XTB Broker Review

| Date: 17/08/2025 | 175 Views | Trading Account Registration |

XTB Broker Review – One of the top tier Brokers in the Trading World

Greetings, traders! Welcome to our comprehensive XTB Broker Review at Tradevietstock. Today, we’re diving deep into XTB, a leading name in Forex and CFD trading. While not as prominent in Asia, this XTB Broker Review highlights why it’s gained a strong reputation globally, especially in Europe, for its professional-grade platform and diverse offerings. Let’s explore what makes XTB one of the top choices in your trading journey.

XTB Online Trading Registration

i. Background and Trustworthiness – A Titan in Trading

Firstly, we start with its origins. Founded in 2002 in Poland, XTB has become a leading tier-1 liquidity provider. A key highlight of this XTB Broker Review is its listing on the Warsaw Stock Exchange (ticker: XTB) since 2016, showcasing its transparency. XTB operates under strict regulations from authorities like:

- Financial Conduct Authority (FCA, UK)

- Cyprus Securities and Exchange Commission (CySEC)

- Polish Financial Supervision Authority (KNF)

- Federal Financial Supervisory Authority (BaFin, Germany)

Please note that XTB owns a direct liquidity model, which ensures fast order execution without third-party delays, reducing requotes. With over 1 million users worldwide, XTB ranks among the top five Forex brokers and its public listing bolsters its credibility.

