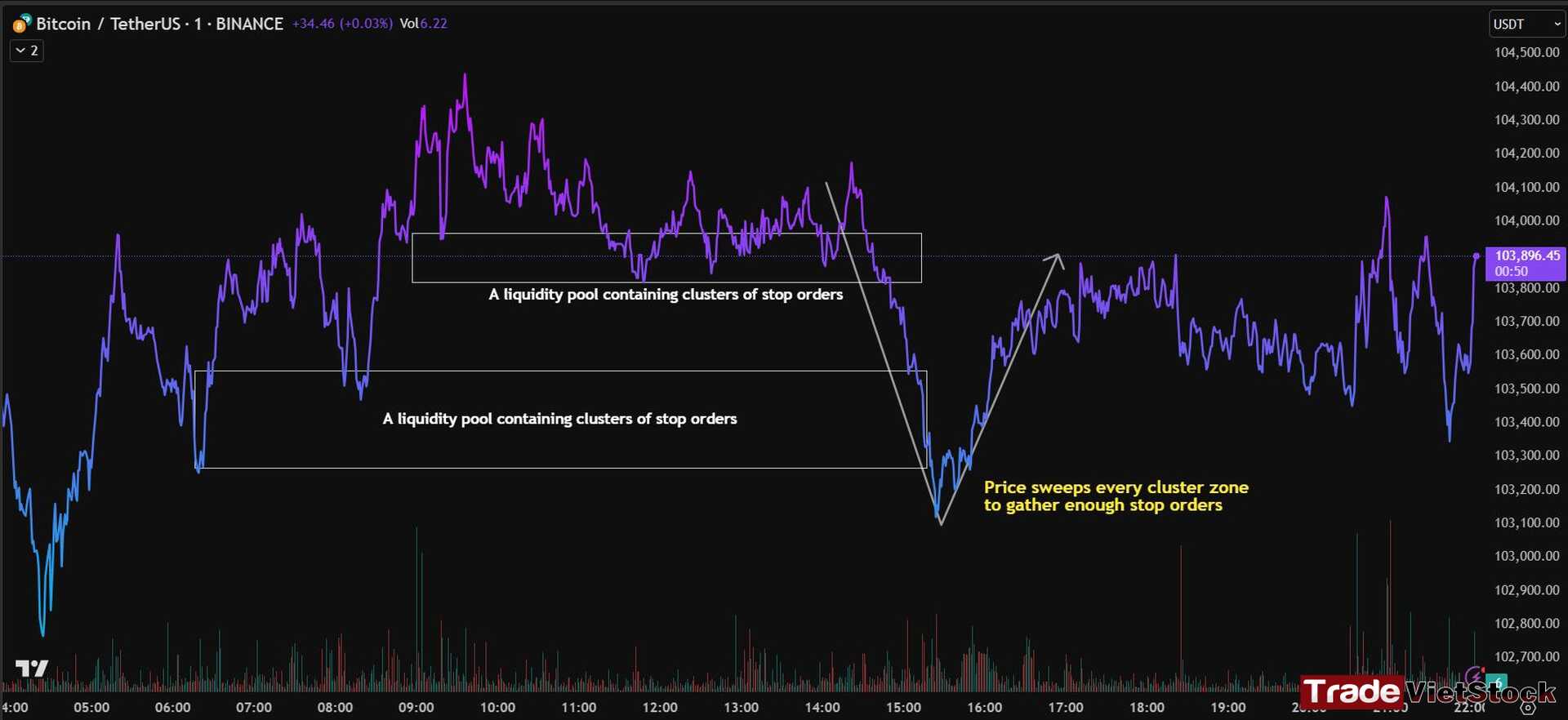

Retail traders often cluster their Stop Loss (SL) orders around obvious support or resistance levels. These clustered stops create what is known as a liquidity pool—a concentration of pending orders waiting to be executed. When market makers want to push prices higher, they need to tap into this liquidity pool on the selling side. Triggering these stop losses converts sell orders into buy market orders, since a stop loss on a sell position acts as a buy stop order when activated. By driving the price toward these stop levels, market makers cause many buy stop orders to trigger simultaneously, generating a surge in buying pressure.

This surge in buying provides the liquidity market makers need to continue pushing prices upward efficiently. At the same time, it attracts more sellers (supply), creating a natural balance that allows the price to rise without the market maker having to take on excessive risk or expend excessive resources.

For example, when the price intends to move upward, it must first locate a significant amount of buy-side liquidity to sustain a long-term rally. To achieve this, the market often dips first, sweeping through pools of clustered stop orders—primarily buy stops placed above recent highs.

