Are Forex Brokers scammers

| Date: 08/08/2025 | 218 Views | Investment and Trading Academy |

Are Forex Brokers Scammers – Hidden Realities Nobody Talks About

Let’s take a closer look at how FX/CFD brokers actually operate to answer the question: Are Forex brokers scammers, as the rumors claim? Why is this form of investing both risky and yet full of potential for traders who want to seize every opportunity in the world’s market fluctuations? Join Tradevietstock as we uncover the answers.

i. Overview of Retail Brokers

People often ask each other: “Are Forex brokers scammers?”

The truth is this: Forex itself isn’t a scam — but the way many retail brokers operate is not much different from a casino disguised as a financial exchange.

You have to understand: Forex is an OTC (over-the-counter) market, meaning there’s no central exchange like the NYSE for stocks or the CME for commodities. Prices are set through direct agreements between major banks, based on liquidity and real-time market demand, updated every second. Names like JPMorgan, Citi, Deutsche Bank, Barclays, HSBC — these are the players that truly move global exchange rates.

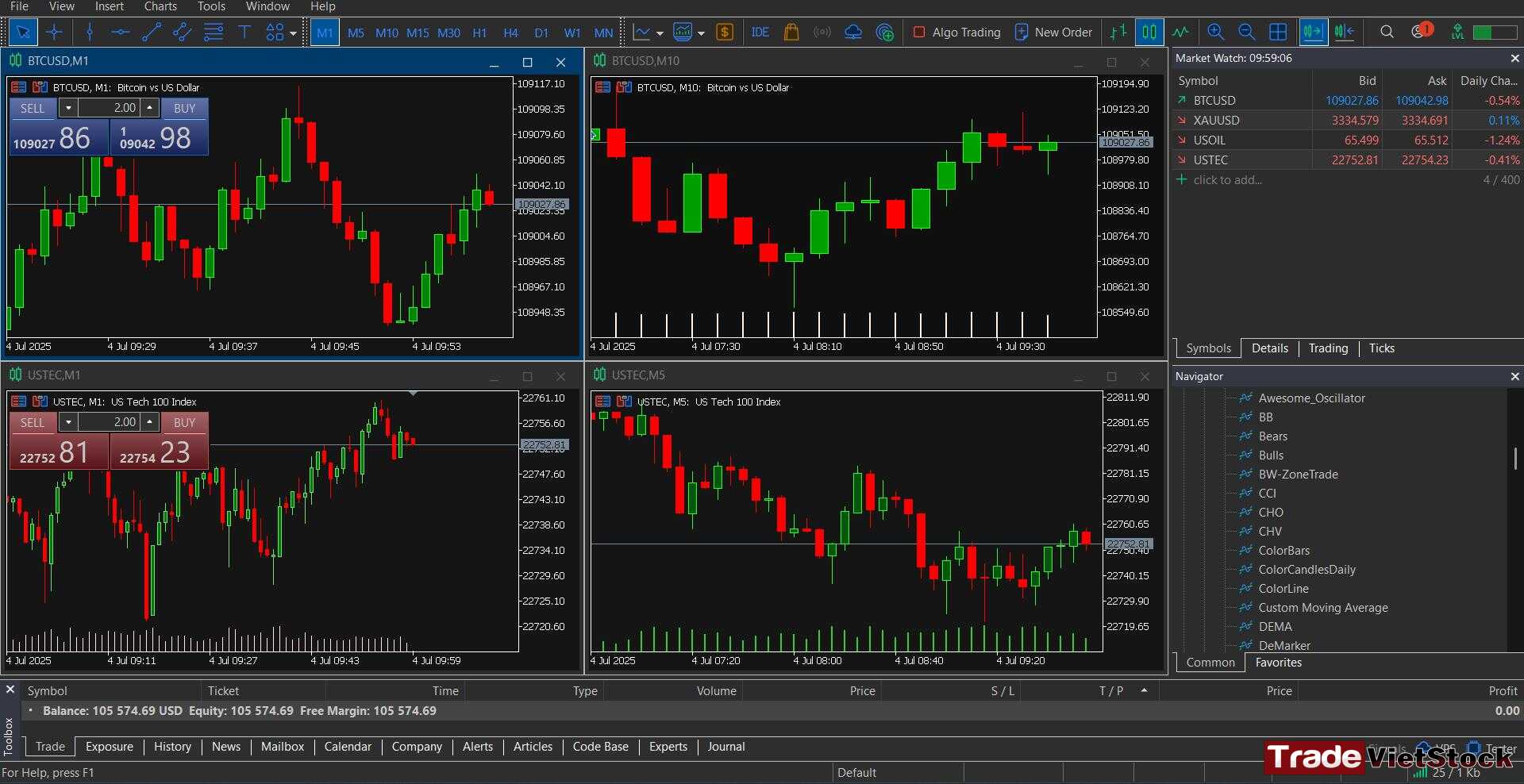

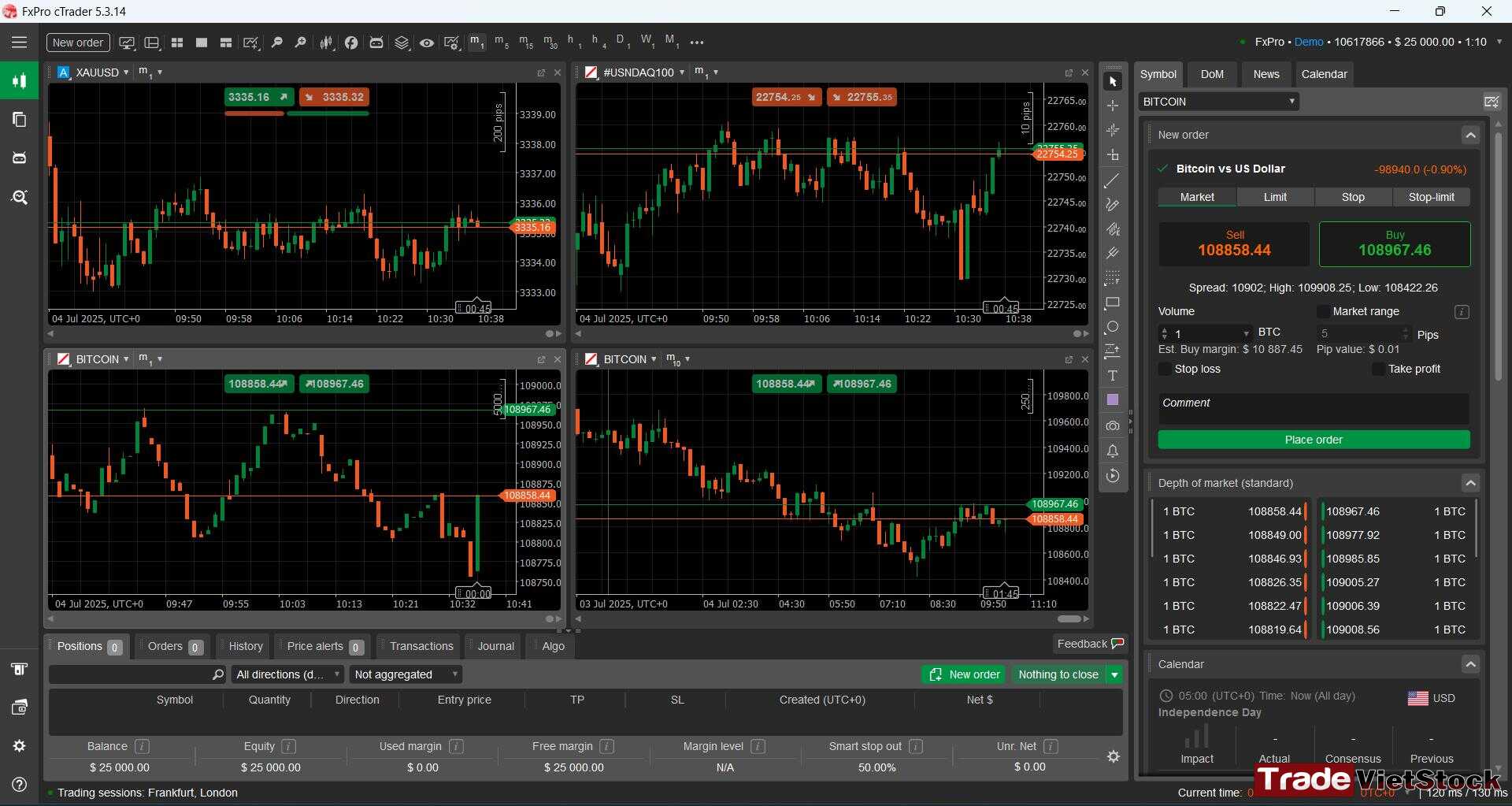

And the prices you see on your broker’s platform — MT4, MT5, or otherwise? They’re just simulations generated by retail brokers for their clients, not the actual interbank market feed.

1. How Do Retail Brokers Really Operate?

Few people realize that 99% of retail Forex brokers you trade with are essentially “the house”.

When you place a Buy order, they’re the ones Selling to you. When you Sell, they’re the ones Buying from you. If you lose, they win. If you win, they lose. And like any casino in the world, if you win too much, you’re quietly added to their blacklist.