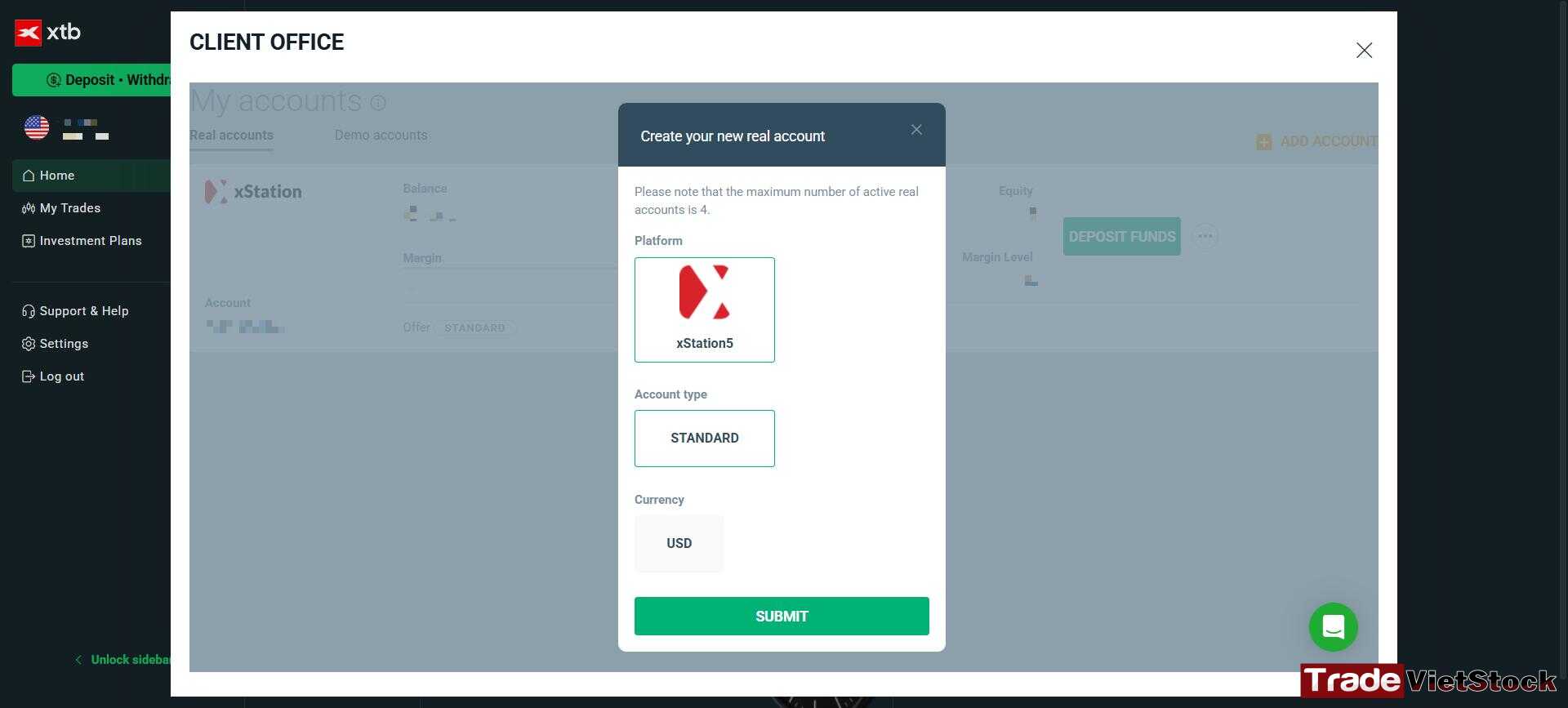

ii. Account Options – Streamlined for All Traders

XTB has a simple account structure. It offers a single Standard Account, ideal for both beginners and experienced traders. Key features include:

- Minimum Deposit: $1

- Maximum Leverage: Up to 1:500

- Spreads: Floating, starting from 0.35 pips

- Commissions: Zero on most instruments

As noted, the account provides access to advanced tools and a vast product range, perfect for swing traders. However, spreads may widen during volatile news events, so XTB suits strategic traders, a point we’ll revisit in this XTB Broker Review.