However, it may also trigger sell stop orders below recent lows from long positions. When these sell stops are hit, they activate new market sell orders, which are absorbed by larger buy limit orders, effectively generating fresh buying interest. This process fills demand and creates the necessary conditions and incentive for a strong upward move.

Another important concept to understand is that price typically seeks liquidity before making a significant move. This means that market makers need to accumulate sufficient resources—primarily liquidity—which consists of both buy and sell stop orders.

During the Asian and London sessions, it’s common to see price sweeping through clustered zones of stop orders. This behavior helps gather enough liquidity to fuel a major move, which often occurs during the New York session. These initial sweeps act as a form of “resource gathering,” clearing out retail positions and building momentum for the next directional move.

However, this sequence isn’t fixed. The roles of the sessions can shift—it’s not always the Asian and London sessions that act as the stop hunt phases, nor is it guaranteed that the New York session delivers the final move.

Still, when we approach the New York session—or get closer to what might be the “true move” of the day—price can begin to shift rapidly. It often sweeps multiple pools of clustered stop orders in an aggressive fashion.

This kind of sharp movement is typically a signal that a decisive moment is approaching. At that point, market makers have likely gathered the liquidity they need to drive the price in their intended direction.

2. Do Market Makers Target Your Stop Loss?

No. Market makers don’t specifically target retail traders’ stop losses. Their goal is to move prices efficiently by accessing liquidity wherever it exists. Since retail traders make up a small portion of overall liquidity, only ~5%, it makes little sense for market makers to expend resources targeting them intentionally. Instead, the activation of retail stops happens incidentally as market makers push prices through liquidity pools to fulfill their larger institutional goals.

3. Why Do You Get Stopped Out?

You get stopped out because your Stop Loss is placed at common levels where many other traders also place theirs. These clusters form liquidity pools that attract market makers looking to gather enough orders to move the price. When price reaches these areas, it triggers a wave of stop orders, resulting in a quick price movement that hits your stop loss. This isn’t personal or targeted—it’s simply a natural effect of how liquidity is structured in the market.

If you want to avoid stop hunt in trading, you should avoid placing your entries and stop loss positions around these common zones.

ii. Tutorial: How to avoid stop hunt in trading

1. Patience is the key

Many traders lose money not because they pick the wrong direction, but because they enter too early or in the wrong session. The market often moves sideways in the Asian session, where there’s low liquidity and no real trend. This is when price tends to hunt stops and fake breakouts are common. Professional traders avoid this by being selective — they wait for the market to show clear intent, usually during the London–New York overlap when volume picks up. They don’t trade just to stay active.

Waiting for the right setup and timing reduces the chances of being stop-hunted and helps you stay emotionally stable. If there’s no clear setup, it’s better to do nothing than to force a trade and lose.

In short, you should wait until the market has gathered enough liquidity — meaning that all the clustered zones have been swept. This creates new opportunities for fresh order flow to enter and push the price further.

2. Detect a perfect entry

To avoid stop hunt in trading, you’ll need an optimal entry. A perfect entry occurs after all clustered orders have been swept and the market begins to form new reversal signals. Several key conditions should be met, including:

- The price moves aggressively, creating large gaps that trigger FOMO (fear of missing out), compelling traders to want to enter the market immediately with a market order.

- The price moves aggressively in one direction, pushing the Volatility Range significantly. In some cases, the price even moves outside the Volatility Range, indicating an unusually rapid move and signaling a potential trap for traders who chase the move.

- Sell signals appear (though these require further confirmation, which will be discussed below). These signals can indicate the start of a reversal and present a potential entry opportunity.

As shown in the image above, the price rises so drastically that it extends the Volatility Range in one direction without any bounce back. This is often a trap designed to lure traders into chasing market orders. However, it’s a trap of emotions, not intention—the market isn’t deliberately trying to trick retail traders; rather, they get caught because this is simply how the market operates.

When price moves sharply in one direction without retracing, it’s usually to attract more order flow or to fill all the orders within that range. This serves a crucial purpose: gathering enough liquidity for the next significant move. So, don’t get caught up in the aggression—stay patient and wait for the right opportunity to act.