Behind the scenes, every account is classified into groups. New traders, reckless gamblers, or those trading randomly get their orders “held” in-house — the B-Book model. On the other hand, skilled players — those doing arbitrage, scalping, or making consistent profits — get pushed to the A-Book, meaning the broker offloads your trades to a Liquidity Provider (LP) or a Prime of Prime (PoP) to take on the risk instead.

Here’s the kicker: the broker can switch your account between groups at any time.

Today you might be on the A-Book because you trade like a beginner. Tomorrow, if you start winning consistently, you could be quietly shifted to the B-Book — without you ever knowing.

2. Where Does the Real Liquidity Come From?

That “Liquidity Pool” your broker proudly advertises? In reality, it’s usually just a compilation of bid/ask quotes from a handful of low-tier Liquidity Providers (LPs). And those LPs themselves are pulling prices from the interbank market — where Tier-1 banks trade directly with each other, with minimum deal sizes in the millions, sometimes hundreds of millions, of USD per click.

Retail brokers don’t have the capital to play directly in the interbank pool. Instead, they rent access from low-tier LPs or Prime of Prime (PoP) providers to get both prices and liquidity. Then, once the data reaches the broker’s servers, it’s often “edited” in-house: spreads widened, volumes faked, quotes delayed, slippage increased — whatever suits their business model.

The chart you see on your platform? That’s a staged feed. The prices are simulated from LP data, and the volumes are numbers generated within the broker’s own system. They’re not the actual traded volumes in the real market. So if you’re doing VSA analysis or trading order flow and you trust that volume blindly, you’re essentially analysing a fabricated picture.