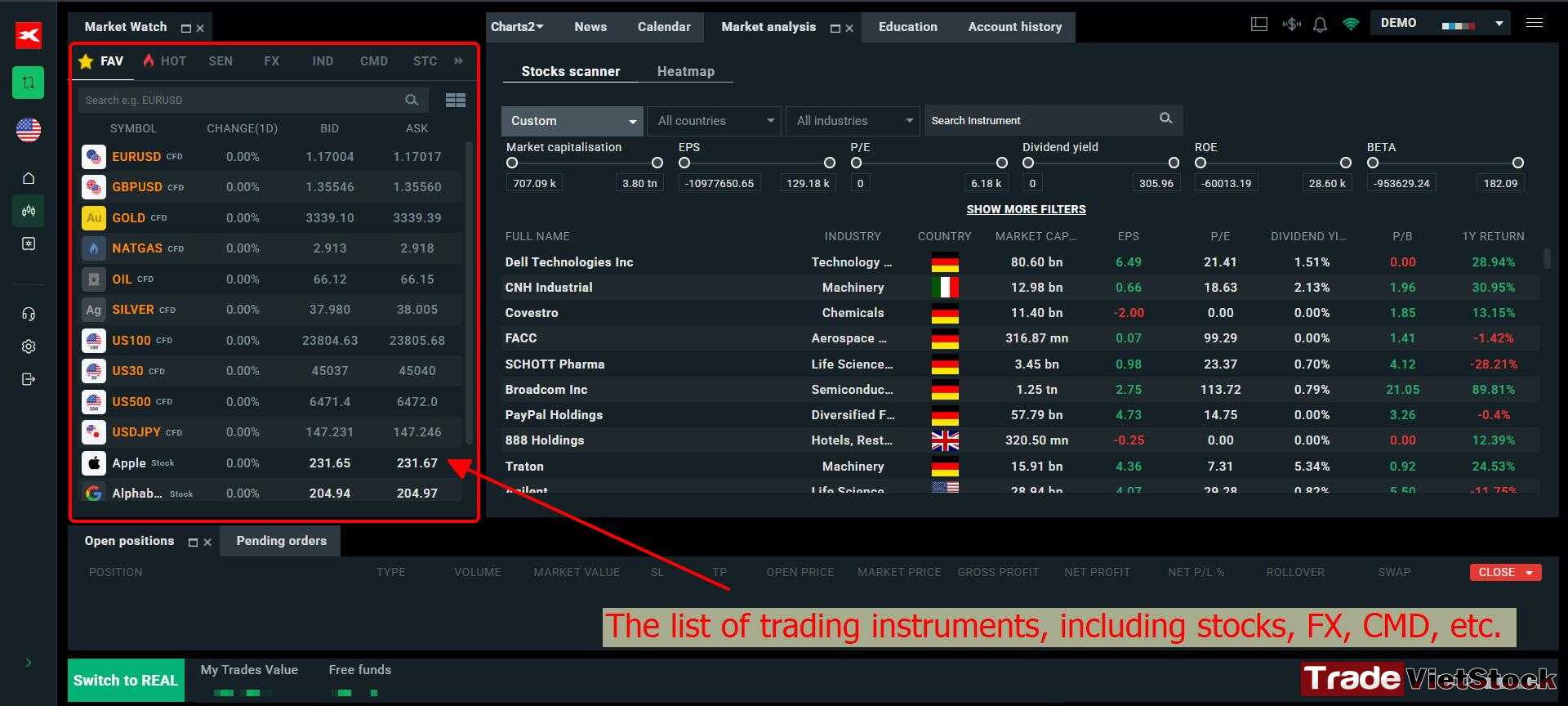

iii. Product Range – A Diverse Trading Universe

A standout in this XTB Broker Review is XTB’s extensive portfolio, offering over 6,100 instruments across multiple asset classes:

- Forex: 71 currency pairs

- Stock Indices: 33 indices, including swap-free options

- Stocks: 3,082 stocks from markets like the US, UK, Germany, and Poland

- Stock CFDs: 1,988 CFDs from North American and European exchanges

- ETF CFDs: 178 funds, including the S&P 500

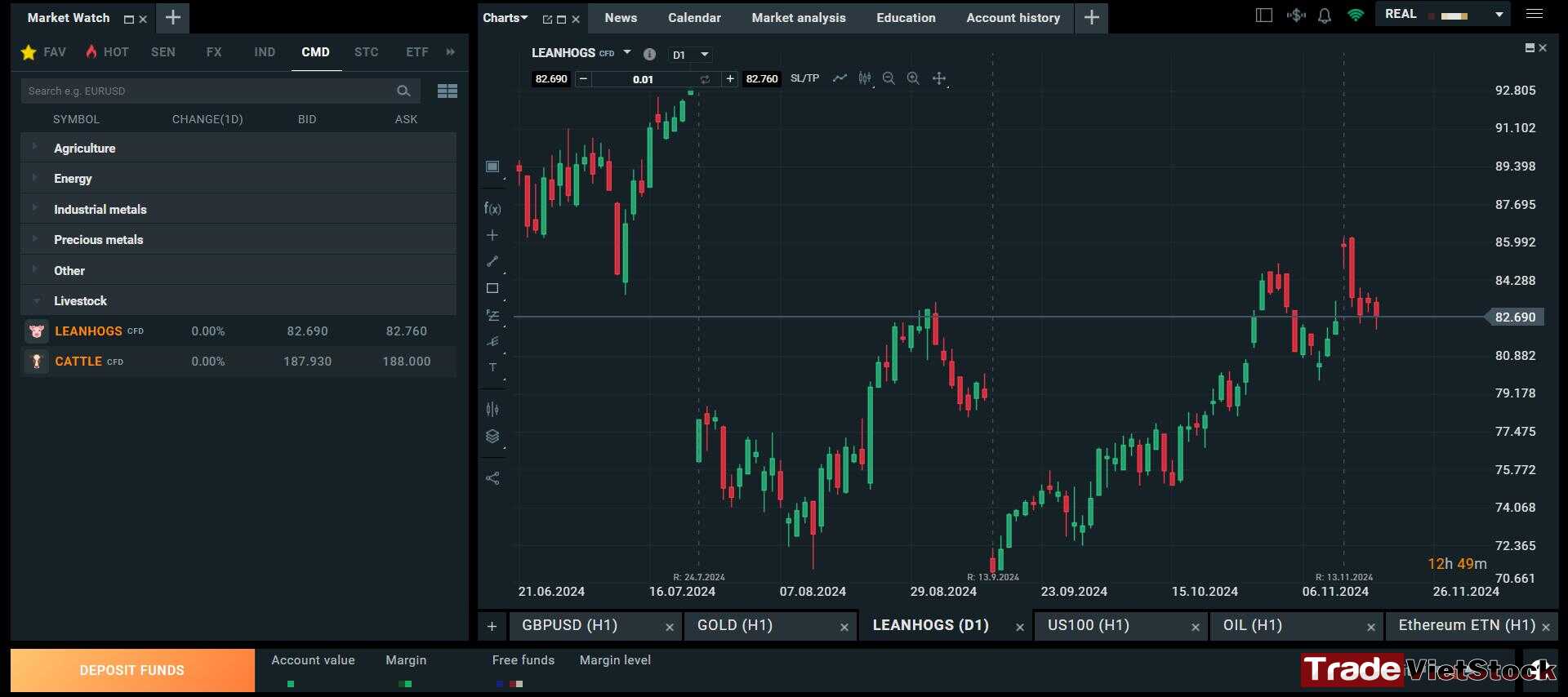

- Commodities: 28 options, including gold, oil, coffee, and agricultural products

- ETFs: 783 codes

After the recent XTB Broker Review, I praise its variety, surpassing brokers like Exness by including niche markets like livestock. Macro-focused traders will find XTB’s range ideal.

Note: Crypto trading (e.g., BTC/USD) is restricted in some Asian markets like Vietnam, but Bitcoin-trading ETFs are available. Outside these regions, XTB supports crypto trading, comparable to Binance or Bybit.

iv. Trading Costs and Conditions – Competitive and Transparent

Let’s examine XTB’s cost structure:

- Spreads: Starting at 0.35 pips for Forex, though they may fluctuate during volatility

- Commissions: None on most products

- Leverage: Up to 1:500 for Forex, 1:5 for crypto

- Swap-Free Trading: Available for gold and select indices

The swap-free gold trading is a highlight in this XTB Broker Review, saving costs for overnight positions. Traders should monitor spreads during news events to manage costs effectively.