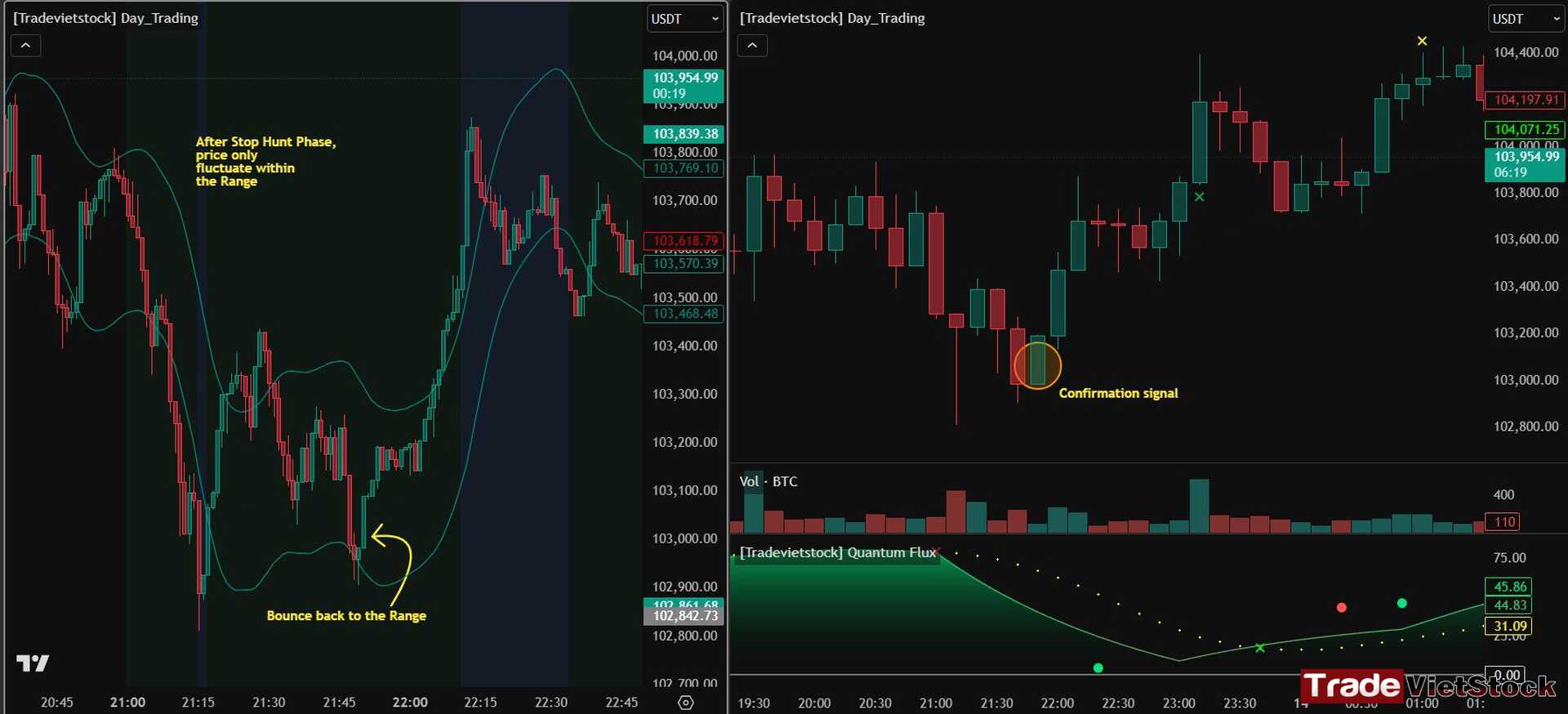

The perfect entry is always a new formation that hasn’t appeared on the chart before. After the price moves drastically, as in the scenario described above, we look for Sell Signals from Tradevietstock’s algorithm indicator (represented by the yellow cross “X” in the image below). Confirmation comes from a higher timeframe.

For example, the image above shows two Sell Signals. On the higher timeframe, the first Sell Signal lacks confirmation from a bearish candlestick pattern. However, the second Sell Signal is confirmed by a bearish candlestick formation—a long upper wick. This provides an ideal entry point for a Short Sell position.

Wait for the price to move aggressively first, sweeping the liquidity pool and gathering the necessary liquidity. When trading signals appear, check the higher timeframes for candlestick confirmation. That’s when you’ll find your best entry point.

3. Optimal stop-loss placement

How to avoid stop hunt in trading? The key is placing your stop loss perfectly. After identifying your entry, place your stop loss just below the Volatility Range. If your stop loss gets hit, it means the price has sharply changed direction—giving you a chance to reverse your position. However, this scenario is quite rare.

As shown in the image above, the price suddenly moves out of the range, indicating a stop hunt and liquidity sweep. Waiting for this stage to pass is one of the best ways to avoid being caught in stop hunts while trading. During this phase, the price shifts unexpectedly, sweeps both sides, and repeatedly moves outside the range. So, how can you trade in this condition?

Once this stage passes, the price will gradually re-enter the Volatility Range and form a strong bullish candlestick. This is your entry signal, with your stop loss placed just below the Band.