3. Why Do Prices Look Almost the Same Across Brokers?

Many traders wonder: If brokers are different, why do their charts look almost identical, with only slight spread differences?

The reason is simple: all retail brokers source their base prices from the same interbank ecosystem. The only differences come from how each broker tweaks them:

- Adding their own spread

- Applying a slight price delay (a few milliseconds)

- Widening spreads when they need to “squeeze” profitable clients

Small price discrepancies between brokers — just a few points — are perfectly normal. In fact, these tiny gaps are exactly what HFT (High-Frequency Trading) firms exploit in price arbitrage between liquidity pools. But make no mistake — retail traders can’t pull this off. Brokers have already locked that door.

How HFT Firms Profit from This

HFT firms place their servers right next to brokers’ or LPs’ servers — often co-located in the same data centers as major ECNs like Equinix LD4, NY4, TY3. The moment they detect a price difference for the same currency pair across two pools or brokers, they instantly:

- Buy where the price is lower

- Sell where the price is higher

…executing the trade in under 1 millisecond, pocketing the spread difference.

Example:

- LP A: EUR/USD = 1.08421

- LP B: EUR/USD = 1.08424

HFT bots detect a 0.3-pip difference (0.00003) — enough to profit with a $5M trade. They Buy from LP A and Sell to LP B simultaneously, netting $150 instantly. Doing this hundreds of times per second can yield millions in daily profits.

Firms like Jump Trading, Citadel, XTX Markets, Hudson River Trading, Tower Research are the kings of this game.