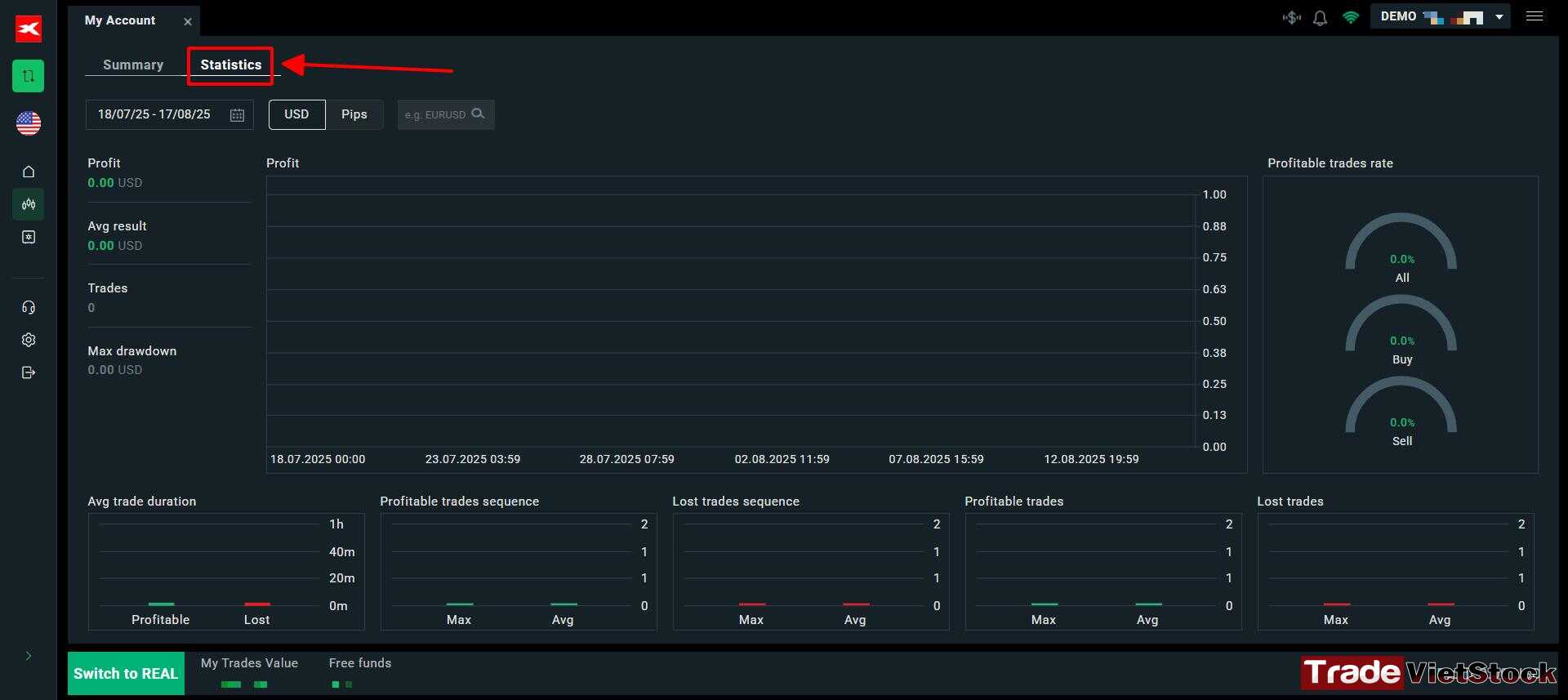

v. Clarity and Account Management Features – Insightful and User-Friendly

A key aspect that I like most about XTB is the platform’s clarity and robust account management tools, particularly its Statistics Section. The xStation platform offers a dedicated analytics hub that provides traders with clear, actionable insights into their performance. Key features include:

- Performance Metrics: Detailed breakdowns of trading history, including profit/loss, win rate, and average trade duration.

- Portfolio Overview: Real-time tracking of open positions, margin usage, and account balance.

- Risk Management Tools: Visualizations of risk exposure and leverage usage to help traders make informed decisions.

- Customizable Reports: Filterable data by asset class, time period, or trade type, presented in clear charts and tables.

This XTB Broker Review highlights how these tools empower traders to refine strategies with transparent data. The intuitive interface, available in Vietnamese, ensures accessibility for all users, making account management seamless and effective.