For example, the image below shows the price passing through the Stop Hunt phase after several rapid shifts that break the Volatility Range. Following this, the price moves steadily along the Band in one direction, mainly to sweep the last liquidity pool created during the recent Stop Hunt phase. Finally, the price forms a strong candlestick as it re-enters the Range. This candlestick acts as a confirmation for your entry, with your stop loss placed just below the Band.

Another example below shows that after the Stop Hunt phase passes, the price slowly re-enters the Range and eventually forms a strong bullish candlestick. This candlestick signals your entry point, with the stop loss placed just below the Range.

Place your stop loss just around the Volatility Range—at the lower or upper Band.

4. Effective risk calculation

Trading is fundamentally about math—calculating probabilities and managing risk. You need to know how much you stand to gain if you win and how much you’re willing to risk if you lose. Without proper risk management, a single bad trade can wipe out your entire account. That’s why managing risk and sticking to a well-defined trading strategy is essential.

Every strategy has a win rate and a risk-reward ratio, and success depends on following these rules strictly. For example, a 40% win rate can still be profitable if your risk-reward ratio is about 4:1—risking $100 to make $400. Losing streaks are inevitable, but by risking only a small percentage of your capital per trade (like 0.2–2%), you ensure you survive through rough patches and give the math time to work in your favor. Deviating from the strategy or risking too much leads to blown accounts and missed opportunities.

For more insights on risk management and the math behind trading, visit this blog for detailed information: HERE.

5. Real life examples of how to avoid stop hunt in trading

The image below shows the price just passing the stop hunt phase after several rapid shifts, breaking the Volatility Range. Following this phase, the price moves more slowly within the Range and forms a combination of candlestick confirmation signals for a Long position in a higher timeframe.

Next, for the entry position, the price moves within the Range after the stop hunt phase. Confirmation comes from a strong candlestick and a long bottom wick candlestick on a higher timeframe.

To avoid stop hunts in trading, it’s best to avoid trading during the stop hunt phase itself, as shown in the example below. Only enter trades once the stop hunt phase has passed and the price moves more slowly, re-entering the Range. This indicates the market has finished gathering liquidity.

iii. Conclusion

Avoiding stop hunt in trading and finding the perfect entry boils down to patience, discipline, and a solid understanding of market liquidity. Market makers don’t target your stop loss personally—they simply seek liquidity to fuel their moves. By waiting for the stop hunt phase to pass, confirming entries with higher timeframe signals, and placing your stop loss just outside the Volatility Range, you minimize the risk of being prematurely stopped out.

Effective risk management and sticking strictly to your trading strategy are essential to surviving losing streaks and achieving consistent profitability. Remember, trading is math and probability—manage your risk carefully, respect the process, and let the market come to you.

| Stage | Description | What to Do |

| 1. Stop Hunt Phase | Price moves sharply, sweeping clustered stop orders and breaking the Volatility Range. | Avoid trading during this unpredictable phase. |

| 2. Liquidity Gathering Complete | Price slows down and re-enters the Volatility Range or consolidates after the stop hunt. | Prepare to watch for entry signals. |

| 3. Confirmation Signals Form | Formation of strong candlesticks, long wicks, or indicator signals confirming market direction. | Look for these signals on higher timeframes before entry. |

| 4. Entry & Stop Loss Placement | Enter trade after confirmation; place stop loss just outside the Volatility Range (upper/lower Band). | Enter confidently with proper stop loss placement. |

| 5. Risk Management | Calculate risk per trade (0.2%-2%) and maintain a healthy risk-reward ratio. | Manage position size and risk to survive losing streaks. |

In trading, patience is profit, discipline is defense, and math is your only true edge.

📌 Interested in learning more about different account types or crypto trading knowledge? Check out our educational resources HERE

📌 Want to see detailed reviews of the top 5 best crypto exchanges? Read the full review HERE

I know trading isn’t an easy game, especially for those who take it seriously. That’s why I believe you should practice consistently before finding the trading strategies that suit you best. You can start risk-free by opening a demo FX account to get familiar with the market.

Below are registration links for two of the best brokers:

- XTB Online Trading — the top broker for traders in the EU

- Exness — the best choice for traders in Asia

You can also experience world-class services and trusted reputations from some of the top 5 crypto exchanges:

- Binance — The largest crypto exchange on Earth

- Bybit — A well-established name known for its long-standing reputation and diverse financial instruments

- Bitget — User-friendly interface combined with a strong reputation

- MEXC — The lowest trading fees with one of the most beginner-friendly interfaces

- OKX — A major name known for secure asset storage and powerful DEX tools

Tiếng Việt

Tiếng Việt