Why Retail Traders Can’t Do It

- No direct API access to LPs

- No co-location servers

- Retail quotes are delayed

- Brokers run built-in anti-latency-arbitrage algorithms

So even if you spot a price difference between two MT4 brokers, your order will either fail, get requoted, suffer heavy slippage, or be canceled outright.

That’s why HFT firms can make staggering profits from micro price gaps — and retail traders like us will never get close.

ii. How Do Retail Brokers Make Money?

1. How Retail Brokers Profit

Most retail Forex traders don’t realize that when they place a Buy or Sell order on MT4/MT5, their direct counterparty is often not “the market” — but other traders on the platform, and in many cases, the broker itself.

The majority of retail brokers operate under the B-Book model, which means that if a trader loses, the broker keeps the full amount. If a trader wins, the broker must pay them from its own funds — often funded by the losses of other clients. In essence, a retail broker’s profits come directly from the money retail traders burn in the market.

Behind the scenes, in the broker’s backend system, each trading account is classified based on trading behavior:

- Losing or random traders — Beginners, gamblers, or traders with no clear strategy are highly likely to lose, so the broker will “hold” all of their trades in-house (B-Book) and pocket their losses.

- Consistently profitable traders — Especially fast scalpers or arbitrage players — are flagged as high risk and pushed to the A-Book, meaning the broker passes their trades to a Liquidity Provider to avoid taking the loss themselves.

If you’re a trader with a long losing streak, your broker will happily take the other side of your trades because you’re their profit source. But if you’re a pro with a strong winning record, the broker will classify you as a risk and push your trades out to the interbank market, or hedge your positions by taking the same trades in the interbank pool.

For example: if you place a Buy order with the broker, they will also Buy in the interbank market. If you win, they use their profit from the interbank trade to pay you; if you lose, they keep your loss directly.

2. How Profits Are Affected When Clients Win Too Much

The critical weakness of a B-Book broker is simple: if clients win too much, the broker’s profits take a direct hit. That’s why brokers often try to control — or even interfere — through technical measures. Many will widen spreads, delay execution, limit position sizes, or reduce leverage for accounts that are consistently profitable, creating a disadvantage for the trader. This behavior is especially common during periods of high market volatility.

That said, not every case is deliberate manipulation. Sometimes, when prices move too fast and available bid/ask quotes are scarce, spreads naturally widen. But regardless of the reason, the one who benefits is still the broker.

There have been several public examples of this in the industry. For instance, in 2020, Plus500 had to immediately adjust its risk management when COVID-driven market swings allowed many clients to score big profits by shorting oil and stock indices. Their earnings dropped sharply because they had to pay out too much to winning traders. In their own reports, Plus500 openly admitted that the bulk of their revenue comes from client losses.

Similarly, IG Markets once reported a quarterly profit decline simply because more traders won than they had anticipated.

These examples reveal a core truth: retail brokers’ profits don’t mainly come from spreads or commissions — they primarily come from client losses. That’s why you’ll see so many retail brokers today offering zero spread and zero commission accounts. If the service is “free,” you can probably guess where their profits are really coming from.

3. Real-World Cases and How Brokers Handle Overly Profitable Clients

There are plenty of stories circulating about traders making over $40,000 in a single month using fast news-trading strategies. At first, the broker lets them trade without interference. But once their volume and profits pass the broker’s internal risk threshold, things change fast: orders start getting requoted, spreads suddenly widen without reason, take-profit orders hang without execution, and leverage is quietly slashed to 1:50. Soon after, the trader receives an email stating their account is closed due to “trading activity that poses a risk to the liquidity system.”

Stories like this are not rare. Most brokers have automated monitoring systems that flag and reclassify traders. Anyone making consistent, outsized profits will be switched to another liquidity pool or have their trading conditions deliberately worsened. Some brokers take a more subtle approach — they allow the trader to keep trading, but quietly widen spreads at critical moments or increase overnight swap fees to slowly drain the account.

These tactics are more common with smaller or questionable brokers that show signs of being scams. Larger, more reputable brokers tend to do this far less often — but “less often” doesn’t mean “never.”