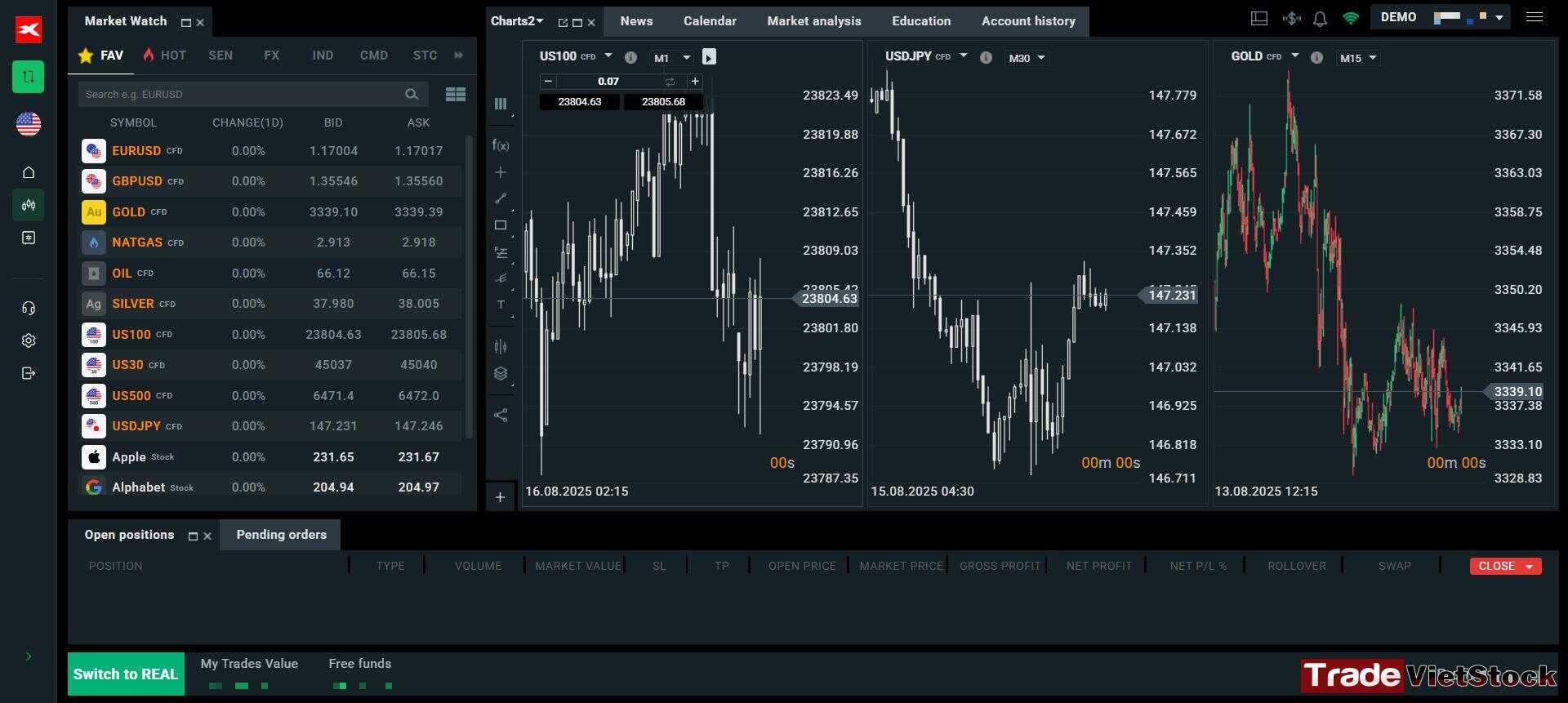

vi. Trading Platform – xStation, a Game-Changer

Like brokers using MT4 or MT5, XTB’s proprietary xStation platform is competitive among all. Its features include:

- Web-Based Trading: User-friendly with Vietnamese support, integrated news, calendars, and analysis tools.

- Efficient Order Execution: Seamless across asset classes.

- Accessibility: No network restrictions, ensuring smooth access.

I find xStation superior to Exness’s web platform and competitors like Mitrade. However, traders needing custom indicators or bots may prefer Exness’s MT4/MT5 support.