If you want to verify the credibility of major brokers — especially the top 4 in Asia and Europe — you can check out our guide on the Top 4 FX Brokers in the Region [link here].

III. Who Really Controls Prices and Liquidity in the Global Market?

1. What Price Are You Actually Seeing?

Most newcomers to the market assume the prices on their charts are the real market prices, purely driven by global supply and demand. But in retail Forex, it’s not that simple. The prices you see on MT4, MT5, or other trading platforms are actually streams from Liquidity Providers (LPs), passed through your broker — and often tweaked before they reach your screen.

2. Who’s Behind Those Constantly Moving Numbers?

To truly understand where Forex prices come from, we have to go deeper — into the interbank market. This is the arena where the world’s largest banks and a select few privileged financial institutions trade directly with each other, with minimum deal sizes often ranging from several million to hundreds of millions of USD per order.

Names like JP Morgan Chase, Citibank, Deutsche Bank, Barclays, HSBC are the “kings” that control global FX pricing. A single order worth hundreds of millions from one of these giants can instantly shift the bid/ask levels across the interbank system — and by extension, the entire market.

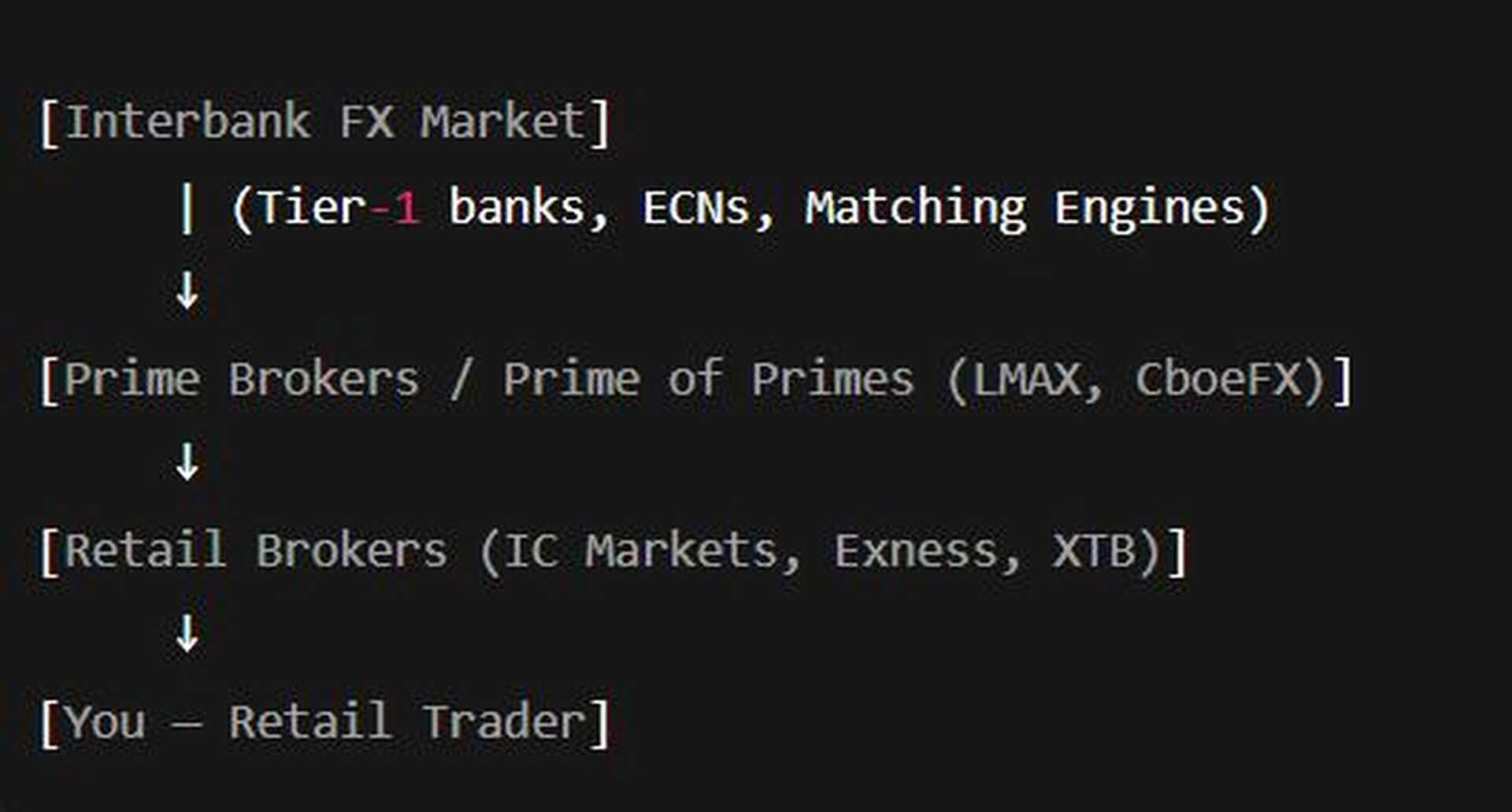

In this system, institutions are ranked in tiers:

- Tier-1: The mega-banks capable of generating their own liquidity and setting their own prices for currency pairs.

- Lower-tier banks or prime brokers: Primarily act as price takers or distributors of prices set by Tier-1 banks.

Retail brokers have no direct access to the interbank market. They must go through LPs or Prime of Prime (PoP) providers — intermediaries that collect and aggregate prices from the interbank market, then redistribute them to brokers.

That’s why the prices you see on MT4/MT5 are actually aggregated quotes, passing through multiple layers of intermediaries, and potentially adjusted with spread mark-ups, price modifications, or a few milliseconds of delay before they appear on your chart.

3. How Are Global Prices and Liquidity Really Controlled?

Many people assume that Forex price movements are driven by the collective buying and selling of retail traders worldwide. In reality, that’s not the case. True liquidity comes from the interbank system and Tier-1 liquidity providers (LPs). Whenever these institutions place large orders, they create bid/ask imbalances and establish new price levels. Lower-tier LPs and brokers are forced to take those prices, add their own spreads, and then distribute them to clients.