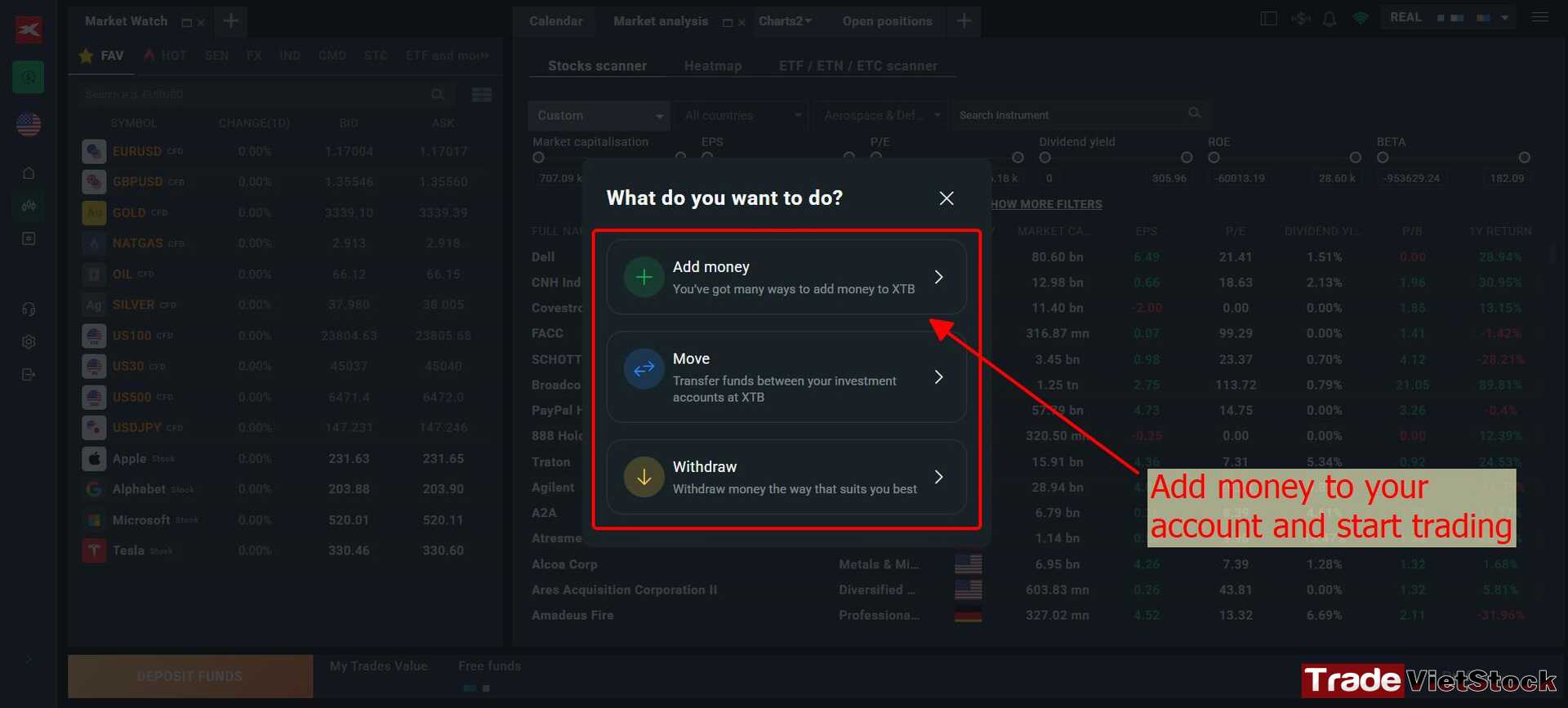

vii. Deposits and Withdrawals – Quick and Convenient

XTB supports various deposit and withdrawal methods, with QR code transfers being a fee-free, fast option. Please note that transactions are processed within 24 hours, even on weekends, making fund management seamless. Visit XTB’s website for funding details.