This is why, whether you open MT4 from Broker A or Broker B, the prices are usually very similar — differing only slightly in spreads or latency. However, during sensitive moments such as Non-Farm Payroll releases or Federal Reserve interest rate announcements, you’ll notice that brokers widen spreads and delay order execution differently. That’s because each broker adjusts its output pricing based on the level of liquidity it has purchased from its LPs.

Conversely, when liquidity drops — for example, during the Asian session in the morning or over the weekend — LPs will pull some orders from their books to limit risk. Retail brokers must then widen their spreads to protect themselves from clients trading against thin order books.

Some brokers even go further, creating fake prices, simulating liquidity pools, or using their own internal price simulators when their LPs stop quoting. The chart you see still ticks, but in reality it’s just an internally generated feed.

And most importantly, retail traders will never see the so-called “true volume” of the Forex market. Because Forex is an over-the-counter (OTC) market, there is no way to aggregate total global volume at any given moment. Each broker only shows the internal volume or the volume from the lower-tier LP they are connected to. Therefore, volume analysis on a retail Forex chart is essentially based on fake or simulated data.

4. Who Actually Gets to Trade Directly with Tier-1?

Many new traders believe that opening an account with a “good” broker means they’re trading at true global prices. In reality, placing orders directly into the Tier-1 interbank system is something only a very small group worldwide is allowed to do.

The entities that can trade directly with Tier-1 include:

- Major banks such as JP Morgan, HSBC, Deutsche Bank, Citi, and Barclays

- Certain high-level international prime brokers like Goldman Sachs Prime or Morgan Stanley Prime

- A tiny group of HFT funds or trading firms holding special licenses, massive capital reserves, and direct liquidity agreements with Tier-1 banks

Everyone else — including all PoPs (Prime-of-Prime), smaller LPs, retail brokers, and even mid-sized hedge funds — must buy price feeds and liquidity through intermediaries. To qualify as a direct client of a Tier-1 bank, an institution must process enormous daily trade volumes, maintain collateral of tens of millions of USD, hold top-tier regulatory licenses, and run co-located servers directly connected to the bank’s data centers in London or New York.