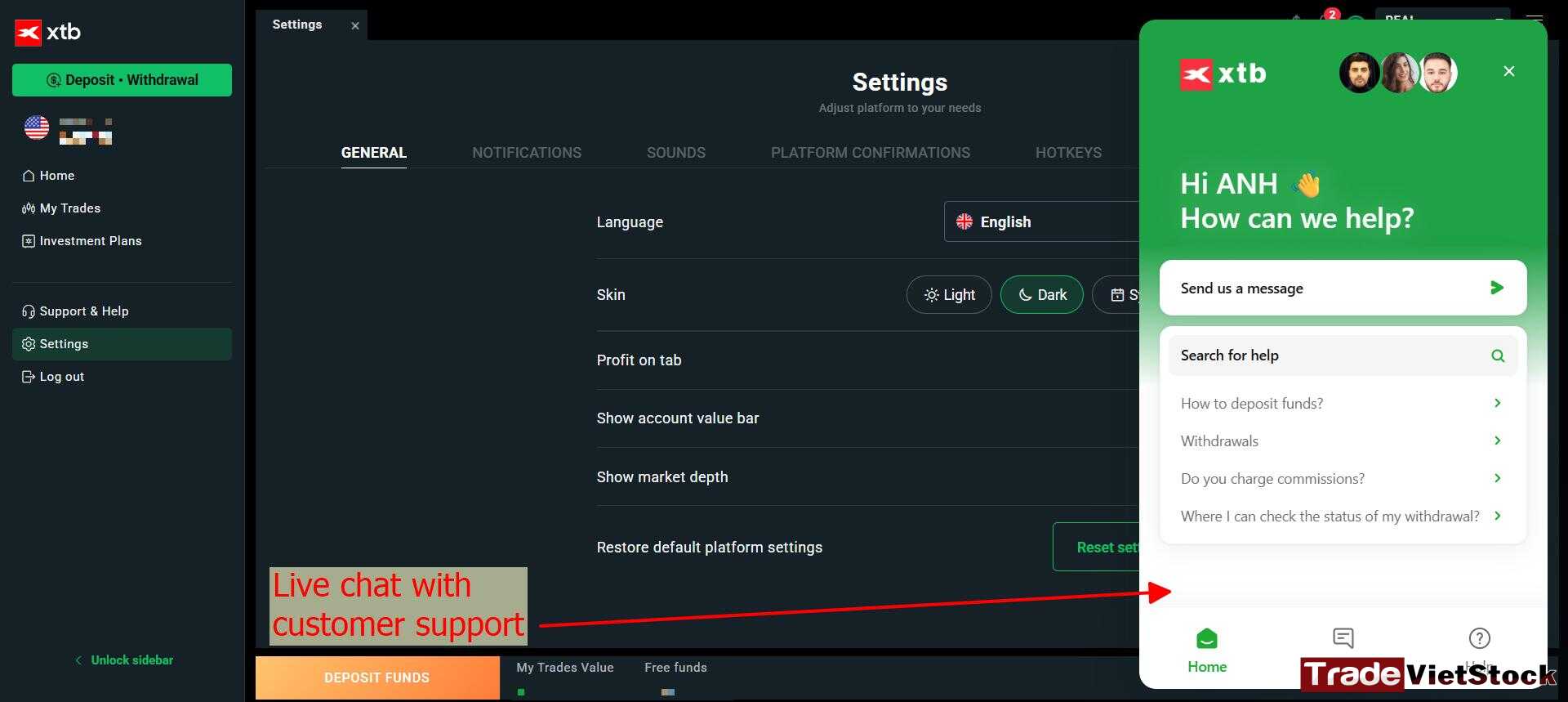

viii. Live Chat with Customer Support – Timely and Human-Powered

A standout feature in this XTB Broker Review is XTB’s live chat customer support, which sets it apart from many brokers relying on automated bots. XTB offers real-time, human-driven support that ensures prompt and personalized assistance. Key highlights include:

- 24/5 Availability: Accessible during market hours, ensuring help is available when you need it.

- Human Interaction: Unlike competitors using generic bot responses, XTB’s support team consists of knowledgeable staff who address queries with clarity and expertise.

- Multilingual Support: Available in multiple languages, including Vietnamese, for seamless communication.

- Quick Response Times: Queries are typically answered within minutes, making it ideal for urgent issues like account setup, trading glitches, or withdrawal concerns.

XTB’s live chat is a game-changer for traders who value responsive, human interaction over automated systems, ensuring a smoother trading experience.

ix. Final Thoughts and How to Get Started

After this XTB broker review, I believe that XTB is most suitable for 2 types of traders:

- Experienced Traders: As you can see XTB as perfect for seasoned traders seeking a robust platform with diverse products, unlike Exness’s simpler offerings.

- Macro-Focused Investors: Those tracking global trends, like commodity prices or policy changes, will thrive with XTB’s range, such as trading agricultural commodities.

XTB may not suit beginners due to its complexity. Exness is better for those starting out.

This XTB Broker Review concludes that XTB isn’t the cheapest but excels as a professional, reliable platform with a vast product range and innovative xStation. Having switched from Exness to XTB, I find it ideal for advanced traders. Beginners may prefer Exness’s simplicity.

Ready to try XTB? Sign up for a free Forex CFD account by clicking the link below. Stay tuned for more broker reviews.

XTB Online Trading — the top Forex broker for traders in the EU

Tiếng Việt

Tiếng Việt