Even among HFT firms, not everyone gets Tier-1 access. Only elite players such as Jump Trading, XTX Markets, or Citadel Securities hold a seat at the interbank table — because they bring in trading volumes and liquidity levels significant enough for the banks to care about.

For retail traders or smaller funds, trading can only be done through brokers, PoPs, or ECN platforms like Currenex, FXall, or Integral. These platforms simply take prices and liquidity from Tier-1, then redistribute them downstream.

The key point is: retail participants — even if you deposit USD 1 million into a broker — are still considered retail and will never access direct Tier-1 liquidity.

Some experienced traders like to imagine that opening an account at an ECN or “raw spread” broker means they are trading directly with banks. This is not true. An ECN is merely a price aggregator from multiple LPs, distributing that feed to clients. The FX market is tightly tiered, and Tier-1 only deals with counterparties in the same league.

iv. So, are Forex brokers scammers?

After hearing about all these mechanisms — from liquidity pools to brokers taking the opposite side of client trades, even widening spreads, freezing orders, or increasing swap rates to limit highly profitable traders — the question arises: “So, are Forex brokers scammers after all those shady activities?”

The answer is: NOT NECESSARILY!

First, the world’s top-tier brokers — big names like IC Markets, Pepperstone, FXCM (after being fined and restructured), OANDA, IG Markets, Exness, FXPro, and XTB — hold official licenses from national financial regulators such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), and FSCA (South Africa).

These licenses can’t simply be bought; brokers must meet minimum capital requirements, have client fund protection, segregate client deposits from operating accounts, undergo regular audits, and maintain transparent reporting. So are Forex brokers scammers? Not really!

This means they are legally authorized to offer forex brokerage services, and mechanisms like B-Book or A-Book are legitimate internal risk-management tools. The real question is how they use these tools for each group of clients.

Second, not all brokers deliberately “prey on clients.” Top-tier brokers actually prefer clients who trade consistently, in large volumes, and for the long term, because such accounts bring steady spread revenue. They’re also willing to A-Book large traders to avoid internal risk. Some brokers even maintain dedicated risk-dealing desks to manage unusual accounts — they’re not always setting traps to “squeeze” traders.

Third, this is simply the nature of the industry since retail forex trading became commercialized. Brokers are just the ones organizing the game. Whether you win or lose heavily depends on your knowledge of the rules. If you win consistently, the broker must find a way to hedge against you — that’s business logic. But if you trade moderately, avoid spread traps, time entries well, and manage your capital strictly, you can still survive in this game.

That said, small brokers, offshore brokers, brokers with “junk” licenses, or cloned-domain scam brokers are the ones to avoid at all costs. These are the types willing to manipulate prices, trigger fake stop-losses, block withdrawals, or freeze accounts without reason. Playing with them means you’ll lose your money whether you win or lose trades — this is what’s called cross-border asset seizure.

Finally, even large, legitimate brokers still put company profits first. So issues like spread widening or leverage reductions are simply part of the nature of this market. It’s a game where those who understand the rules deeply survive, and those who naively believe it’s a fair-play arena will eventually blow their accounts.

The solution to avoid losing money due to ineffective trading strategies — while improving your market experience — is to start with a demo account. Begin by building a proper capital management plan (such as a Fixed Fractional model in Excel) and test it on demo before going live.

So, are Forex brokers scammers? The answer depends on your capital management, your trading knowledge, and your skills. If you’re good, this can be a promising investment channel. If you lose, it’s just another gambling table.

📌 Interested in learning more about different account types or crypto trading knowledge? Check out our educational resources HERE

📌 Want to see detailed reviews of the top 5 best crypto exchanges? Read the full review HERE

Furthermore, if you want real-time signals everyday, you can check out our small Investment and Trading community on Telegram: [HERE]

Don’t forget to follow this Investment and Trading Signal for free investment analysis and trading crypto and forex CFDs signals.

I know trading isn’t an easy game, especially for those who take it seriously. That’s why I believe you should practice consistently before finding the trading strategies that suit you best. You can start risk-free by opening a demo FX account to get familiar with the market.

Below are registration links for two of the best brokers:

- XTB Online Trading — the top Forex broker for traders in the EU

- Exness — the best choice for traders in Asia

Tiếng Việt

Tiếng Việt